Understanding exchange rates is crucial for anyone involved in international finance, travel, or global trade. Exchange rates dictate how much one currency is worth in terms of another and influence the cost of goods, services, and investments across borders. Whether you’re a business owner managing foreign transactions, a traveller planning a trip abroad, or an investor looking to diversify, grasping the basics of exchange rates is essential for making informed decisions.

Exchange rates are not static; they fluctuate constantly due to a variety of factors including interest rates, inflation, and geopolitical events. By understanding exchange rates and the forces behind their movements, you can better anticipate changes, minimize costs, and optimize financial outcomes. This guide will walk you through the fundamentals, helping you to navigate the complexities of the global currency market with confidence.

Table of Contents

How are Exchange Rates Determined in the Global Market?

Exchange rates are determined by the interaction of various factors in the global market, primarily through the forces of supply and demand. When the demand for a particular currency increases, its value tends to rise relative to other currencies. Conversely, if demand decreases, the currency’s value will likely fall. This dynamic is influenced by several key factors:

- Interest Rates: Higher interest rates in a country can attract foreign capital, leading to an increased demand for that country’s currency. As a result, the currency appreciates in value.

- Economic Indicators: Economic stability, growth forecasts, and trade balances also play a significant role. A country with a strong economy is more likely to attract investment, bolstering its currency value.

- Market Speculation: Traders and investors speculate on future movements of currencies, which can significantly impact exchange rates. If investors believe a currency will strengthen, they will buy more of it, increasing its value.

The global market operates 24/7, meaning exchange rates can fluctuate frequently within a single day. These rates are often quoted in pairs, such as USD/EUR or GBP/JPY, indicating the amount of one currency needed to purchase another.

What are the Different Types of Exchange Rates?

Understanding the types of exchange rates is essential for comprehending how currencies are valued and traded globally. There are primarily two types of exchange rates: floating and fixed.

- Floating Exchange Rates:

- Floating exchange rates are determined by the free market through supply and demand. These rates fluctuate continuously, influenced by market forces such as economic data, interest rates, and geopolitical events. Major currencies like the US dollar, the euro, and the yen typically have floating exchange rates.

- Advantages: Flexibility in adjusting to economic conditions, allowing for automatic correction of trade imbalances.

- Disadvantages: Can lead to high volatility, which can be challenging for businesses and economies relying on stable exchange rates.

- Fixed Exchange Rates:

- In contrast, fixed exchange rates (or pegged rates) are set and maintained by a country’s government or central bank. The currency’s value is pegged to another major currency or a basket of currencies. For example, some countries peg their currency to the US dollar.

- Advantages: Provides stability and predictability in international trade and investment.

- Disadvantages: Limits a country’s ability to adjust its currency value in response to economic conditions, which can lead to economic imbalances.

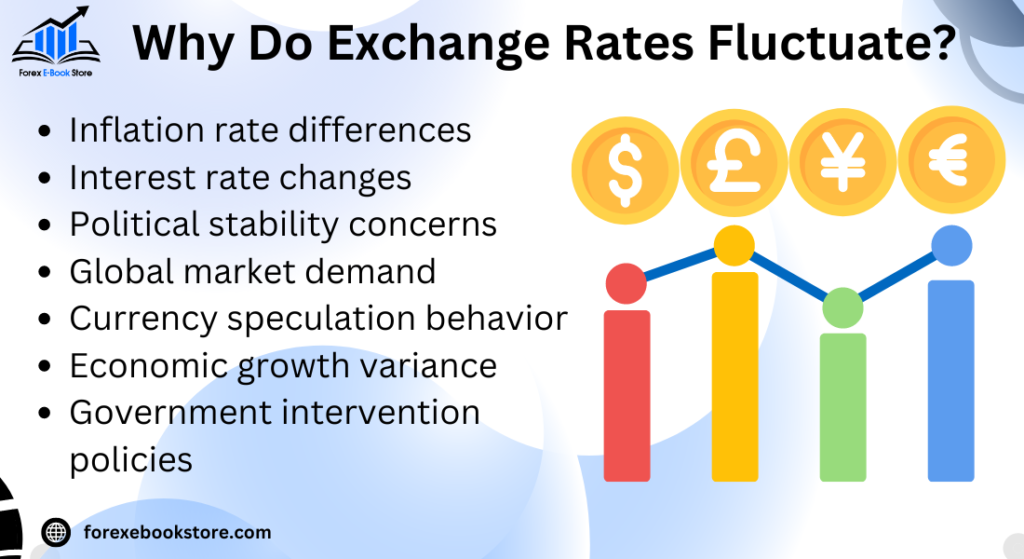

Why Do Exchange Rates Fluctuate?

Exchange rates fluctuate due to a myriad of factors, making them inherently volatile. One of the primary reasons for these fluctuations is economic performance. A country with strong economic indicators, such as low unemployment and high GDP growth, is likely to see its currency appreciate. Conversely, economic instability can lead to a depreciation of the currency.

Another significant factor is interest rate differentials between countries. When a country raise s its interest rates, it typically attracts more foreign capital, leading to an increased demand for its currency and a subsequent appreciation. On the other hand, lower interest rates can result in currency depreciation.

Political stability and events also play a crucial role. Political uncertainty or geopolitical tensions can lead to a lack of confidence in a country’s currency, causing it to lose value. Conversely, a stable political environment tends to boost investor confidence, leading to currency appreciation.

- Short-term Speculation: Traders and investors constantly speculate on currency movements, which can cause rapid and significant fluctuations in exchange rates.

- Supply and Demand: As with any market, supply and demand dynamics are at play. For example, if a country exports more than it imports, demand for its currency will rise, leading to an appreciation.

How Do Central Banks Impact Exchange Rates?

Central banks play a pivotal role in influencing exchange rates through various monetary policies and interventions. One of the primary tools they use is interest rate adjustments. By increasing or decreasing interest rates, central banks can make a currency more or less attractive to investors. For example, when a central bank raises interest rates, it typically leads to an appreciation of the currency as higher returns attract foreign capital.

Another significant method is direct intervention in the foreign exchange market. Central banks may buy or sell their currency to influence its value. If a currency is appreciating too rapidly and harming exports, a central bank might intervene by selling its currency to increase supply and lower its value. Conversely, if a currency is depreciating and causing inflationary pressures, the central bank might buy its currency to reduce supply and stabilize its value.

Additionally, central banks influence exchange rates through quantitative easing (QE) or tightening. QE involves the purchase of financial assets to inject liquidity into the economy, often leading to currency depreciation due to increased money supply. Conversely, tightening the money supply can lead to currency appreciation as it restricts the available currency in the market.

How Do Floating and Fixed Exchange Rates Differ?

Floating Exchange Rate

A floating exchange rate is determined by the free market through supply and demand dynamics relative to other currencies. When demand for a currency is high, its value increases; conversely, when demand is low, its value decreases. This system allows for more flexibility as the exchange rate can adjust automatically in response to changes in the global economy. For instance, if a country experiences an economic boom, its currency value may rise due to increased investor confidence and demand.

Key Characteristics:

- Market-Driven: The value fluctuates based on economic conditions.

- Flexibility: Adjusts to economic changes like inflation or interest rates.

- Global Impact: Influences and is influenced by global trade and investment flows.

Fixed Exchange Rate

In contrast, a fixed exchange rate, also known as a pegged rate, is a government-maintained exchange rate that is set against another major currency, such as the U.S. dollar or the Euro. Governments use their foreign currency reserves to maintain the fixed rate, intervening in the market to buy or sell their currency to keep it at the target value. This system provides stability and predictability, which can be beneficial for businesses and investors who operate in multiple countries.

Key Characteristics:

- Government Control: The exchange rate is maintained by the government or central bank.

- Stability: Reduces the uncertainty in international trade and investment.

- Economic Management: Often used to control inflation or stabilize an economy.

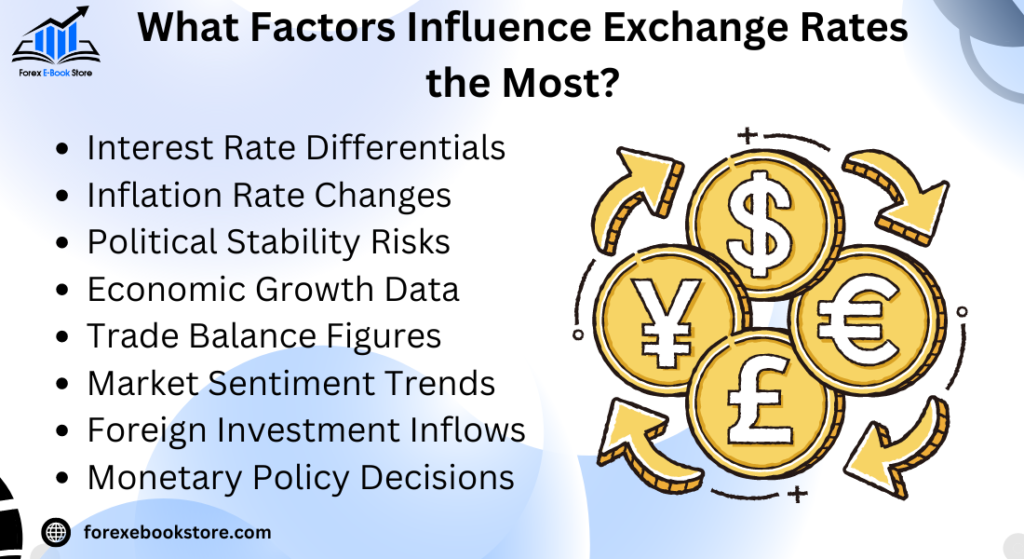

What Factors Influence Exchange Rates the Most?

Economic Indicators

Exchange rates are heavily influenced by key economic indicators such as interest rates, inflation, and gross domestic product (GDP). For example, higher interest rates in a country can attract foreign capital, increasing demand for its currency and causing its value to rise. Conversely, high inflation may lead to depreciation as it erodes purchasing power.

Key Economic Indicators:

- Interest Rates: Higher rates generally attract investment, boosting currency value.

- Inflation: Higher inflation can decrease currency value by reducing purchasing power.

- Economic Growth (GDP): Strong economic performance typically strengthens a currency.

Political Stability and Economic Performance

Political stability is another crucial factor that impacts exchange rates. Countries with stable governments and sound economic policies are more attractive to foreign investors, leading to stronger currency values. On the other hand, political instability or economic mismanagement can cause a currency to depreciate rapidly.

Political and Economic Factors:

- Government Stability: Stable governments with predictable policies attract investment.

- Economic Policy: Effective fiscal and monetary policies can strengthen a currency.

- Global Perception: How a country is viewed globally affects its currency’s strength.

Market Speculation

Currency values can also be influenced by market speculation. If investors believe a currency will rise or fall in the future, their trading activities can drive the currency’s value up or down in the present. Speculation often reacts to anticipated changes in economic conditions, political events, or global market trends.

Market Dynamics:

- Speculative Trading: Investor actions based on future expectations can shift currency values.

- Global Events: Political events, natural disasters, or changes in global markets can lead to rapid currency fluctuations.

What is the Role of Interest Rates in Exchange Rate Movements?

Interest rates are one of the most critical determinants of exchange rate movements. The relationship between interest rates and exchange rates is primarily driven by capital flows. When a country’s central bank increases interest rates, it offers higher returns on investments denominated in that currency, attracting foreign capital. This increased demand for the currency leads to an appreciation in its value.

Conversely, when a central bank lowers interest rates, the return on investments decreases, leading to reduced foreign capital inflows and, often, a depreciation of the currency. This dynamic explains why currencies of countries with higher interest rates tend to strengthen, while those with lower interest rates may weaken.

Interest rate differentials—the difference between interest rates in two different countries—are also crucial in determining exchange rates. Investors often engage in what is known as carry trades, where they borrow in a currency with low interest rates and invest in a currency with higher rates, profiting from the interest rate differential. This practice can further influence exchange rates, driving up the value of the currency with the higher interest rate.

How Does Inflation Affect Exchange Rates?

Inflation and exchange rates are closely intertwined. Generally, a country with a lower inflation rate than others will see an appreciation in its currency value. This is because lower inflation rates typically signal economic stability and stronger purchasing power, making the currency more attractive to foreign investors.

Conversely, higher inflation erodes purchasing power and can lead to a depreciation of the currency. This happens because as inflation rises, the real value of the currency falls, making goods and services more expensive. As a result, there may be a decline in demand for the currency, leading to its depreciation on the global market.

Purchasing Power Parity (PPP) is a theory that explains the relationship between inflation and exchange rates. According to PPP, the exchange rate between two countries should equal the ratio of the countries’ price levels for a fixed basket of goods and services. Thus, if one country experiences higher inflation than another, its currency should depreciate accordingly to restore the balance of purchasing power between the two currencies.

Understanding the link between inflation and exchange rates is crucial for businesses and investors. By monitoring inflation trends, they can make more informed decisions about currency risks and hedging strategies, ensuring better financial outcomes in international transactions.

What Are Currency Conversion Spreads and Why Do They Matter?

Currency conversion spreads, also known as exchange rate spreads, are the difference between the buy (bid) and sell (ask) prices offered by banks or currency exchange services. This spread is a form of profit margin for these financial institutions. The spread can vary significantly depending on the institution, the amount of currency being exchanged, and the specific currencies involved.

Understanding currency conversion spreads is essential because it directly affects the cost of exchanging money. A wider spread means that the institution is taking a larger cut, resulting in a less favorable exchange rate for the customer. For instance, if you are exchanging a large amount of money, even a small difference in the spread can lead to significant losses.

To minimize these costs, it’s crucial to compare the spreads offered by different providers. Some online platforms or financial services may offer narrower spreads, making them more cost-effective for large transactions. Being aware of these differences can help you save money, especially when dealing with frequent or substantial currency exchanges.

How Can You Calculate the True Cost of Currency Exchange?

Calculating the true cost of currency exchange goes beyond simply looking at the exchange rate. It’s important to account for any additional fees and the currency conversion spread. Here’s how you can calculate it:

- Find the Mid-Market Rate: This is the true value of the currency pair, often referred to as the interbank rate, which you can find on financial news websites or currency converters.

- Compare with the Offered Rate: Check the rate provided by your bank or exchange service. The difference between this rate and the mid-market rate is the spread.

- Calculate the Spread: Subtract the offered rate from the mid-market rate to determine the spread. Then, convert this into a percentage of the mid-market rate to understand the true cost.

- Include Additional Fees: Some services may charge flat fees or percentages on top of the spread. Add these to your calculation to find the total cost.

For example, if the mid-market rate for USD to EUR is 0.85 and your bank offers 0.83, the spread is 0.02. If there’s a 1% fee, the total cost will be higher than the simple difference in rates. By knowing these costs, you can make more informed decisions and possibly negotiate better terms or switch providers.

What Tools and Strategies Can Help You Get the Best Exchange Rate?

Securing the best exchange rate involves using the right tools and adopting strategic practices. Here are some ways to ensure you get the most favorable rates:

- Use Online Currency Converters: Websites and apps like XE.com and OANDA provide real-time exchange rates, which you can compare against the rates offered by your bank or exchange service to identify the most cost-effective option.

- Monitor Rates Regularly: Exchange rates fluctuate throughout the day. By monitoring these fluctuations, you can time your transactions to take advantage of favorable movements. Many platforms offer alerts that notify you when your desired rate is reached.

- Avoid Airport or Hotel Exchanges: These locations typically offer some of the worst rates due to high overhead costs. Instead, use local banks or ATMs, which often provide better rates.

- Consider Using Multi-Currency Accounts: Services like Wise (formerly TransferWise) allow you to hold and transfer money in multiple currencies at the mid-market rate with low fees. This can be particularly beneficial for frequent travelers or businesses that deal with international transactions.

- Leverage Credit Cards with No Foreign Transaction Fees: Some credit cards offer competitive exchange rates with no additional foreign transaction fees, making them a good option for purchases abroad.

How Do Exchange Rates Impact Global Trade and Economies?

Exchange rates play a critical role in shaping global trade and the overall health of economies. A country’s exchange rate directly influences its exports and imports. When a country’s currency is strong, its goods and services become more expensive for foreign buyers, which can reduce demand for its exports. Conversely, a weaker currency makes a country’s goods and services cheaper on the global market, boosting exports.

However, a weaker currency can also make imports more expensive, leading to higher costs for consumers and businesses that rely on foreign goods. This can contribute to inflationary pressures within the economy as the cost of imported goods and services rises. For example, countries that rely heavily on imported oil may see a significant impact on their economies when their currency depreciates.

- Trade Balance: A country with a weaker currency might experience a trade surplus as exports increase and imports decrease. Conversely, a stronger currency could lead to a trade deficit.

- Foreign Investment: Exchange rates also impact foreign direct investment (FDI). A strong currency might deter foreign investors due to the high cost of investing, whereas a weaker currency might attract more investment by making assets cheaper.

The interplay between exchange rates and global trade is complex and can have far-reaching implications for economic stability, employment, and inflation.

What Are the Risks Associated with Exchange Rate Fluctuations?

Exchange rate fluctuations present several risks, particularly for businesses and investors engaged in international activities. One of the primary risks is transaction risk, which arises when there is a time lag between the initiation and settlement of a transaction. During this period, exchange rates can change, potentially leading to losses. For example, if a U.S. company agrees to pay a European supplier in euros and the euro strengthens against the dollar before the payment is made, the company will incur a higher cost than anticipated.

Another significant risk is translation risk. This occurs when multinational companies consolidate their financial statements from foreign subsidiaries. If the exchange rates fluctuate unfavorably, the value of foreign earnings can decrease, impacting the overall financial performance of the company.

- Economic Risk: Also known as operating exposure, this refers to the impact of exchange rate fluctuations on a company’s market value. For instance, if a U.S. company has substantial operations in Europe, a stronger dollar could reduce its competitive edge, as its products become more expensive compared to local competitors.

- Investment Risk: Investors holding foreign assets are also exposed to exchange rate risk. A currency depreciation in the country where the investment is held can lead to lower returns when converted back into the investor’s home currency.

Businesses and investors often use hedging strategies such as forward contracts, options, and currency swaps to mitigate these risks, although these come with their own costs and complexities.

How Do Businesses Manage Exchange Rate Risk?

Managing exchange rate risk is essential for businesses involved in international trade or with operations across multiple countries. One of the most common strategies is hedging, which involves using financial instruments to protect against potential losses from exchange rate fluctuations. For example:

- Forward Contracts: These allow businesses to lock in an exchange rate for a future transaction, providing certainty and protection against adverse movements in the rate.

- Options: Currency options give businesses the right, but not the obligation, to exchange money at a predetermined rate on or before a specified date, offering flexibility while managing risk.

- Currency Swaps: These involve exchanging cash flows in different currencies, allowing companies to manage their foreign currency exposure effectively.

Businesses also manage exchange rate risk through natural hedging by aligning revenue and expenses in the same currency. For instance, a U.S. company with operations in Europe might source materials from European suppliers, ensuring that both revenues and costs are in euros. This reduces the need to convert currencies and minimizes exposure to exchange rate fluctuations.

- Diversification: By diversifying their operations across multiple regions and currencies, businesses can reduce their reliance on any single currency and spread their risk.

- Regular Monitoring and Forecasting: Companies often use sophisticated tools and models to monitor exchange rate trends and forecast potential movements. This allows them to make informed decisions and adjust their hedging strategies accordingly.

Effective management of exchange rate risk enables businesses to protect their profit margins, stabilize their financial performance, and maintain competitiveness in the global market.

What is the Impact of Geopolitical Events on Exchange Rates?

Geopolitical events have a profound impact on exchange rates as they can create uncertainty and instability in the global markets. These events include wars, political elections, trade negotiations, and international sanctions. When such events occur, they often lead to fluctuations in currency values as investors and traders react to the potential risks or opportunities these events might present.

For instance, political instability or conflict in a country can lead to a loss of investor confidence, causing the country’s currency to depreciate. Investors may seek safer assets, often in more stable currencies like the U.S. dollar or Swiss franc, leading to an appreciation of those currencies. On the other hand, positive geopolitical developments, such as successful trade agreements, can boost a country’s currency by increasing investor confidence and promoting economic stability.

- Trade Wars and Sanctions: Trade wars and economic sanctions are specific types of geopolitical events that can drastically alter exchange rates. For example, during the U.S.-China trade war, the Chinese yuan depreciated significantly as tariffs and trade barriers reduced the demand for Chinese goods, thereby lowering the demand for the yuan.

- Elections and Policy Changes: Elections, especially in major economies, can lead to currency volatility as markets react to the potential changes in economic policy. For instance, a candidate perceived as pro-business might strengthen the local currency due to expectations of favorable economic conditions.

Understanding the potential impact of geopolitical events on exchange rates is crucial for businesses and investors as it allows them to anticipate changes and adjust their strategies to manage risk.

How Can Travelers Minimize Currency Exchange Costs?

Travelers often face high currency exchange costs, but there are several strategies to minimize these expenses. One of the most effective ways is to avoid exchanging money at airports or tourist-heavy areas, where exchange rates are often unfavorable due to high overhead costs. Instead, using local ATMs or banks can provide better rates, though it’s important to check for any additional fees that might apply.

Another strategy is to use credit cards with no foreign transaction fees. Many credit cards offer competitive exchange rates that are often better than what you would get from cash exchange services. Additionally, using a credit card can provide benefits such as rewards points or travel insurance.

- Prepaid Travel Cards: These cards allow you to load money in multiple currencies at fixed rates before you travel, protecting you from fluctuations in exchange rates during your trip.

- Online Currency Exchange Services: Platforms like Wise offer low-cost currency exchange with real-time rates, which can be more cost-effective than traditional banks or exchange bureaus.

Travelers should also consider monitoring exchange rates before their trip and exchanging money when the rates are most favorable. Some online services allow you to set alerts for when the exchange rate reaches your preferred level, helping you get the best deal possible.

What Should You Know About Exchange Rates Before Investing Internationally?

Investing internationally offers the potential for significant returns, but it also introduces exchange rate risk. This risk arises because the value of your investment is affected by changes in exchange rates between your home currency and the currency of the investment. For instance, even if your investment performs well, a depreciation in the foreign currency relative to your home currency can reduce your returns.

One important factor to consider is currency hedging. Hedging involves using financial instruments, such as currency futures or options, to protect against adverse movements in exchange rates. Some international investment funds offer hedged versions that protect against currency risk, which can be particularly beneficial in volatile markets.

- Diversification: Spreading investments across multiple currencies can help reduce risk. By diversifying, you are less exposed to the fluctuations of a single currency.

- Economic Indicators: Before investing, it’s crucial to consider the economic indicators of the country in question, such as interest rates, inflation, and political stability. These factors can influence exchange rates and, consequently, the value of your investment.

Finally, it’s important to stay informed about global events that might impact exchange rates. Economic policies, geopolitical developments, and market sentiment can all affect currency values, making it essential to regularly review and adjust your investment strategy in response to changing conditions.

Conclusion

Understanding exchange rates is crucial for navigating the complexities of international finance. Whether dealing with floating or fixed exchange rates, the factors influencing currency values—such as economic indicators, political stability, and market speculation—play a significant role in shaping global trade and investment. By grasping these dynamics, businesses and investors can make more informed decisions, minimizing risks associated with currency fluctuations.

Just as understanding exchange rates is vital for managing international transactions, mastering the art of reading candlestick charts is essential for making informed decisions in financial markets. Candlestick charts offer a visual representation of price movements, helping traders identify potential trends and reversals. Together, these skills—understanding exchange rates and interpreting candlestick charts—equip individuals with a robust toolkit for navigating both the forex market and broader financial markets, enhancing their ability to strategize effectively.