The foreign exchange market, commonly known as Forex or FX, is the global marketplace for trading national currencies. The unique aspect of Forex is that it has no central marketplace; instead, currency trading is conducted electronically over-the-counter (OTC), which means that all transactions occur through computer networks among traders worldwide. The Forex market is the largest and most liquid financial market in the world, with a daily trading volume exceeding $7.5 trillion.

Forex trading involves the simultaneous buying of one currency and selling of another, which means currencies are traded in pairs. Major currency pairs include EUR/USD, USD/JPY, GBP/USD, and USD/CHF. These pairs represent the exchange rate between two currencies, indicating how much of the quoted currency is needed to purchase one unit of the base currency. Forex trading is highly attractive due to its 24-hour accessibility, high liquidity, and potential for significant profit.

Table of Contents

What is Forex Market?

The foreign exchange market, commonly known as the forex or FX market, is the global marketplace for trading national currencies. It is the largest and most liquid financial market in the world, with a daily trading volume exceeding $7.5 trillion. The forex market operates 24 hours a day, five days a week, enabling continuous currency trading across different time zones.

Structure and Participants

The forex market is decentralized, meaning there is no central exchange or physical location where transactions occur. Instead, trading is conducted electronically over-the-counter (OTC), involving a network of banks, brokers, and financial institutions. The primary participants in the forex market include central banks, commercial banks, hedge funds, corporations, and individual retail traders.

Key Features

- Currency Pairs: In the forex market, currencies are traded in pairs, such as EUR/USD or USD/JPY. Each pair represents the exchange rate between two currencies, indicating how much of the quote currency is needed to purchase one unit of the base currency.

- Liquidity and Accessibility: The forex market’s immense size and volume ensure high liquidity, allowing traders to execute large orders without significantly impacting the price. The market’s accessibility, with trading available 24/5, makes it appealing to traders worldwide.

- Volatility: Due to various factors like economic data releases, geopolitical events, and central bank policies, currency prices can fluctuate rapidly, providing opportunities for significant profits as well as risks of substantial losses.

How Does Forex Trading Work?

Forex trading, also known as FX trading, is the process of buying and selling currencies to profit from their fluctuating values. This trading happens in an over-the-counter (OTC) market, meaning there is no centralized exchange. Instead, transactions occur directly between parties, facilitated by a global network of banks, brokers, and financial institutions.

In forex trading, currencies are always traded in pairs, such as EUR/USD or GBP/JPY. When you trade forex, you are simultaneously buying one currency and selling another. For example, if you believe the euro will appreciate against the US dollar, you would buy the EUR/USD pair. If the euro’s value increases as predicted, you can sell it back for a profit.

Trading Mechanisms

The forex market operates 24 hours a day, five days a week, thanks to overlapping time zones of major financial centers like London, New York, Sydney, and Tokyo. This continuous operation allows traders to react to global economic events in real-time.

Forex trading can be executed through various methods:

- Spot Market: Immediate exchange of currencies at the current market rate.

- Forward Market: Contracts to buy or sell a currency at a future date at a predetermined price.

- Futures Market: Similar to forwards, but contracts are standardized and traded on exchanges.

Key Components

- Base Currency and Quote Currency: In any forex pair, the first currency is the base currency, and the second is the quote currency. The exchange rate indicates how much of the quote currency is needed to buy one unit of the base currency.

- Leverage: Forex traders often use leverage, which allows them to control larger positions with a smaller amount of capital. While this can amplify profits, it also increases the potential for losses.

Why is Forex Trading Popular?

Forex trading has gained immense popularity for several reasons, making it an attractive market for traders of all levels.

High Liquidity

The forex market is the most liquid financial market globally, with a daily trading volume exceeding $7.5 trillion. This high liquidity ensures that traders can enter and exit positions easily without significant price fluctuations.

Accessibility and Flexibility

Forex trading is accessible to a wide range of participants, including individuals, institutions, and governments. With the advent of online trading platforms, retail traders can now participate in the market with relatively small capital investments. The market’s 24-hour nature allows traders to execute trades at any time, providing flexibility to those with other commitments.

Potential for High Returns

Forex trading offers the potential for substantial returns due to its high volatility. Traders can profit from both rising and falling markets by taking long or short positions. Additionally, the use of leverage can amplify profits, though it also increases the risk.

Diverse Trading Opportunities

The forex market offers a vast array of currency pairs to trade, including major pairs like EUR/USD, minor pairs like EUR/GBP, and exotic pairs like USD/TRY. This diversity allows traders to find opportunities in various economic conditions and regions.

Hedging and Speculation

Forex trading serves both hedging and speculative purposes. Businesses and investors use forex to hedge against currency risk, while speculators aim to profit from changes in exchange rates.

What Are Forex Currency Pairs?

Forex trading revolves around currency pairs, which are the national currencies from two countries coupled for trading on the foreign exchange (FX) market. A currency pair compares the value of one currency to another, known as the base currency and the quote currency. For example, in the EUR/USD pair, the euro (EUR) is the base currency, and the US dollar (USD) is the quote currency. The quoted price indicates how much of the quote currency is needed to purchase one unit of the base currency.

Types of Currency Pairs

- Major Pairs: These involve the most traded currencies globally, usually paired with the USD. They include EUR/USD, USD/JPY, GBP/USD, and USD/CHF. Major pairs are highly liquid and have tight spreads due to their large trading volumes.

- Minor Pairs: These are currency pairs that do not include the USD. Examples include EUR/GBP, EUR/CHF, and GBP/JPY. While still fairly liquid, minor pairs typically have wider spreads compared to major pairs.

- Exotic Pairs: These involve one major currency and one from a smaller or emerging market. Examples include USD/SGD (US dollar/Singapore dollar) and EUR/TRY (euro/Turkish lira). Exotic pairs are less liquid and have wider spreads, making them more volatile and risky.

How is Forex Traded?

Forex trading operates on a decentralized global market, meaning trades are conducted over the counter (OTC) rather than on a centralized exchange. This setup allows for continuous trading 24 hours a day, five days a week, as trading sessions overlap in major financial centers such as London, New York, Sydney, and Tokyo.

Trading Mechanisms

Forex trading can be done through various mechanisms, including:

- Spot Market: Immediate exchange of currencies at the current market rate.

- Forward Market: Contracts to buy or sell a currency at a future date at a predetermined price.

- Futures Market: Standardized contracts traded on exchanges, agreeing to buy or sell a set amount of a currency at a set price and date in the future.

Key Components

- Base and Quote Currency: The base currency is the first currency listed in a pair, and the quote currency is the second. For example, in the EUR/USD pair, EUR is the base currency, and USD is the quote currency.

- Leverage: Forex traders often use leverage to control larger positions with a smaller amount of capital, which can amplify both profits and losses.

- Bid and Ask Prices: The bid price is the amount a broker will pay to buy the base currency, while the ask price is the amount a broker will sell the base currency for.

By understanding these fundamental mechanisms, traders can effectively participate in the forex market and leverage its opportunities.

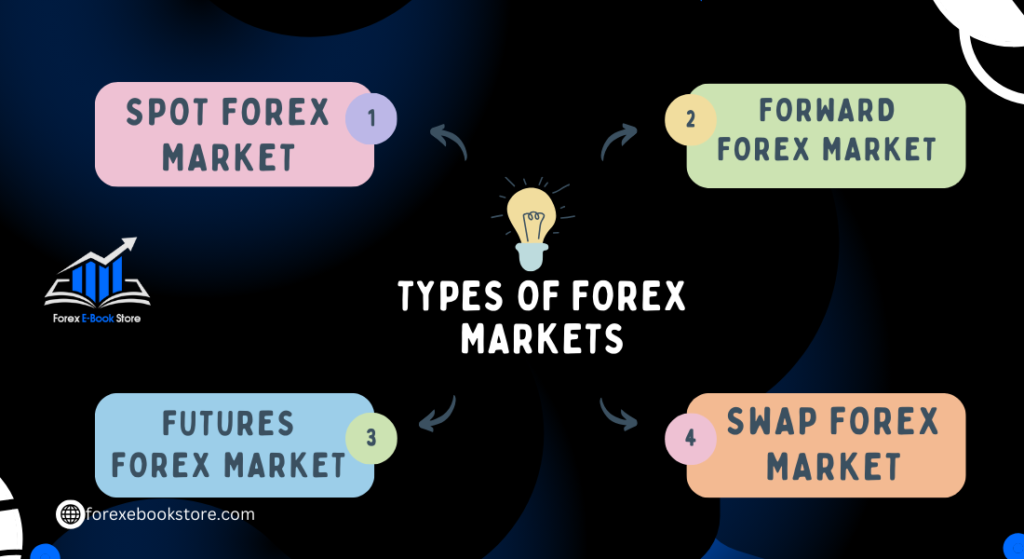

What are the Different Types of Forex Markets?

Forex markets can be categorized based on the types of trades and contracts used:

Spot Forex Market

The spot market involves the immediate exchange of currency pairs at the current market rate. Transactions are typically settled within two business days. This market is highly liquid and is the most straightforward form of what is forex trading.

Forward Forex Market

In the forward market, contracts are made to buy or sell a certain amount of a currency at a specified price on a future date. These contracts are customized and traded OTC, allowing parties to hedge against future currency fluctuations

Futures Forex Market

The futures market involves standardized contracts to buy or sell currencies at a set price and date in the future. Unlike the forward market, futures contracts are traded on exchanges and are legally binding. These contracts help manage currency risk by locking in prices for future transactions.

Understanding the different types of forex markets allows traders to choose the best approach based on their trading goals and risk tolerance. Each market offers unique opportunities and challenges, making it essential to grasp their distinct characteristics for successful trading.

Who Participates in the Forex Market?

What is forex market, it is the largest and most liquid financial market in the world, with a diverse range of participants who trade for various reasons. These participants include central banks, commercial banks, hedge funds, multinational corporations, retail traders, and more.

Central Banks

Central banks play a crucial role in the forex market as they implement monetary policies and engage in currency interventions to stabilize their economies. For example, the Federal Reserve (Fed), the European Central Bank (ECB), and the Bank of Japan (BoJ) can influence exchange rates by adjusting interest rates and controlling money supply. Their actions can significantly impact currency values and market sentiment.

Commercial Banks

Commercial banks are the largest players in the forex market, facilitating currency transactions for clients, including individuals, corporations, and institutional investors. They profit from the spread between the buying and selling prices of currencies. Banks also engage in speculative trading and maintain inventories of currencies to act as dealers for large market participants. The interbank market, where banks trade currencies among themselves, forms a significant part of what is forex trading.

Hedge Funds and Institutional Investors

Hedge funds and institutional investors, such as pension funds and mutual funds, participate in the forex market to diversify portfolios and hedge against currency risk. Hedge funds, known for their speculative nature, use various strategies to exploit market inefficiencies and generate profits. Institutional investors often take long-term positions based on economic trends and fundamental analysis, influencing currency prices through their significant portfolio adjustments.

What is the Role of Leverage in Forex Trading?

Leverage is a critical concept in what is forex trading, allowing traders to control larger positions with a relatively small amount of capital. This amplifies both potential profits and potential losses, making it a powerful but risky tool.

How Leverage Works

What is forex trading, leverage is expressed as a ratio, such as 50:1, 100:1, or even 500:1. This ratio indicates how much larger a position a trader can control compared to their actual investment. For instance, with a 100:1 leverage ratio, a trader can control $100,000 in the market with just $1,000 of their capital. This enables traders to maximize their gains from small market movements.

Risks of Leverage

While leverage can significantly increase the potential return on investment, it also elevates the risk of substantial losses. A small adverse movement in currency prices can lead to losses that exceed the trader’s initial investment. Therefore, traders must use leverage wisely and implement robust risk management strategies, such as setting stop-loss orders to limit potential losses.

Practical Applications

Leverage is widely used by retail traders, hedge funds, and institutional investors to enhance their trading capacity. Retail traders often use leverage to access larger market positions than they could with their capital alone. However, due to the high risk associated with leverage, it is essential for traders to have a deep understanding of market dynamics and to use leverage judiciously.

How to Analyze Forex Markets?

What is forex market analysis, it is vital for making informed trading decisions. Traders use various methods to analyze the market, including fundamental analysis, technical analysis, and sentiment analysis.

Fundamental Analysis

Fundamental analysis involves evaluating economic indicators, government policies, and other macroeconomic factors that influence currency values. Key indicators include interest rates, inflation rates, GDP growth, employment data, and political stability. For example, if a country’s central bank raises interest rates, its currency might strengthen due to higher returns on investments denominated in that currency.

Technical Analysis

Technical analysis focuses on studying price charts and using historical data to predict future price movements. Traders use tools such as moving averages, trend lines, and various chart patterns to identify potential entry and exit points. Technical analysis helps traders understand market sentiment and make short-term trading decisions based on price patterns and indicators.

Sentiment Analysis

Sentiment analysis gauges the overall mood of market participants. It involves analyzing data such as trader positions, news reports, and economic forecasts to determine whether the market sentiment is bullish or bearish. Understanding market sentiment can help traders align their strategies with the prevailing market conditions.

What Are the Risks of Forex Trading?

What is forex trading, while offering substantial profit potential, comes with a variety of risks that traders need to be aware of and manage effectively.

Market Volatility

One of the primary risks in forex trading is market volatility. Currency prices can fluctuate rapidly due to various factors, such as economic data releases, geopolitical events, and changes in central bank policies. These fluctuations can make it difficult to predict future currency movements accurately, potentially leading to significant losses. Traders must be prepared for sudden price swings and have strategies in place to manage their positions during volatile market conditions.

Leverage Risk

Leverage is a common feature in What is forex trading that allows traders to control larger positions with a relatively small amount of capital. While leverage can amplify profits, it also increases the risk of substantial losses. High leverage means that even a small adverse movement in currency prices can lead to significant financial losses, potentially exceeding the initial investment. Traders must use leverage cautiously and implement robust risk management practices, such as setting stop-loss orders to limit potential losses..

Counterparty Risk

Forex trading is conducted over-the-counter (OTC), meaning trades are not executed on a centralized exchange but rather through a network of financial institutions. This introduces counterparty risk, the possibility that the other party in a trade may default on their obligations. To mitigate this risk, traders should choose regulated brokers with strong financial standings and good reputations. Conducting due diligence on brokers and understanding their regulatory environment can help protect against counterparty default.

What Strategies Are Used in Forex Trading?

What is forex successful trading relies on the application of various strategies, each tailored to different market conditions and trader objectives.

Trend Following

Trend following is a strategy where traders attempt to capture gains by analyzing the momentum of an asset in a particular direction. This strategy involves identifying upward or downward trends and making trades that align with the prevailing direction. Technical indicators like moving averages and trend lines are commonly used to identify trends and determine entry and exit points.

Range Trading

Range trading involves identifying currency pairs that trade within a defined range over a period. Traders buy at the support level and sell at the resistance level, expecting the price to revert to the mean. This strategy is most effective in stable markets without strong trends. Key tools for range trading include support and resistance levels, Bollinger Bands, and oscillators like the Relative Strength Index (RSI).

Breakout Trading

Breakout trading seeks to capitalize on significant price movements that occur after a currency pair breaks through key support or resistance levels. This strategy involves entering trades when the price breaks out of a predefined range, with the expectation that the price will continue in the breakout direction. Breakout traders use tools such as volume indicators and volatility measures to confirm breakouts and reduce the risk of false signals.

What Tools and Platforms are Used for Forex Trading?

Forex trading requires the use of various tools and platforms to analyze the market, execute trades, and manage risk effectively.

Trading Platforms

Trading platforms are software applications that provide traders with access to the What is forex market. Popular platforms include MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader. These platforms offer advanced charting tools, real-time market data, automated trading capabilities, and access to a wide range of technical indicators and analytical tools.

Technical Analysis Tools

Technical analysis tools help traders analyze price charts and identify potential trading opportunities. Common tools include:

- Moving Averages: Used to smooth out price data and identify trends.

- Bollinger Bands: Help measure market volatility and identify overbought or oversold conditions.

- Relative Strength Index (RSI): An oscillator that measures the speed and change of price movements to identify potential reversal points

Economic Calendars

An economic calendar is a crucial tool for What is forex traders, providing information about upcoming economic events and data releases that can impact currency prices. Traders use economic calendars to stay informed about key events such as interest rate decisions, GDP reports, and employment data, enabling them to anticipate and react to market-moving news.

How to Get Started with Forex Trading?

Educate Yourself

Before diving into forex trading, it’s crucial to educate yourself about the market and its mechanics. Familiarize yourself with key concepts such as currency pairs, pips, lots, and leverage. Understanding how the forex market operates, including the different trading sessions and factors that influence currency fluctuations, is essential. Numerous educational resources are available online, including e-books, webinars, and courses, which can provide a solid foundation in What is forex trading.

Choose a Reliable Forex Broker

What is forex broker, selecting a broker is vital for a successful trading experience. Look for brokers that are regulated by recognized financial authorities, offer competitive spreads, and have user-friendly trading platforms. Additionally, consider the broker’s reputation, customer support, and the range of trading instruments they offer. Opening a demo account with a few brokers can help you evaluate their platforms and services before committing real funds.

Open and Fund a Trading Account

Once you have chosen a broker, the next step is to open a trading account. Brokers typically offer various types of accounts, such as standard, mini, or micro accounts, catering to traders with different levels of experience and capital. You will need to provide personal information and complete a know-your-customer (KYC) procedure. After your account is approved, fund it using methods such as bank transfers, credit/debit cards, or online payment systems.

What is the History and Evolution of the Forex Market?

Early Beginnings

What is Forex history, market dates back to ancient times when currency trading involved bartering goods and services. However, the modern forex market began to take shape after the establishment of the gold standard in the 19th century, which pegged currencies to the value of gold, facilitating international trade.

Bretton Woods Agreement

The Bretton Woods Agreement in 1944 was a significant milestone in the evolution of the forex market. It established fixed exchange rates where currencies were pegged to the US dollar, which was convertible to gold. This system created stability in international trade but collapsed in the early 1970s due to the inability of the US to maintain gold convertibility, leading to the adoption of floating exchange rates.

Development of Modern Forex Market

After the collapse of the Bretton Woods system, What is Forex market evolved into the decentralized and highly liquid market we know today. Technological advancements, such as the advent of the Internet and electronic trading platforms, have further transformed the market, making it accessible to individual retail traders. The market now operates 24 hours a day, five days a week, and facilitates trillions of dollars in daily trading volume.

What are the Regulatory Aspects of Forex Trading?

Importance of Regulation

Regulation in the What is Forex market is essential to ensure fair trading practices, protect traders’ funds, and maintain market integrity. Regulatory bodies oversee brokers and enforce compliance with financial laws and standards. Traders should choose brokers regulated by reputable authorities to mitigate the risks associated with fraud and misconduct.

Major Regulatory Bodies

Several major regulatory bodies oversee forex trading globally, including the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA) in the US, the Financial Conduct Authority (FCA) in the UK, and the Australian Securities and Investments Commission (ASIC). These organizations set rules for brokers, conduct audits, and handle disputes between brokers and traders

Regulatory Changes and Their Impact

Regulatory changes can significantly impact What is Forex trading conditions. For instance, regulations may impose limits on leverage, affect the availability of certain trading instruments, or introduce new compliance requirements. Staying informed about regulatory developments is crucial for traders to adapt their strategies and ensure they are trading within the legal framework.

Conclusion

The Forex market is a dynamic and extensive marketplace that operates around the clock, enabling global currency trading. It offers numerous benefits such as high liquidity and the potential for significant profits through leverage, but also comes with risks that necessitate a thorough understanding of market dynamics and strong risk management practices. With the right knowledge and strategies, traders can effectively navigate the complexities of Forex to achieve their financial goals.