Forex day trading is a style of trading where positions are opened and closed within the same trading day. This means that traders do not hold positions overnight, thus avoiding the risks associated with market movements while they are not actively monitoring the market. What is Forex day trading? It involves the rapid buying and selling of currency pairs, capitalizing on small price movements during the day. This approach is popular among traders who prefer short-term strategies and who have the time to actively monitor the market.

In Forex day trading, traders typically use technical analysis to identify trends, support and resistance levels, and other indicators that can help predict price movements. By focusing on highly liquid currency pairs such as EUR/USD or GBP/USD, day traders can quickly enter and exit trades, aiming to make a series of small profits that accumulate throughout the day. The main goal is to capitalize on intraday volatility while managing risk through risk management techniques like stop-loss orders.

Table of Contents

How is Forex Day Trading Different from Other Trading Styles?

Forex day trading stands out from other trading styles due to its short-term nature. Unlike swing trading or position trading, where traders may hold positions for several days or even weeks, day traders close all positions before the market closes each day. This minimizes the risk of overnight market movements affecting open trades. Day traders focus on taking advantage of intraday volatility to make multiple small trades throughout the day.

In contrast, swing traders look for larger price movements and typically rely on a combination of technical and fundamental analysis, holding trades for several days. Position traders, on the other hand, aim to capitalize on long-term trends and may hold positions for weeks or months. Forex day trading requires quick decision-making and constant market monitoring, making it suitable for traders who have the time and skills to execute rapid trades.

Key Differences in Trading Styles:

- Day Trading: Positions opened and closed within the same day.

- Swing Trading: Positions held for several days or weeks.

- Position Trading: Long-term trades held for weeks or months.

What Are the Key Features of Forex Day Trading?

Forex day trading is characterized by several key features that differentiate it from other trading strategies. These features include the use of short timeframes, frequent trades, and a focus on liquidity and volatility.

- Short Timeframes: Day traders typically use minute charts (1-minute, 5-minute, or 15-minute) to make quick decisions. These short timeframes allow them to capitalize on small price movements throughout the day. The goal is to make multiple trades, each targeting a small profit.

- High Liquidity: Forex day traders focus on highly liquid currency pairs like EUR/USD, USD/JPY, and GBP/USD because these pairs offer tight spreads and high trading volume. Liquidity is essential for day traders to enter and exit positions quickly without significant price slippage.

- Volatility: Volatility is a key factor in day trading. Day traders look for periods of heightened market activity, such as during major economic news releases or overlapping trading sessions, where price movements can be more pronounced.

Key Features of Forex Day Trading:

- Minute charts for rapid decision-making.

- Focus on liquidity with highly traded currency pairs.

- Volatility to take advantage of intraday price swings.

What Are the Best Currency Pairs for Forex Day Trading?

Choosing the right currency pairs is crucial for successful Forex day trading. Day traders typically focus on major currency pairs due to their high liquidity, tight spreads, and consistent volatility. These pairs are more predictable and less prone to erratic price movements compared to exotic currency pairs.

- EUR/USD: This is the most traded currency pair globally and offers the highest liquidity. With low spreads and frequent price movements, EUR/USD is a favorite among day traders.

- GBP/USD: Known for its volatility, GBP/USD is ideal for traders looking for larger price movements. However, this pair can be riskier due to its higher volatility, so traders should use strict risk management.

- USD/JPY: This pair is popular due to its liquidity and lower volatility compared to GBP/USD. It’s a reliable choice for traders seeking stability in their day trading strategy.

Best Currency Pairs for Day Trading:

- EUR/USD: High liquidity and tight spreads.

- GBP/USD: High volatility, offering large price swings.

- USD/JPY: Lower volatility, ideal for more stable day trading.

How Do You Choose the Best Timeframes for Forex Day Trading?

Selecting the right timeframe is critical for success in Forex day trading. Since day traders open and close trades within the same day, they rely on short-term charts to make rapid decisions. The most commonly used timeframes in day trading are 1-minute, 5-minute, and 15-minute charts. These timeframes allow traders to track price movements in real-time and react quickly to changing market conditions.

- 1-Minute and 5-Minute Charts: These timeframes are ideal for highly active day traders who want to capture small price movements throughout the day. With such short timeframes, traders need to be skilled in making quick decisions, as small price fluctuations can present profitable opportunities. However, these timeframes also require constant monitoring and come with higher risk due to the rapid price changes.

- 15-Minute Charts: For traders who prefer slightly longer holding periods during the day, the 15-minute chart is a common choice. It provides more clarity on broader trends while still allowing traders to capitalize on intraday movements. This timeframe is ideal for those who want to balance quick trades with a better view of overall market direction.

Recommended Timeframes for Forex Day Trading:

- 1-minute or 5-minute charts: Best for active traders looking for small, frequent trades.

- 15-minute charts: Offers a balance between short-term trades and market trends.

What Technical Indicators Are Most Effective for Forex Day Trading?

In Forex day trading, technical indicators are essential tools that help traders make informed decisions by analyzing price patterns and market trends. The best technical indicators for day trading are those that offer insights into market momentum, volatility, and trend direction. Day traders typically use a combination of indicators to confirm trade signals and increase their chances of success.

- Moving Averages (MA): Moving Averages, such as the Simple Moving Average (SMA) and Exponential Moving Average (EMA), are widely used to identify the direction of the trend. By smoothing out price data, they help traders spot potential entry and exit points. Many day traders use the 50-period or 200-period moving averages to track both short-term and long-term trends.

- Relative Strength Index (RSI): The RSI is a momentum indicator that measures whether a currency pair is overbought or oversold. It is especially useful for day traders looking to spot potential reversals or confirm trade entries. When the RSI moves above 70, the market is considered overbought, while a reading below 30 indicates oversold conditions.

- Bollinger Bands: This volatility indicator helps day traders assess market conditions. The Bollinger Bands expand and contract based on market volatility, making it easier to identify periods of high activity and potential breakouts.

Top Technical Indicators for Forex Day Trading:

- Moving Averages (SMA/EMA): Identify trends and potential entry/exit points.

- Relative Strength Index (RSI): Measure overbought and oversold conditions.

- Bollinger Bands: Assess market volatility and breakout potential.

What Risk Management Techniques Should You Use in Forex Day Trading?

Effective risk management is essential in Forex day trading, where fast market movements can lead to both profits and losses in a short period. To protect their capital and minimize losses, day traders rely on various risk management techniques.

- Position Sizing: One of the most critical aspects of risk management is controlling the size of each trade. Day traders typically risk only a small percentage of their trading capital on each trade, usually between 1-2%. By keeping the trade size small, they ensure that a string of losing trades won’t wipe out their entire account.

- Stop-Loss Orders: Stop-loss orders are vital for limiting losses in day trading. A stop-loss automatically closes a trade once the market reaches a predetermined price level. This prevents traders from holding onto losing positions and ensures they exit the trade before significant damage is done to their capital.

- Risk-Reward Ratio: Successful day traders often use a favorable risk-reward ratio, such as 1:2 or 1:3. This means that for every dollar risked, the potential reward is two or three times greater. By consistently maintaining a favorable risk-reward ratio, traders can remain profitable even if they experience several losing trades.

Key Risk Management Techniques:

- Position sizing: Risk only 1-2% of your capital per trade.

- Stop-loss orders: Automatically close trades to limit losses.

- Risk-reward ratio: Aim for a 1:2 or 1:3 risk-reward ratio to ensure profitability.

How Do You Develop a Forex Day Trading Strategy?

Developing a Forex day trading strategy involves creating a set of rules and guidelines that help traders make consistent decisions when entering and exiting trades. The key to a successful strategy is finding a balance between identifying opportunities in the market and managing risk. Most strategies incorporate both technical analysis and market conditions to determine the best times to trade.

- Define Your Entry and Exit Rules: The foundation of any day trading strategy is having clear entry and exit rules. These rules should be based on technical indicators such as moving averages, RSI, or Bollinger Bands to help identify trends and reversals. For example, a trader might enter a trade when the price breaks above a key moving average and exit when the RSI reaches overbought levels.

- Set Risk Management Parameters: Every strategy must include risk management techniques to protect your capital. This includes using stop-loss orders, position sizing, and ensuring a favorable risk-reward ratio. For example, risk only 1-2% of your capital per trade and aim for a minimum 1:2 risk-reward ratio.

Steps to Develop a Day Trading Strategy:

- Define entry and exit points: Use indicators like moving averages or RSI.

- Incorporate risk management: Use stop-losses and proper position sizing.

- Test and refine: Backtest your strategy to optimize its effectiveness.

What Tools Do Forex Day Traders Use to Maximize Success?

Successful day traders rely on a variety of tools to help them analyze the market, execute trades, and manage their portfolios efficiently. These tools range from trading platforms to economic calendars and technical analysis software.

- Trading Platforms: Platforms such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5) are popular among day traders. These platforms offer real-time charting, technical indicators, and the ability to execute trades quickly. MT4 and MT5 also support automated trading, allowing traders to set predefined conditions for entering and exiting trades.

- Economic Calendars: Day traders need to stay informed about major economic events that can cause market volatility. Tools like Forex Factory or Investing.com’s economic calendar allow traders to track important announcements such as interest rate decisions, GDP reports, and employment data. These events can lead to significant price movements, presenting opportunities for profitable trades.

- Charting Software: Tools like TradingView provide advanced charting features that help traders analyze trends, patterns, and indicators in real time. Customizable charts and a wide range of technical analysis tools make it easier for traders to identify potential entry and exit points.

Essential Tools for Forex Day Traders:

- MetaTrader 4/5: For real-time charting and trade execution.

- Economic calendars: To stay informed about key market-moving events.

- TradingView: For advanced charting and technical analysis.

What Are Common Mistakes in Forex Day Trading and How to Avoid Them?

Even experienced traders can make mistakes in Forex day trading, leading to significant losses. Identifying these mistakes early and avoiding them is crucial for long-term success. Common mistakes include overtrading, ignoring risk management, and failing to adapt to changing market conditions.

- Overtrading: One of the most common mistakes is overtrading, where traders open too many positions in a short time. This can happen when traders become emotionally driven and try to chase profits after a series of wins or losses. Overtrading leads to poor decision-making and increases the risk of losses. To avoid this, stick to your predefined strategy and avoid emotional trading.

- Ignoring Risk Management: Another critical mistake is failing to implement proper risk management. Traders who don’t use stop-loss orders or who risk too much of their capital on a single trade can quickly experience significant losses. By sticking to risk management rules like risking only 1-2% of capital per trade and using stop-losses, traders can avoid catastrophic losses.

- Failing to Adapt to Market Conditions: Market conditions can change rapidly, and what worked yesterday may not work today. Traders who don’t adapt their strategies to suit market conditions, such as moving from trending markets to range-bound markets, often face losses. Regularly reviewing and adjusting your strategy is crucial for staying profitable.

Common Mistakes to Avoid in Day Trading:

- Overtrading: Stick to your strategy and avoid emotional trading.

- Ignoring risk management: Always use stop-losses and control position sizes.

- Failing to adapt: Adjust your strategy based on changing market conditions.

How Do You Adapt Your Forex Day Trading Strategy to Market Conditions?

Adapting your Forex day trading strategy to evolving market conditions is essential for maintaining profitability. Market conditions can change due to factors like economic data releases, geopolitical events, and changes in liquidity, and these shifts require traders to adjust their strategies accordingly.

- Trending vs. Range-Bound Markets: Forex markets can either trend in a specific direction or move sideways within a range. In trending markets, strategies like trend-following and using moving averages work well, while in range-bound markets, traders can focus on support and resistance levels to buy low and sell high. Recognizing which market environment you’re in allows you to switch between strategies effectively.

- Adapting to Volatility: High volatility presents both risks and opportunities for day traders. When the market is highly volatile due to major news events, widening stop-loss levels or reducing position sizes can help manage risk. Traders may also switch to shorter timeframes during volatile periods to capitalize on quick price movements.

Tips for Adapting to Market Conditions:

- Trending markets: Use trend-following strategies with moving averages.

- Range-bound markets: Focus on support and resistance for buy/sell opportunities.

- High volatility: Widen stop-losses and use smaller position sizes to manage risk.

What Role Does Volatility Play in Forex Day Trading?

Volatility is a key factor in Forex day trading because it directly influences price movements and trading opportunities. Volatility refers to the amount of price fluctuation within a given period. Higher volatility creates more trading opportunities, as prices can swing significantly within short timeframes, which is ideal for day traders.

- High Volatility: In periods of high volatility, day traders can benefit from larger price swings, which can lead to quick profits. For instance, during major economic events like interest rate announcements or political elections, volatility often spikes. However, with increased volatility comes higher risk, so it’s important to use risk management tools like stop-loss orders and limit positions sizes to mitigate potential losses.

- Low Volatility: In contrast, low volatility often leads to less frequent trading opportunities, as price movements are smaller and more predictable. During low volatility periods, traders may need to focus on high-liquidity currency pairs like EUR/USD or USD/JPY to find more consistent price action.

How Volatility Impacts Forex Day Trading:

- High volatility: Offers more trading opportunities but requires careful risk management.

- Low volatility: Fewer opportunities; focus on highly liquid pairs to find trades.

How Can You Backtest and Optimize a Forex Day Trading Strategy?

Backtesting is an essential process that allows traders to test their Forex day trading strategy on historical market data to see how it would have performed under different conditions. By backtesting, traders can identify strengths and weaknesses in their strategy and optimize it for better results.

- Choosing the Right Backtesting Software: Platforms like MetaTrader 4 (MT4) or TradingView allow traders to simulate trades on past data, helping them to understand how their strategy would have fared in various market environments. These tools offer detailed performance metrics, such as win rate, maximum drawdown, and profit factor, which are useful for fine-tuning the strategy.

- Optimization: After backtesting, traders can optimize their strategy by adjusting the parameters of their technical indicators, such as moving averages or stop-loss levels. For example, changing the period of a moving average or tweaking the risk-reward ratio can improve performance. Regular optimization ensures that the strategy remains effective as market conditions evolve.

Steps for Backtesting and Optimizing a Strategy:

- Use backtesting software: Platforms like MT4 or TradingView to test your strategy on historical data.

- Analyze performance metrics: Look at win rates, drawdowns, and profit factors.

- Optimize technical parameters: Adjust indicators like moving averages or stop-losses to improve results.

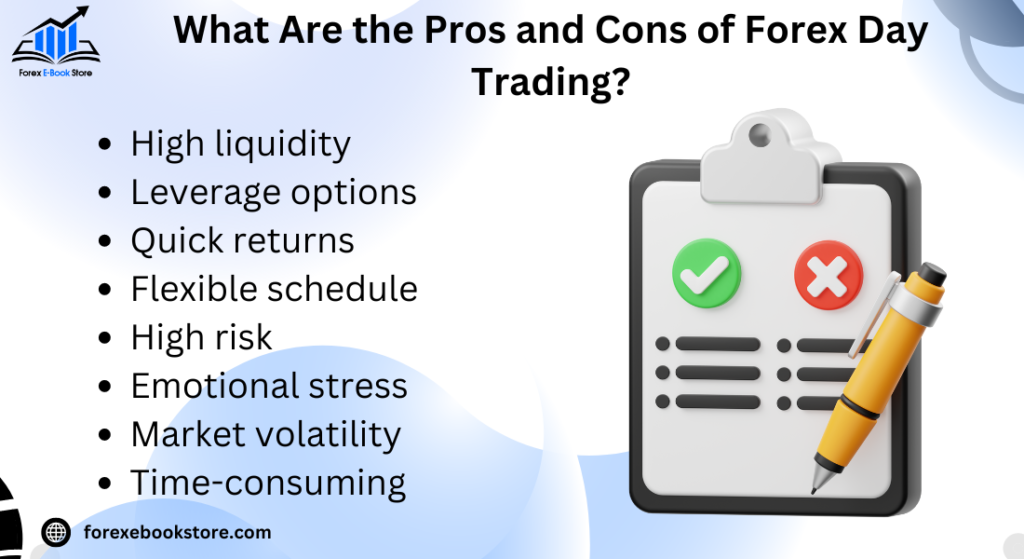

What Are the Pros and Cons of Forex Day Trading?

Forex day trading comes with several advantages and disadvantages, making it important for traders to assess whether this style of trading fits their goals and risk tolerance. While it offers opportunities for quick profits, it also involves significant risks and demands.

- Pros of Forex Day Trading:

- Quick Profits: Day trading allows traders to capitalize on small price movements, potentially leading to fast returns if executed well.

- No Overnight Risk: Since all positions are closed by the end of the day, day traders avoid the risks associated with overnight market movements and gaps.

- High Liquidity: The Forex market is the most liquid in the world, offering traders the ability to enter and exit trades easily, especially when focusing on major currency pairs like EUR/USD or USD/JPY.

- Cons of Forex Day Trading:

- High Stress: The fast-paced nature of day trading can be stressful, requiring constant attention and quick decision-making.

- High Transaction Costs: The frequent trading of day traders can result in higher transaction costs, including spreads and commissions, which can eat into profits if not carefully managed.

- Market Volatility: While volatility can create opportunities, it also increases risk. Unexpected market moves can lead to rapid losses without proper risk management.

Pros and Cons of Day Trading:

- Pros: Quick profits, no overnight risk, high liquidity.

- Cons: High stress, high transaction costs, market volatility risk.

What Are the Best Practices for New Forex Day Traders?

For new traders, Forex day trading can be challenging due to the fast-paced environment and the need for discipline. However, by following best practices, beginners can increase their chances of success while minimizing risks.

- Start with a Demo Account: Beginners should practice on a demo account before trading with real money. This allows them to test their strategies and get familiar with trading platforms like MetaTrader 4 (MT4) or MetaTrader 5 (MT5) without risking capital.

- Focus on One or Two Currency Pairs: Instead of trading multiple pairs, new traders should focus on one or two major currency pairs like EUR/USD or USD/JPY. These pairs offer high liquidity and lower spreads, making them easier to trade for beginners.

- Keep Emotions in Check: Emotional trading is one of the biggest pitfalls for beginners. Day traders should stick to their trading plan and avoid making impulsive decisions based on fear or greed.

Best Practices for New Forex Day Traders:

- Practice on a demo account before trading with real money.

- Trade one or two major currency pairs for better focus.

- Avoid emotional trading and stick to a trading plan.

How Do You Maintain Discipline in Forex Day Trading?

Discipline is key to long-term success in Forex day trading. Without discipline, traders are more likely to deviate from their strategy, leading to emotional trading and poor decision-making. Maintaining discipline involves adhering to a well-structured trading plan and staying focused on long-term goals.

- Stick to Your Trading Plan: A well-defined trading plan is the foundation of disciplined trading. The plan should include rules for entry and exit points, position sizing, and risk management. Traders who follow their plan consistently are less likely to make emotional decisions based on short-term market fluctuations.

- Set Daily Limits: To avoid overtrading or chasing losses, traders should set daily profit and loss limits. For example, if a trader reaches a pre-set loss limit for the day, they should stop trading to prevent further losses. Similarly, once a profit target is hit, it’s wise to lock in gains and avoid unnecessary risk.

Tips for Maintaining Discipline:

- Follow your trading plan: Stick to predefined rules for entry, exit, and risk management.

- Set daily profit/loss limits: Stop trading after reaching set limits to avoid emotional trading.

What Are the Psychological Challenges in Forex Day Trading?

Forex day trading involves not only technical skills but also psychological resilience. Many traders face mental challenges such as fear, greed, and the pressure of making fast decisions. These emotions can lead to poor decision-making and significant losses if not managed effectively.

- Fear and Greed: Two of the most common emotions in trading are fear and greed. Fear can prevent traders from entering profitable trades or cause them to close positions too early, while greed can push traders to overtrade or take excessive risks. Staying grounded and sticking to your trading strategy can help mitigate the effects of these emotions.

- Overconfidence: After a series of winning trades, traders can become overconfident, leading to reckless decisions and overleveraging. It’s important to maintain a level head and always stick to your predefined risk management rules, even when you’re on a winning streak.

Psychological Challenges in Day Trading:

- Fear and greed: Can lead to impulsive or emotional decisions.

- Overconfidence: Leads to excessive risk-taking and deviation from strategy.

How Do You Track and Analyze Your Forex Day Trading Performance?

Tracking and analyzing your Forex day trading performance is critical for identifying areas of improvement and ensuring consistent progress. Successful traders often maintain a detailed trading journal that records every trade, including the rationale behind it, the outcome, and lessons learned.

- Use a Trading Journal: A trading journal helps traders document their trades, including the time of entry, exit, profit or loss, and market conditions at the time of the trade. This allows traders to review past decisions, identify patterns, and adjust their strategies accordingly. Many traders use spreadsheets or dedicated apps to track their performance.

- Analyze Key Metrics: Key metrics to analyze include the win rate, average profit/loss per trade, and maximum drawdown. Reviewing these metrics helps traders understand if their strategy is effective or if adjustments are needed to improve profitability and reduce risk.

Performance Tracking and Analysis Tips:

- Maintain a trading journal: Document each trade with details on outcomes and decisions.

- Analyze key metrics: Track win rates, profit/loss ratios, and drawdowns to assess strategy effectiveness.

How Do You Set Realistic Goals in Forex Day Trading?

Setting realistic goals in Forex day trading is essential for maintaining motivation and avoiding burnout. Unlike long-term investors, day traders focus on short-term gains, but it’s important to set achievable goals that align with your trading plan and risk tolerance.

- Define Short-Term and Long-Term Goals: Traders should set both short-term goals (daily or weekly targets) and long-term goals (monthly or annual profitability targets). For example, a short-term goal might be to make a certain percentage profit on your account each week, while a long-term goal could be to grow your trading capital by a specific amount over the year.

- Focus on Process, Not Just Profits: While profits are the end goal, focusing too heavily on financial results can lead to poor decision-making. Instead, set goals related to the process, such as sticking to your trading strategy, managing risk effectively, or maintaining discipline. These process-based goals help ensure long-term success and consistent profitability.

Tips for Setting Realistic Goals:

- Set short-term and long-term goals: Focus on both daily/weekly and monthly/yearly targets.

- Process over profits: Prioritize following your strategy and maintaining discipline over short-term gains.

Conclusion

In conclusion, Forex day trading is a fast-paced strategy that involves opening and closing trades within the same day to capitalize on small price movements. Traders must use a combination of technical analysis, risk management, and discipline to succeed in this dynamic environment. By focusing on key elements like choosing the right currency pairs, adapting to market conditions, and managing emotions, traders can maximize their chances of success.

Before diving into day trading, it’s essential to understand the broader process of developing a Forex trading strategy. A solid trading strategy provides the foundation for day trading, offering clear guidelines for entry and exit points, risk management, and overall market approach. Whether you’re day trading or taking a longer-term view, developing a strategy is the first step toward consistent trading success.