In the Forex market, a pip (short for “percentage in point” or “price interest point”) is the smallest unit of price movement for a currency pair. It represents a standard measure of the change in value between two currencies. For most currency pairs, a pip is equivalent to a movement in the fourth decimal place (0.0001), making it a crucial concept for traders to understand as they evaluate the impact of market fluctuations on their trades.

The concept of a pip is fundamental in Forex trading because it allows traders to quantify their potential profits and losses. For example, if the EUR/USD pair moves from 1.1000 to 1.1001, it has moved by one pip. Understanding how pips work and how they are calculated helps traders set effective stop-loss and take-profit levels, manage risk, and develop trading strategies.

Table of Contents

What is a Pip in Forex Trading?

In Forex trading, a pip (short for “percentage in point” or “price interest point”) is the smallest price movement that an exchange rate can make based on market convention. For most currency pairs, a pip is equivalent to a movement in the fourth decimal place (0.0001), except for currency pairs involving the Japanese yen, where a pip is the second decimal place (0.01). For example, if the EUR/USD currency pair moves from 1.1000 to 1.1001, it has moved by one pip.

Pips are crucial in Forex trading as they are the fundamental units for measuring price changes in currency pairs. They allow traders to quantify and manage their trades by providing a standard measure for price movements. Understanding how pips work is essential for calculating potential profits and losses. For instance, if a trader buys EUR/USD at 1.1000 and sells it at 1.1010, they have made a profit of 10 pips. This measurement helps traders set stop-loss and take-profit levels, manage risk, and develop effective trading strategies

How Does a Pip Work in Forex?

In Forex trading, a pip (percentage in point) is the smallest price movement that can occur in a currency pair. For most currency pairs, one pip equals a change in the fourth decimal place (0.0001). For example, if the EUR/USD pair moves from 1.1000 to 1.1001, this movement is equal to one pip. However, for currency pairs involving the Japanese yen, a pip is represented by the second decimal place (0.01).

Pips are crucial for traders as they measure the amount of change in the exchange rate for a currency pair. Understanding pips allows traders to calculate potential profits or losses. For instance, if a trader buys EUR/USD at 1.1000 and sells it at 1.1010, they have gained 10 pips. This measurement helps in setting stop-loss and take-profit orders, managing risk, and determining trade size.

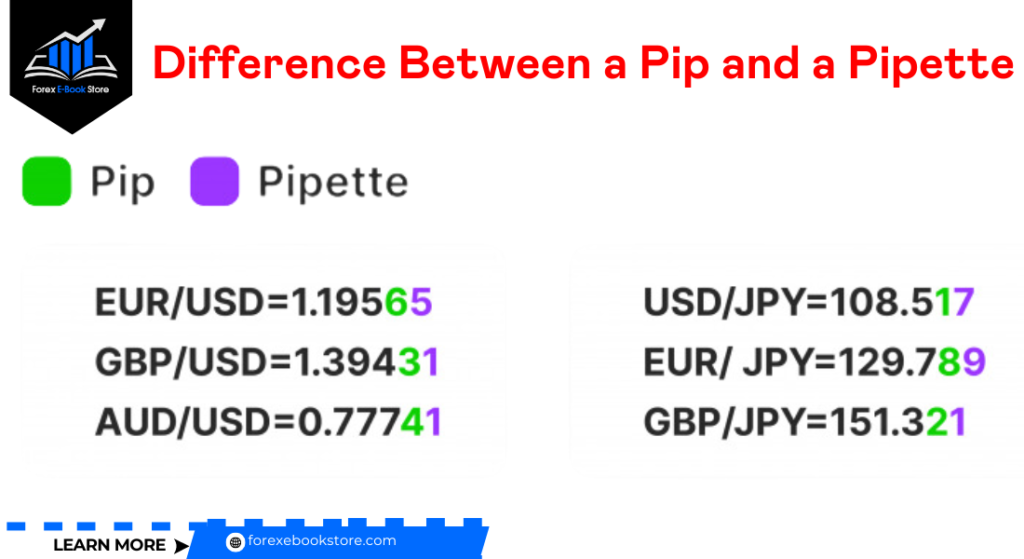

What is the Difference Between a Pip and a Pipette?

While a pip represents a standard unit of price movement in Forex, a pipette is a fractional pip, which provides even more precision in pricing. A pipette is one-tenth of a pip. For example, if the EUR/USD moves from 1.10000 to 1.10001, this movement equals one pipette. This level of detail is beneficial for traders who need finer granularity in price changes, especially when trading in high volumes or during high volatility periods.

Pipettes are typically represented as the fifth decimal place in most currency pairs or the third decimal place in currency pairs involving the Japanese yen. They allow for more accurate pricing and better risk management, helping traders to fine-tune their entry and exit points.

How to Calculate the Value of a Pip?

Calculating the value of a pip is essential for Forex traders to understand their potential profits or losses. The value of a pip varies depending on the currency pair being traded and the lot size of the trade. The general formula to calculate the pip value is:

Pip Value=Pip in Decimal Places x Exchange Rate × Trade Volume\text{Pip Value}

= \frac{\text{Pip in Decimal Places}}{\text{Exchange Rate}} \times \text{Trade Volume}Pip Value

=Exchange RatePip in Decimal Places×Trade Volume

For example, if you are trading a standard lot (100,000 units) of EUR/USD at an exchange rate of 1.2000, the value of one pip is:

Pip Value=0.00011.2000×100,000=$8.33\text{Pip Value}

= \frac{0.0001}{1.2000} \times 100,000

= \$8.33Pip Value

=1.20000.0001×100,000

=$8.33

For currency pairs involving the Japanese yen, such as USD/JPY, if the exchange rate is 110.00, the pip value for a standard lot is calculated as:

Pip Value=0.01110.00×100,000=$9.09\text{Pip Value}

= \frac{0.01}{110.00} \times 100,000

= \$9.09Pip Value=110.000.01×100,000

=$9.09

Learn how to calculate pip value helps traders assess the potential impact of price movements on their trades, allowing them to make informed decisions and manage their risk effectively.

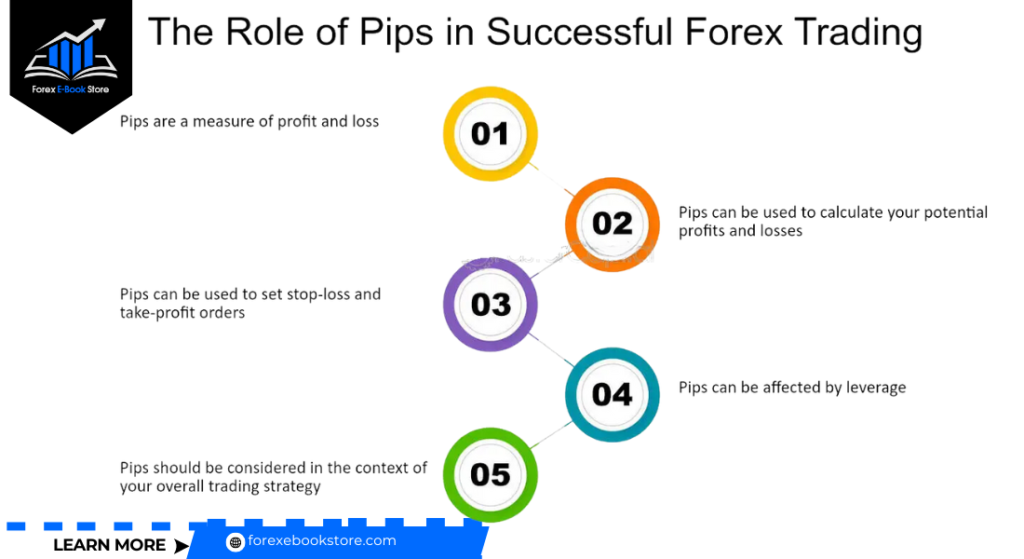

What is the Role of Pips in Forex Trading?

Pips play a critical role in Forex trading as they are the fundamental units of measurement for price movements in currency pairs. A pip, which stands for “percentage in point,” typically represents a one-digit movement in the fourth decimal place of a Forex quote (0.0001) for most currency pairs. For pairs involving the Japanese yen, a pip is represented in the second decimal place (0.01).

Pips are essential for several reasons:

- Measuring Price Changes: Pips quantify the smallest changes in currency exchange rates. For example, if the EUR/USD pair moves from 1.1000 to 1.1005, it has moved by 5 pips. This precise measurement helps traders understand and track even the smallest price fluctuations in the market.

- Calculating Profits and Losses: The value of a pip impacts the potential profit or loss of a trade. When a trader buys a currency pair, their profit or loss is determined by the number of pips the market moves in their favor or against them. For instance, a 50-pip movement in a trader’s favor with a standard lot size can result in a significant profit.

- Setting Stop-Loss and Take-Profit Levels: Traders use pips to set stop-loss and take-profit levels, which are crucial for risk management. By calculating how many pips they can afford to lose or gain, traders can set these levels to manage their trades effectively and protect their capital from large losses.

How Do Pips Affect Profit and Loss in Forex?

Pips directly influence the profitability of Forex trades. Here’s how they impact profit and loss:

- Profit Calculation: The number of pips gained or lost in a trade determines the trader’s profit or loss. For example, if a trader buys the EUR/USD pair at 1.1000 and sells it at 1.1050, they have gained 50 pips. The monetary value of these pips depends on the lot size of the trade. For a standard lot of 100,000 units, each pip is typically worth $10, resulting in a $500 profit for this trade.

- Loss Calculation: Conversely, if the market moves against the trader, the number of pips lost will determine their financial loss. If the EUR/USD pair moves from 1.1000 to 1.0950, resulting in a 50-pip loss, the trader would lose $500 for a standard lot. Understanding What is a Pip value helps traders calculate and mitigate potential losses by setting appropriate stop-loss orders.

- Risk Management: By knowing What is a Pip and the value of a pip, traders can better manage their risk exposure. They can determine the appropriate position size and set stop-loss levels to limit potential losses. Effective risk management ensures that traders do not overexpose their accounts to the market, preserving their trading capital.

How to Use Pips to Set Stop-Loss and Take-Profit Levels?

What is a Pip, it is instrumental in setting stop-loss and take-profit levels, which are essential components of a trading strategy:

- Stop-Loss Levels: A stop-loss order is set to limit a trader’s potential loss on a trade. By determining the number of pips they are willing to risk, traders can set a stop-loss order at a specific level to automatically close the trade if the market moves against them. For instance, if a trader buys EUR/USD at 1.1000 and sets a stop-loss 30 pips below 1.0970, the trade will close automatically if the price reaches 1.0970, capping the loss at 30 pips.

- Take-Profit Levels: A take-profit order is set to lock in profits when the market moves in the trader’s favor. By setting a take-profit level based on the desired number of pips, traders can ensure that their trades close automatically once the target is reached. For example, if a trader aims for a 50-pip profit on a EUR/USD trade entered at 1.1000, they might set a take-profit order at 1.1050.

- Balancing Risk and Reward: Effective use of stop-loss and take-profit levels helps traders balance their risk and reward. By analyzing What is a Pip historical movements and current market conditions, traders can set these levels to maximize profits while minimizing potential losses. This disciplined approach enhances the overall success and sustainability of their trading strategy.

These sections provide a complete understanding of the role of what is a Pip in Forex trading, their impact on profit and loss, and their use in setting stop-loss and take-profit levels. This knowledge is essential for developing effective trading strategies and managing risk in the Forex market.

What Are Fractional Pips in Forex Trading?

What is a Pips Fractional, it also known as pipettes, represent a more precise unit of measurement in Forex trading. While a standard pip is the smallest price movement for most currency pairs, typically at the fourth decimal place (0.0001) or the second decimal place for pairs involving the Japanese yen (0.01), a fractional pip goes a step further by dividing a pip into ten smaller units. This means a fractional pip appears in the fifth decimal place for most pairs or the third decimal place for yen pairs. For instance, if the EUR/USD pair moves from 1.12000 to 1.12001, this change represents one pipette.

The introduction What is a Pips fractional that allows for more precise pricing and tighter spreads, which can be beneficial for high-frequency traders and those using scalping strategies. By offering finer granularity in price movements, fractional pips help traders achieve more accurate entry and exit points, improving overall trade efficiency and potential profitability.

Why Are Pips Important for Forex Traders?

What is a Pip, it is a crucial for Forex traders because they serve as the basic unit for measuring price movements in currency pairs. This measurement is essential for calculating profits and losses in trades. For example, if a trader buys the EUR/USD pair at 1.1000 and the price rises to 1.1010, the trader has gained 10 pips. The monetary value of these pips depends on the trade size, with each pip typically worth $10 for a standard lot (100,000 units).

Moreover, what is a Pip, these are integral to risk management strategies. By understanding pip values, traders can set stop-loss and take-profit levels to limit potential losses and lock in gains. This ability to quantify risk and reward helps traders manage their capital more effectively, making informed decisions that align with their risk tolerance and trading goals.

How to Use Pips in Forex Trading Strategies?

Pips are a foundational element in developing and executing Forex trading strategies. Here’s how they are used:

- Setting Stop-Loss and Take-Profit Orders: Traders use pips to determine the placement of stop-loss and take-profit orders. For instance, if a trader buys the EUR/USD at 1.1000 and wants to limit potential losses to 20 pips, they might set a stop-loss at 1.0980. Similarly, if they aim to gain 30 pips, they might set a take-profit order at 1.1030. These levels help manage risk and secure profits systematically.

- Calculating Trade Size: The number of pips a trader expects to gain or lose influences the size of their trades. By assessing the potential pip movement and its monetary value, traders can adjust their position sizes to align with their risk management rules. For example, if a trader is willing to risk $100 on a trade and each pip is worth $10, they can afford to risk 10 pips and should size their position accordingly.

- Developing Trading Strategies: What is a Pips are used in various technical analysis tools and indicators to develop and refine trading strategies. Traders analyse historical pip movements to identify trends and patterns, helping them predict future price movements and make strategic trading decisions. Whether using moving averages, Fibonacci retracements, or other technical tools, understanding pip values is critical for accurate analysis and strategy development.

Conclusion

Understanding what a pip is in Forex trading is crucial for grasping the finer details of how currency price movements are measured. A pip, or “percentage in point,” represents the smallest price movement in a currency pair, typically the fourth decimal place in most currency pairs. This understanding lays the foundation for better navigating the dynamics of Forex trading, where even minor fluctuations can lead to significant profit or loss.

Building on this, it’s essential to comprehend the concept of currency pairs, as introduced in the previous topic, “Understanding Currency Pairs.” Currency pairs form the basis of Forex trading, where the value of one currency is quoted against another. Knowing how these pairs interact helps traders appreciate how pips are calculated and the overall implications for their trading strategies. Together, these concepts provide a comprehensive framework for beginners to advance in Forex trading.