A margin call is a demand from a broker for an investor to deposit additional funds or securities into their margin account. This usually happens when the value of the securities purchased with borrowed money falls below a certain level, making the account’s equity insufficient to meet the broker’s maintenance requirements. Margin calls are a critical aspect of margin trading, as they help protect brokers from potential losses due to market fluctuations.

When a margin call is triggered, the investor must promptly add funds to their account or sell some of their securities to bring the account back to the required margin level. Failure to meet a margin call can lead to the automatic liquidation of assets, which may result in significant financial losses.

Table of Contents

How Does a Margin Call Work in the Stock Market?

A margin call in the stock market is triggered when the value of the investor’s account falls below the broker’s required maintenance margin. When you buy securities on margin, you’re borrowing money from your broker to pay for a portion of the investment. The securities act as collateral for the loan. If the value of those securities drops significantly, the equity in your account might not be enough to cover the loan, leading to a margin call.

When a margin call occurs, the broker will demand that you deposit additional funds or sell some of your assets to bring your account back to the required level. For instance, if you purchased $10,000 worth of stocks using $5,000 of your own money and $5,000 borrowed from the broker, a 25% drop in stock value would reduce your equity to $2,500. If the maintenance margin is set at 30%, you would need to deposit an additional $500 to meet the margin call.

Why Do Margin Calls Occur?

Margin calls occur primarily due to a decline in the value of the securities in your margin account. This can happen for various reasons, including market volatility, poor earnings reports, or broader economic factors that negatively impact the stock market. When the market value of your investments drops, the equity in your margin account decreases, making it insufficient to meet the broker’s maintenance margin requirement.

Another common reason for margin calls is excessive use of leverage. Leverage amplifies both potential gains and losses. If an investor is highly leveraged and the market moves against them, even a small decline in asset value can trigger a margin call. Brokers impose these calls to ensure that the loaned amount remains secure and that they can recover the borrowed funds if necessary.

What Are the Risks Associated with Margin Calls?

The risks associated with margin calls are substantial and can lead to significant financial losses. One of the most immediate risks is the forced liquidation of assets. If an investor is unable to meet a margin call by depositing additional funds, the broker has the right to sell the securities in the margin account to cover the shortfall. This can happen without the investor’s consent, potentially at a time when the market is down, leading to losses.

Another risk is the potential for a downward spiral of losses. If the market continues to decline, multiple margin calls can occur in quick succession, forcing the sale of more assets at increasingly lower prices. This situation can deplete an investor’s account rapidly, leaving them with little to no equity. Additionally, the use of leverage magnifies both gains and losses, so the impact of a margin call can be much greater than initially anticipated.

How Can You Avoid a Margin Call?

Avoiding a margin call requires proactive management of your margin account and a deep understanding of the risks involved in margin trading. One of the most effective strategies is to maintain a cushion of extra equity in your account beyond the minimum required by your broker. This buffer can help absorb minor market fluctuations without triggering a margin call. Regularly monitoring your account balance and the market conditions is also essential; this allows you to anticipate potential margin calls and take action before they occur.

Another strategy is to use stop-loss orders on your investments. A stop-loss order automatically sells a security when it reaches a predetermined price, helping you limit losses. By setting stop-loss orders, you can prevent your account’s equity from falling too low, thereby reducing the likelihood of a margin call. Additionally, diversifying your portfolio can mitigate the risk associated with market volatility, as losses in one area may be offset by gains in another, stabilizing your overall account value.

Furthermore, limiting the use of leverage is crucial. While leveraging can amplify gains, it also increases the risk of a margin call when the market moves unfavorably. By borrowing less and relying more on your capital, you reduce the chances of being caught off guard by a sudden market downturn.

What Happens After a Margin Call is Triggered?

When a margin call is triggered, the broker will notify you that your account equity has fallen below the required maintenance margin. This notification may be delivered through various channels, such as email, phone, or an alert on your trading platform. Once you receive this notification, you typically have a short window of time—often 24 to 48 hours—to meet the margin call by either depositing additional funds or selling some of your securities.

If you fail to meet the margin call within the specified time frame, the broker will take action to protect their loan by liquidating some or all of your assets. This forced sale can occur without your consent and may result in significant losses, especially if the market is performing poorly. The broker’s primary goal is to ensure that the loan is fully covered, so they will sell enough of your assets to bring your account back to the required margin level.

In some cases, if the market is particularly volatile, the value of your securities could drop so rapidly that the broker liquidates assets before you even have a chance to respond to the margin call. This can leave you with little to no equity in your account, and you may even owe additional funds if the sale of your assets doesn’t cover the debt.

What Are the Consequences of Failing a Margin Call?

Failing to meet a margin call can lead to several serious consequences, the most immediate of which is the forced liquidation of your assets. When your broker sells your securities to cover the margin deficiency, it often results in losses, especially if the market is down. This forced sale may occur at an unfavorable time, locking in losses that might have been avoided if you had more time to react or if the market had a chance to recover.

Another significant consequence is damage to your credit with the brokerage firm. If the sale of your assets doesn’t fully cover the outstanding debt, you will be required to pay the remaining balance. If you’re unable to pay, the broker may take legal action to recover the funds, which can lead to additional fees, legal costs, and a tarnished financial record. This could also affect your ability to borrow in the future or engage in further margin trading.

Moreover, the psychological impact of failing a margin call can be substantial. The stress and financial strain of losing significant investments, coupled with the responsibility of paying off any remaining debt, can lead to a loss of confidence in your trading abilities. It may take considerable time to recover financially and emotionally from such an event, underscoring the importance of carefully managing margin accounts to avoid these severe consequences.

What Are the Differences Between Initial Margin and Maintenance Margin?

Initial margin and maintenance margin are two critical concepts in margin trading that serve different purposes in managing leveraged positions. The initial margin is the minimum amount of equity that an investor must deposit when opening a margin account or placing a margin trade. This initial deposit acts as collateral for the borrowed funds, allowing the investor to leverage their position. The amount required for the initial margin is typically a percentage of the total value of the securities being purchased and varies depending on the broker and the type of securities involved.

On the other hand, the maintenance margin is the minimum amount of equity that must be maintained in a margin account after a trade has been initiated. Unlike the initial margin, which is a one-time requirement, the maintenance margin is continuously monitored by the broker to ensure that the value of the account does not fall below a certain threshold. If the account’s equity drops below this level due to market fluctuations, a margin call will be issued, requiring the investor to deposit additional funds or liquidate assets to restore the required margin level.

Key Differences:

- Purpose:

- Initial Margin: Required to open a margin position.

- Maintenance Margin: Required to maintain the margin position.

- Timing:

- Initial Margin: Paid upfront when the trade is initiated.

- Maintenance Margin: Monitored continuously after the trade is open.

- Consequences of Non-Compliance:

- Initial Margin: The trade cannot be executed.

- Maintenance Margin: A margin call is triggered, possibly leading to asset liquidation.

How Do Brokers Notify You of a Margin Call?

When your account’s equity falls below the required maintenance margin, brokers have several methods to notify you of a margin call. The primary purpose of this notification is to inform you that immediate action is needed to bring your account back into compliance with the broker’s requirements.

Common Notification Methods:

- Email Alerts: Most brokers will send an email notification when a margin call is triggered. This email will detail the amount of the margin call, the current equity in your account, and the steps required to resolve the situation.

- Phone Calls: In cases where the situation is urgent, brokers may call you directly to ensure that you are aware of the margin call and understand the actions needed. This is especially common if the margin call is substantial or if the market is highly volatile.

- Platform Alerts: Many brokers also utilize notifications within their trading platforms. These alerts may pop up when you log in, or they might be displayed prominently in your account dashboard. This method ensures that you receive the notification even if you miss an email or phone call.

Action Required Upon Notification:

- Deposit Additional Funds: Increase your account’s equity by transferring funds to cover the margin call.

- Sell Securities: Liquidate some assets to reduce the margin deficit and restore the required maintenance margin.

- Close Positions: In some cases, you may need to close out specific positions to meet the margin requirements.

What Strategies Can Be Used to Meet a Margin Call?

When facing a margin call, investors have several strategies at their disposal to meet the broker’s demands and restore the account to compliance. These strategies aim to quickly increase the account’s equity or reduce the margin requirement, thus avoiding forced liquidation of assets.

Common Strategies:

- Deposit Additional Cash: The most straightforward way to meet a margin call is to deposit additional funds into your margin account. This increases the account’s equity and can quickly resolve the margin call without needing to liquidate any assets.

- Sell Securities: If you don’t have additional cash to deposit, selling some of the securities in your margin account can reduce the outstanding loan balance. By liquidating enough assets, you can bring your account back within the required maintenance margin levels.

- Transfer Collateral: Some brokers allow investors to transfer additional securities into the margin account as collateral. This can help meet the margin requirements without needing to liquidate assets or deposit cash.

Preventive Measures:

- Monitor Account Regularly: Regularly checking your margin account balance can help you anticipate margin calls and take action before they occur.

- Use Stop-Loss Orders: Placing stop-loss orders on your investments can help limit losses and prevent your account from falling into a margin call situation.

- Limit Leverage: Reducing the amount of leverage used in your trades lowers the risk of a margin call, as smaller market movements will have less impact on your account’s equity.

Can You Negotiate a Margin Call with Your Broker?

In some cases, it may be possible to negotiate a margin call with your broker, but this largely depends on the broker’s policies and the specific circumstances of the margin call. If you have a strong relationship with your broker and a good track record, they might offer some flexibility, especially if the market downturn appears to be temporary. For example, a broker might grant you an extension on the deadline to meet the margin call, giving you more time to come up with the necessary funds or to sell assets at a more favorable price.

However, it’s important to understand that brokers are under no obligation to negotiate. Their primary responsibility is to protect the loan they extended to you, and they are within their rights to liquidate your assets without prior notice if you fail to meet the margin requirements. In some cases, brokers might agree to liquidate only a portion of your assets, or they might allow you to select which assets to sell, but these negotiations are not guaranteed and often depend on the size of your account and the severity of the market conditions.

If you do choose to negotiate, it’s crucial to act quickly and communicate clearly with your broker. The earlier you reach out after receiving a margin call, the more likely you are to receive some leeway. Be prepared to explain your financial situation and present a clear plan for meeting the margin requirements. While not all brokers will be open to negotiation, demonstrating your commitment to resolving the issue can sometimes result in a more favorable outcome.

How Are Margin Calls Handled in Different Markets (Forex, Stocks, Futures)?

Margin calls operate differently across various financial markets, including forex, stocks, and futures, due to the distinct nature of these markets and the varying levels of risk involved.

Forex Market:

In the forex market, margin calls can be particularly aggressive due to the high leverage typically available to traders. Forex brokers often offer leverage ratios as high as 50:1 or more, meaning that even small market movements can significantly impact an account’s equity. When a margin call is triggered in forex trading, brokers often take swift action to liquidate positions, sometimes even before notifying the trader, to prevent further losses. This is because the forex market operates 24/7, and price movements can be extremely rapid, leaving little room for manual intervention by traders.

Stock Market:

In the stock market, margin calls are usually less immediate, giving traders a window of time—typically 24 to 48 hours—to meet the margin requirement. Stock brokers might notify traders via email, phone calls, or platform alerts, and they might offer more flexibility in how traders can respond, such as allowing them to sell specific stocks to meet the margin call or deposit additional funds. However, if the margin call is not met within the specified time, the broker will proceed to liquidate enough assets to cover the margin deficiency.

Futures Market:

The futures market presents another unique scenario. Margin requirements in futures trading are often set by the exchange rather than the broker, leading to less flexibility in how margin calls are handled. Futures contracts are also marked to market daily, meaning that margin calls can be triggered by daily fluctuations in the value of the contracts. When a margin call occurs, futures traders typically must add funds to their account by the next trading session to maintain their positions. Failure to do so will result in the broker closing out positions at the current market price, which could result in significant losses.

What Are the Legal Implications of Margin Calls?

Margin calls come with several legal implications that investors should be aware of, particularly in cases where the margin call is not met. When you enter into a margin agreement with a broker, you agree to the terms and conditions that allow the broker to take specific actions if your account falls below the required margin levels. This typically includes the broker’s right to liquidate your assets without prior notice to cover the margin deficiency, as outlined in the margin agreement.

If a broker liquidates your assets to meet a margin call and the proceeds are insufficient to cover the outstanding loan, you may be legally obligated to pay the remaining balance. This is known as a deficiency balance, and failure to pay it can result in the broker taking legal action against you. This could include suing for the remaining balance, which may lead to court judgments, wage garnishments, or liens against your property. In extreme cases, bankruptcy may be considered if the deficiency balance is substantial and you are unable to pay it.

Moreover, margin trading involves a complex set of regulations that vary by country and market. In the United States, for example, the Federal Reserve Board’s Regulation T governs the amount of credit that brokers can extend to customers for the purchase of securities. Violations of these regulations, either by the broker or the investor, can result in legal consequences, including fines and sanctions. Therefore, it’s crucial for investors to fully understand the terms of their margin agreement and the potential legal ramifications before engaging in margin trading.

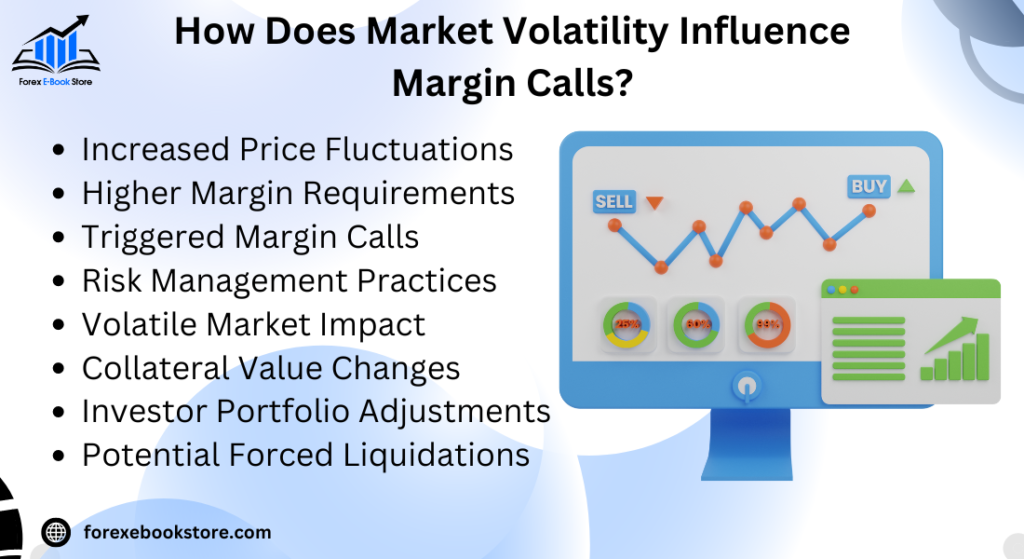

How Does Market Volatility Influence Margin Calls?

Market volatility plays a significant role in the frequency and severity of margin calls. During periods of high volatility, asset prices can fluctuate dramatically within a short time frame. These rapid changes can cause the value of a margin account to drop suddenly, triggering a margin call. Investors holding leveraged positions are particularly vulnerable during volatile markets, as even small price movements can have a magnified impact on their account’s equity.

Impact of Volatility on Margin Accounts:

- Frequent Margin Calls: High volatility increases the likelihood of margin calls, as price swings can quickly reduce the equity in a margin account below the required maintenance level.

- Forced Liquidations: In volatile markets, brokers may act swiftly to liquidate assets if a margin call is not met promptly. This is done to protect the broker’s loan and to prevent further losses in case the market continues to move unfavorably.

- Increased Margin Requirements: To mitigate the risk of margin calls during volatile periods, brokers may raise the maintenance margin requirements. This means that investors need to maintain a higher level of equity in their accounts to avoid triggering a margin call.

For investors, understanding how market volatility affects margin accounts is crucial. During periods of increased volatility, it is advisable to closely monitor margin levels and be prepared to take action, such as reducing leveraged positions or adding additional funds to cushion against potential margin calls.

What Role Does Leverage Play in Margin Calls?

Leverage is a key factor in margin trading that significantly influences the likelihood of margin calls. When investors trade on margin, they are essentially borrowing money from their broker to increase their purchasing power, which allows them to take larger positions than they could with their own capital alone. While leverage can amplify gains, it also magnifies losses, making margin accounts more susceptible to margin calls when the market moves unfavorably.

How Leverage Increases Risk:

- Amplified Losses: With higher leverage, even a small decline in the value of the securities can lead to a substantial reduction in account equity, quickly triggering a margin call.

- Lower Margin of Error: Higher leverage reduces the cushion between the current equity level and the maintenance margin requirement, meaning that minor market fluctuations can lead to a margin call.

- Risk of Over-Leverage: Investors who over-leverage their positions by borrowing too much relative to their account equity are at greater risk of margin calls. In volatile markets, this risk is further compounded, as leveraged positions are more likely to experience significant value swings.

To manage the risks associated with leverage, investors should use it judiciously and ensure they have a clear understanding of how it affects their margin account. Keeping leverage within manageable limits and maintaining a buffer of additional equity can help prevent margin calls and reduce the overall risk of large financial losses.

What Tools Can Help Manage or Predict Margin Calls?

There are several tools and strategies available to help investors manage or predict margin calls. These tools are designed to monitor account equity, assess risk, and provide alerts when margin levels approach critical thresholds, enabling investors to take proactive measures to avoid margin calls.

Common Tools for Managing Margin Calls:

- Margin Calculators: Many brokers offer margin calculators that allow investors to input their account details and trading positions to estimate how close they are to a margin call. These calculators can help investors plan their trades more effectively by providing real-time data on their margin status.

- Stop-Loss Orders: Stop-loss orders are an essential tool for managing risk in margin accounts. By setting a predetermined price at which a security will be sold, investors can limit potential losses and prevent their account equity from falling to levels that would trigger a margin call.

- Margin Call Alerts: Most trading platforms offer customizable alerts that notify investors when their account equity approaches the maintenance margin requirement. These alerts can be sent via email, SMS, or through the trading platform itself, allowing investors to act quickly to meet a margin call.

Predictive Tools:

- Risk Management Software: Advanced risk management software can analyze market conditions and portfolio positions to predict potential margin calls before they occur. These tools use algorithms to assess market volatility, leverage levels, and other factors to provide early warnings of margin risks.

- Portfolio Stress Testing: Some investors use stress testing tools to simulate how their margin account would perform under various market scenarios. By modeling different levels of market volatility and price declines, investors can better understand their exposure to margin calls and adjust their strategies accordingly.

How Did Major Market Crashes Influence Margin Call Regulations?

Major market crashes have significantly influenced the evolution of margin call regulations. Historically, market crashes have exposed the risks of excessive leverage and inadequate margin requirements, prompting regulators to tighten rules to protect both investors and the financial system.

The 1929 Stock Market Crash:

- Catalyst for Regulation: The 1929 crash highlighted the dangers of high leverage, as many investors had borrowed extensively to buy stocks. When the market collapsed, widespread margin calls led to forced liquidations, exacerbating the downward spiral. In response, the U.S. government introduced the Securities Exchange Act of 1934, which gave the Federal Reserve the authority to regulate margin requirements, establishing a baseline for how much investors could borrow.

- Introduction of Regulation T: This regulation set initial margin requirements at 50%, meaning investors could borrow up to 50% of the purchase price of securities. It also established maintenance margin levels to prevent excessive borrowing, reducing the risk of margin calls leading to another market collapse.

The 2008 Financial Crisis:

- Reevaluation of Leverage: The 2008 financial crisis led to a re-evaluation of margin requirements, especially in the derivatives market. Excessive leverage in mortgage-backed securities and other complex financial products played a key role in the crisis, prompting tighter regulation and more conservative margin practices.

- Dodd-Frank Act: In response, the Dodd-Frank Wall Street Reform and Consumer Protection Act was passed in 2010. Among its many provisions, it included stricter rules on leverage and margin for derivatives, aiming to reduce systemic risk and prevent a recurrence of such a crisis.

These regulations have been crucial in maintaining market stability, ensuring that investors cannot over-leverage themselves to the extent that a market downturn could trigger a cascade of margin calls leading to broader financial instability.

Can Margin Calls Be Automated or Managed Through Software?

In today’s digital age, many aspects of margin calls can be automated or managed through software. This automation helps investors respond more quickly to changing market conditions and reduces the risk of missing critical margin calls.

Automation in Margin Trading:

- Auto-Liquidation: Many brokers offer automated liquidation services, which kick in when a margin call is triggered. If the account equity falls below the maintenance margin, the software automatically sells off securities to bring the account back into compliance. This feature is particularly useful in fast-moving markets where delays in human decision-making could lead to significant losses.

- Automatic Alerts: Trading platforms often provide automated alert systems that notify investors via email, SMS, or app notifications when their account equity is nearing the margin call threshold. These alerts allow investors to take preemptive action before a margin call is triggered.

Software Tools for Managing Margin:

- Risk Management Platforms: Comprehensive risk management software can help investors monitor their margin accounts in real-time. These platforms often include features such as real-time margin calculations, predictive analytics, and stress testing to assess how various market conditions could impact the account’s equity.

- Automated Rebalancing: Some platforms offer automated portfolio rebalancing tools, which can adjust the holdings in a margin account to maintain the desired risk profile. For example, if the equity falls below a certain level, the software can automatically sell a portion of the portfolio or reduce leverage to prevent a margin call.

What Are the Best Practices for Risk Management to Prevent Margin Calls?

Preventing margin calls requires a disciplined approach to risk management. By following best practices, investors can minimize the likelihood of a margin call and protect their portfolios from significant losses.

Best Practices for Risk Management:

- Maintain a Cushion of Equity: Always keep a buffer of extra equity in your margin account above the required maintenance margin. This cushion can absorb market fluctuations without immediately triggering a margin call, giving you more time to respond if the market moves against you.

- Diversify Your Portfolio: Diversification helps spread risk across different assets, reducing the impact of a downturn in any single investment. A well-diversified portfolio is less likely to experience the kind of severe declines that lead to margin calls.

- Use Stop-Loss Orders: Implementing stop-loss orders on your trades can help limit potential losses by automatically selling a security when it reaches a predetermined price. This strategy prevents your account equity from falling too low, reducing the risk of a margin call.

- Limit Leverage: Avoid over-leveraging your positions. While leverage can amplify gains, it also increases the risk of a margin call when the market moves unfavorably. Use leverage cautiously and only when you have a clear strategy for managing the associated risks.

- Regular Account Monitoring: Regularly review your margin account and market conditions. Keeping a close eye on your account’s equity levels allows you to take proactive measures, such as adding funds or adjusting positions, before a margin call occurs.

How to Recover from a Margin Call Financially and Emotionally?

Recovering from a margin call can be challenging, both financially and emotionally. The experience can leave investors with significant losses and a sense of failure. However, with a strategic approach, it is possible to rebuild your finances and regain confidence in your trading abilities.

Financial Recovery Steps:

- Assess the Damage: The first step in recovering financially from a margin call is to assess the full extent of your losses. Review your account statements to understand what positions were liquidated and how much of your equity remains. This will give you a clear picture of your current financial situation.

- Reevaluate Your Strategy: Analyze what led to the margin call. Was it due to excessive leverage, market volatility, or poor risk management? Understanding the root cause will help you avoid similar situations in the future. You may need to adjust your trading strategy, such as reducing leverage or diversifying your portfolio, to lower your risk.

- Create a Repayment Plan: If you owe money to your broker due to a deficiency balance, create a repayment plan. Prioritize paying off this debt to avoid further financial strain. If possible, allocate a portion of your income or savings towards repaying the balance as quickly as possible.

Emotional Recovery Steps:

- Acknowledge the Experience: It’s important to acknowledge the emotional impact of a margin call. Feelings of disappointment, stress, and even shame are common, but understanding that losses are a part of trading can help you move forward.

- Seek Support: Talking to other traders or a financial advisor can provide valuable perspective and support. They can offer insights into how to cope with the emotional aftermath and how to adjust your approach moving forward.

- Rebuild Confidence Gradually: Start small as you return to trading. Rebuild your confidence by focusing on less risky investments and gradually increasing your activity as you regain your footing. Avoid jumping back into high-risk trades until you feel fully prepared.

Conclusion

In conclusion, understanding what a margin call is and how to manage it is essential for any investor engaged in margin trading. A margin call can be a turning point in your trading journey, highlighting the importance of effective risk management and careful use of leverage. By knowing how margin calls work, the factors that trigger them, and the best practices for avoiding them, you can protect your investments and navigate the complexities of the financial markets with greater confidence.

It’s also crucial to keep an eye on your account balance since it plays a direct role in determining whether a margin call is triggered. Your account balance reflects your financial standing within your trading account and is affected by the performance of your investments and any borrowed funds. Maintaining a healthy account balance not only helps in avoiding margin calls but also ensures you have the necessary equity to capitalize on new opportunities in the market. Understanding both concepts—what a margin call is and what account balance means—will strengthen your overall trading strategy and contribute to long-term success.