Algorithmic trading in Forex refers to the use of computer programs to execute trades based on a predefined set of rules and strategies. This approach allows traders to automate their trading activities, analyzing massive datasets and market trends in real time to make quicker, more informed decisions. With the ability to remove human emotions from trading, algorithmic trading has become a popular method among both institutional and retail traders looking to capitalize on fast-moving Forex markets.

In Forex trading, algorithms are designed to identify opportunities, execute trades, and manage risks more efficiently than manual trading. By using advanced technologies such as machine learning and artificial intelligence, traders can develop sophisticated strategies that adapt to changing market conditions. Backtesting and high-frequency trading are also commonly used in this space, allowing traders to optimize their systems and improve performance over time.

Table of Contents

How does algorithmic trading work?

Algorithmic trading in Forex operates through the use of pre-programmed instructions that automatically execute trades when certain market conditions are met. These algorithms analyze real-time data and can place trades faster than any human trader could manage.

Key Components of Algorithmic Trading:

- Data Analysis: The algorithm scans historical and live data to identify trading opportunities. These data points could include price, volume, timing, and other technical indicators.

- Predefined Rules: Traders set up rules based on specific indicators or strategies, such as moving averages, relative strength index (RSI), or support and resistance levels.

- Automated Execution: Once the conditions are met, the algorithm executes the trade automatically, reducing reaction time and human error.

Advantages of Automation:

- Speed: Algorithms can process and react to market data much faster than manual trading.

- Efficiency: Automation eliminates emotional trading decisions, providing consistency and discipline in trading strategies.

- 24/7 Trading: In the Forex market, which operates 24 hours a day, algorithms allow continuous trading without human intervention.

By automating trades, algorithmic trading ensures that the execution is precise and timely, enabling traders to take advantage of even the smallest market movements.

What are the benefits of algorithmic trading in Forex?

Algorithmic trading offers several advantages that make it an attractive option for traders in the highly competitive Forex market. These benefits range from increased efficiency to the ability to handle complex strategies that would be challenging to manage manually.

Benefits of Algorithmic Trading:

- Faster Execution: Algorithms can execute trades within milliseconds, allowing traders to capitalize on fleeting opportunities that may not be possible with manual trading.

- Reduced Human Error: Automation eliminates the emotional biases and mistakes that often come with human trading, such as panic selling or overtrading.

- Backtesting: Traders can backtest their strategies on historical data to refine and optimize performance before applying them to live markets. This minimizes the risk of using unproven strategies in real-time trading.

Additional Benefits:

- Risk Management: Algorithms can be programmed to include stop-loss and take-profit orders automatically, helping traders manage risk more effectively.

- Scalability: Algorithms can process and analyze vast amounts of data simultaneously, making it easier to apply complex trading strategies across multiple markets or currency pairs.

By leveraging these benefits, algorithmic trading allows traders to improve their efficiency, consistency, and overall profitability in the Forex market.

What are the risks of using algorithms in Forex trading?

While algorithmic trading provides many advantages, it is not without risks. Understanding these risks is crucial for traders who want to use algorithms responsibly and effectively in the Forex market.

Key Risks of Algorithmic Trading:

- Technical Failures: Since algorithmic trading relies heavily on technology, any technical glitch—such as network issues, software bugs, or server outages—can result in missed trades or unintended losses.

- Example: A poorly coded algorithm might fail to execute trades at the right time, leading to financial losses.

- Over-Optimization: Also known as curve fitting, over-optimizing an algorithm during backtesting can result in a system that performs well on historical data but fails in live market conditions. This can lead to significant losses when applied in real-world trading.

Risk Mitigation Strategies:

- Regular Monitoring: Even though algorithms can automate trades, they still require human oversight to ensure everything functions as expected.

- Fail-safes: Traders should incorporate fail-safes into their algorithms, such as stop-loss orders or maximum loss limits, to prevent extreme losses in case of unforeseen market events or technical failures.

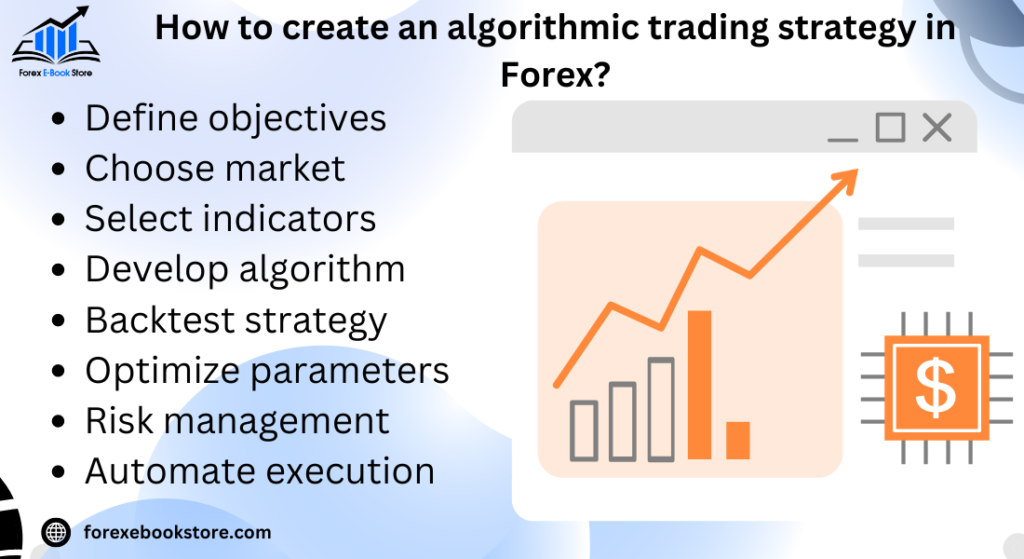

How to create an algorithmic trading strategy in Forex?

Building a successful algorithmic trading strategy in Forex involves a combination of technical analysis, coding skills, and risk management. Traders need to define clear rules and test their strategies before using them in live markets.

Steps to Create an Algorithmic Trading Strategy:

- Define Your Trading Goals: Start by setting clear objectives for your strategy. Decide whether you want to focus on short-term gains, long-term trends, or specific currency pairs.

- Choose Indicators: Select technical indicators that align with your goals. Popular choices for algorithmic strategies include moving averages, Bollinger Bands, and the relative strength index (RSI). These indicators will guide your algorithm in identifying potential entry and exit points.

- Example: A strategy might involve buying when a currency pair’s price crosses above its 50-day moving average and selling when it falls below.

- Code the Algorithm: Using programming languages like Python or platforms such as MetaTrader, you can code your strategy. Ensure the code is precise and integrates all the rules and risk management parameters, such as stop-losses or position sizing.

Testing and Optimization:

- Backtesting: Run your algorithm on historical data to see how it performs under different market conditions. This step is crucial to avoid potential losses during live trading.

- Paper Trading: Test your strategy in a simulated environment before going live to ensure it works in real-time market conditions.

By following these steps, traders can create a robust algorithmic trading strategy that aligns with their risk tolerance and market goals.

What are the common types of algorithms used in Forex trading?

There are various types of algorithms that traders use in the Forex market, each designed to achieve specific trading objectives. These algorithms range from simple rule-based systems to more advanced machine learning models.

Common Algorithm Types:

- Trend-Following Algorithms: These algorithms are designed to identify and capitalize on trends in the market. They typically use indicators like moving averages or price breakouts to determine when to enter or exit trades.

- Example: An algorithm might buy a currency pair when the price crosses above a moving average and sell when it drops below.

- Arbitrage Algorithms: Arbitrage algorithms exploit price discrepancies between different markets or currency pairs. These algorithms are highly time-sensitive and often used in high-frequency trading to take advantage of small, short-lived price differences.

- Example: Buying a currency pair in one market and simultaneously selling it in another where the price is slightly higher.

- Mean Reversion Algorithms: Mean reversion algorithms assume that asset prices will revert to their average over time. These algorithms are designed to buy low and sell high, based on statistical analysis.

- Example: Buying when a currency pair’s price is significantly below its average and selling when it reverts back to the mean.

Specialized Algorithms:

- Market-Making Algorithms: These algorithms place buy and sell orders at different price points to profit from the bid-ask spread.

- High-Frequency Trading Algorithms: These are designed to execute large volumes of trades in fractions of a second, exploiting small price movements.

By understanding the different types of algorithms, traders can choose the ones that best fit their trading style and objectives.

What tools and platforms are used for algorithmic trading in Forex?

To implement algorithmic trading successfully in Forex, traders need access to specialized tools and platforms that can handle automated trades, backtesting, and real-time market analysis. These tools allow traders to develop, test, and execute strategies efficiently.

Popular Algorithmic Trading Platforms:

- MetaTrader 4 (MT4) and MetaTrader 5 (MT5): These platforms are widely used for Forex trading and offer built-in tools for algorithmic trading, including the ability to create and deploy Expert Advisors (EAs). Traders can program their strategies using MetaQuotes Language (MQL) and automate their trades.

- Key Features:

- Automated trading with Expert Advisors (EAs)

- Advanced charting and technical analysis tools

- Backtesting features for strategy validation

- Key Features:

- cTrader: Known for its ease of use and sophisticated trading tools, cTrader allows traders to develop automated strategies using cAlgo, its proprietary algorithmic trading platform. It supports C# programming and provides extensive backtesting capabilities.

- Key Features:

- Flexible coding environment using C#

- Integrated backtesting and optimization tools

- Access to real-time and historical market data

- Key Features:

- NinjaTrader: This platform offers advanced algorithmic trading tools with features such as market data integration, automated trade execution, and backtesting. It is widely used for both Forex and futures trading.

- Key Features:

- Strategy builder for creating automated systems without coding knowledge

- Extensive backtesting with historical market data

- High customization for indicators and automated strategies

- Key Features:

Essential Tools for Algorithmic Trading:

- Backtesting Engines: Tools that allow traders to test their strategies against historical market data to validate performance before live trading.

- VPS (Virtual Private Server): Many traders use VPS services to ensure that their algorithms run continuously, even when their own computer is offline, providing stability and faster execution speeds.

How can beginners start with algorithmic trading in Forex?

For beginners, getting started with algorithmic trading in Forex may seem overwhelming, but with the right approach, it can be a smooth process. The key is to build a solid foundation in both trading and coding skills while gradually incorporating automation.

Steps for Beginners:

- Learn the Basics of Forex Trading: Before diving into algorithms, beginners must first understand the fundamental principles of Forex trading. Learn about currency pairs, leverage, margin, and risk management.

- Choose a Trading Platform: Start with a beginner-friendly platform like MetaTrader 4 or cTrader, which provide access to built-in algorithmic trading tools and educational resources.

- MetaTrader 4: Offers pre-built scripts and the ability to create custom Expert Advisors (EAs).

- cTrader: Ideal for those looking to code strategies in C#.

- Learn Basic Coding: Most algorithmic trading platforms require basic programming knowledge. Start with learning MQL4 for MetaTrader or C# for cTrader. There are plenty of free resources and tutorials available online.

Tips for Beginners:

- Start with Pre-built Algorithms: Many platforms offer pre-built strategies, which you can use as a starting point. You can customize them as you gain more experience.

- Practice on Demo Accounts: Use demo accounts to test your strategies in real-time without risking real money. This will give you confidence and a better understanding of how algorithms behave in live markets.

By mastering the fundamentals of Forex and acquiring basic coding skills, beginners can smoothly transition into the world of algorithmic trading.

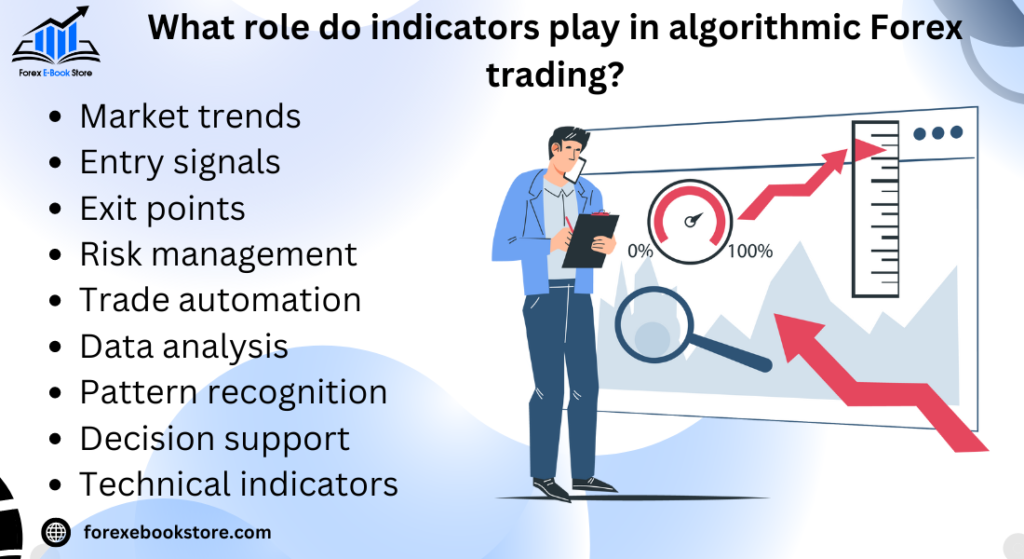

What role do indicators play in algorithmic Forex trading?

Indicators are an essential component of algorithmic trading in Forex. They help traders analyze market data and identify potential buy or sell signals based on predefined criteria. Most algorithms rely heavily on technical indicators to execute trades automatically.

Commonly Used Indicators:

- Moving Averages (MA): This indicator smooths out price data to identify the direction of a trend. It is often used in trend-following algorithms to trigger buy or sell signals when prices cross above or below the moving average.

- Example: A 50-day moving average may trigger a buy signal when the price crosses above it.

- Relative Strength Index (RSI): RSI measures the strength of a currency pair’s price movement. It is used to identify overbought or oversold conditions.

- Example: An algorithm might buy a currency pair when the RSI drops below 30, signaling that it is oversold.

- Bollinger Bands: This indicator consists of a moving average and two standard deviations plotted above and below it. Bollinger Bands are used to identify potential breakout or reversal opportunities.

- Example: An algorithm may execute a buy order when the price touches the lower band, anticipating a reversal.

How Indicators Enhance Algorithmic Trading:

- Automation of Signals: Indicators provide objective signals that can be programmed into algorithms, removing emotions from trading decisions.

- Customization: Traders can combine multiple indicators to create complex strategies tailored to specific market conditions.

- Risk Management: Indicators like RSI can also help algorithms identify when to close positions or set stop-losses, ensuring proper risk management.

By leveraging the power of technical indicators, algorithmic trading systems can efficiently analyze market conditions and execute trades with precision.

How to backtest an algorithmic trading strategy in Forex?

Backtesting is a crucial step in the development of any algorithmic trading strategy. It involves testing your strategy on historical data to evaluate its performance before deploying it in live markets. This process helps traders refine their algorithms and avoid costly mistakes in real-time trading.

Steps for Backtesting an Algorithm:

- Choose a Reliable Platform: Use platforms like MetaTrader 4, cTrader, or NinjaTrader that offer integrated backtesting tools. These platforms allow you to test your strategy against historical data with accurate simulation of market conditions.

- Select Historical Data: Make sure you have access to high-quality, accurate historical data. The time frame you choose should reflect the type of strategy you are testing. For example, day trading strategies require minute-level data, while long-term strategies may use daily or weekly data.

- Evaluate Performance Metrics: Analyze important performance metrics such as:

- Win Rate: The percentage of trades that were profitable.

- Risk-to-Reward Ratio: The ratio of average profit to average loss per trade.

- Drawdown: The largest decline in the account balance during the test period.

Key Considerations:

- Avoid Over-Optimization: Don’t fine-tune the algorithm too much based on historical data (a common issue called curve-fitting). A strategy that performs too perfectly on past data may fail in live markets.

- Simulate Realistic Conditions: Incorporate elements like slippage and transaction costs into your backtesting to get a realistic view of how the algorithm will perform in actual trading.

What are best practices for risk management in algorithmic Forex trading?

Effective risk management is essential in algorithmic Forex trading, as automated systems can execute a large number of trades in a short time. Without proper controls, losses can quickly escalate. By following best practices, traders can mitigate risks and protect their capital.

Key Risk Management Strategies:

- Set Stop-Loss and Take-Profit Levels: Every algorithmic trading strategy should include predefined stop-loss and take-profit levels. These ensure that positions are automatically closed when certain profit or loss thresholds are reached, protecting the trader from excessive losses.

- Example: An algorithm might close a trade when a loss reaches 2% of the account balance, or when a 5% profit target is hit.

- Limit Leverage Usage: While leverage can amplify profits, it also increases risk. Traders should ensure their algorithm does not over-leverage positions, as this could lead to margin calls during market volatility.

- Tip: Set limits on the amount of leverage that can be used in each trade to keep risk under control.

- Diversify Trades: Avoid concentrating risk in a single currency pair or strategy. By diversifying across multiple pairs and strategies, traders can reduce the impact of a losing streak or adverse market conditions.

- Diversification Example: An algorithm could trade both major pairs like EUR/USD and minor pairs like AUD/NZD, spreading risk across different markets.

Monitoring and Adjusting Risk:

- Regular Audits: Continuously monitor your algorithm’s performance to ensure it is adhering to risk management rules. If the market environment changes, adjust your risk parameters accordingly.

- Use a Trailing Stop: A trailing stop adjusts the stop-loss level as the market moves in your favor, locking in profits while reducing the risk of giving back gains.

By implementing these best practices, traders can manage risk effectively and safeguard their capital while using algorithmic trading strategies.

What is the difference between manual and algorithmic trading in Forex?

Both manual trading and algorithmic trading have their own advantages and drawbacks. Understanding the key differences between these two approaches can help traders decide which method suits their style, goals, and market conditions.

Key Differences:

- Speed and Efficiency:

- Algorithmic Trading: Automated systems can execute trades in milliseconds, allowing traders to capitalize on fleeting opportunities and react instantly to market changes. Algorithms are especially useful in high-frequency trading environments.

- Manual Trading: Human traders are slower to execute trades and may miss out on fast-moving opportunities, especially in volatile markets.

- Emotion-Free Trading:

- Algorithmic Trading: By removing emotions from the trading process, algorithms execute strategies with precision and discipline. This is ideal for traders who struggle with emotional biases such as fear and greed.

- Manual Trading: Human emotions can interfere with decision-making, leading to impulsive trades or holding onto losing positions for too long. However, experienced traders may use intuition to make strategic adjustments in real-time.

- Complexity:

- Algorithmic Trading: Requires coding knowledge and the ability to backtest strategies. It’s well-suited for traders who are comfortable with technical analysis and programming.

- Manual Trading: Easier to start with, as it doesn’t require any coding skills. However, it demands constant attention and a deep understanding of market trends.

Which is Better for You?

- Algorithmic Trading: Ideal for traders who prefer a hands-off approach and want to scale their strategies or execute high-frequency trades.

- Manual Trading: Suitable for those who enjoy being actively involved in the market and can manage trades based on real-time market sentiment and analysis.

Ultimately, the choice between manual and algorithmic trading depends on the trader’s goals, experience, and preferences.

What are popular algorithmic trading strategies in Forex?

There are several popular algorithmic trading strategies that traders use to automate their trades in the Forex market. Each strategy is designed to exploit different market conditions, and traders can choose the one that best fits their trading style and risk tolerance.

Common Algorithmic Strategies:

- Trend-Following Strategies: These algorithms are designed to identify and follow trends in the market. They typically use technical indicators such as moving averages or the Average Directional Index (ADX) to detect when a trend is forming and enter trades in the direction of the trend.

- Example: The algorithm might buy when a currency pair breaks above its 50-day moving average and sell when it falls below.

- Arbitrage Strategies: Arbitrage algorithms exploit price differences between different markets or currency pairs. They quickly execute trades to profit from these discrepancies, usually within seconds or even milliseconds.

- Example: If the EUR/USD price differs between two brokers, the algorithm might buy from one broker and sell to the other simultaneously.

- Mean Reversion Strategies: These algorithms are based on the assumption that currency prices will revert to their historical average over time. When a currency pair deviates too far from its average, the algorithm buys or sells to profit from the expected reversion.

- Example: If EUR/USD moves significantly above its 100-day moving average, the algorithm might sell, anticipating the price will drop back to the average.

Advanced Strategies:

- High-Frequency Trading (HFT): These algorithms make a large number of trades in milliseconds to take advantage of tiny price fluctuations. HFT is often used by institutional traders and requires advanced technology to execute.

- Scalping: This strategy focuses on making a large number of small trades in a very short time frame, capturing small price movements throughout the day.

How does high-frequency trading work in Forex?

High-frequency trading (HFT) in Forex involves using complex algorithms to execute a large number of trades at incredibly fast speeds—often within milliseconds. These systems exploit tiny price discrepancies in currency pairs, using sophisticated technology to gain an advantage in a highly competitive market.

How HFT Works:

- Speed and Efficiency: High-frequency trading relies on algorithms and advanced computing power to react faster than manual traders. HFT systems analyze market conditions in real-time, spotting price inefficiencies or arbitrage opportunities and executing trades almost instantly.

- Example: If the price of EUR/USD rises on one exchange but hasn’t yet on another, an HFT system can buy low and sell high in microseconds.

- Low-Latency Trading: Successful HFT strategies depend on having low latency, meaning there is minimal delay between receiving market data and executing trades. Many HFT traders use colocation services, placing their servers close to major financial exchanges to reduce latency.

Advantages and Risks of HFT:

- Advantages:

- Can generate profits from very small price fluctuations due to the speed of execution.

- Allows for large trading volumes, generating profits even with small per-trade gains.

- Risks:

- Requires significant investment in technology and infrastructure.

- Highly sensitive to market volatility, and small changes in algorithms can result in large losses.

HFT is typically used by institutional traders due to the resources required, but it plays a significant role in the Forex market by increasing liquidity and tightening spreads.

How do Forex brokers support algorithmic trading?

Forex brokers provide a range of services to support algorithmic trading, offering platforms, tools, and infrastructure that enable traders to automate their strategies efficiently. Choosing the right broker is critical for traders who rely on automated systems.

Key Broker Services for Algorithmic Trading:

- Trading Platforms: Many brokers offer advanced trading platforms like MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, which have built-in support for Expert Advisors (EAs) and custom algorithms. These platforms allow traders to develop, test, and deploy their strategies seamlessly.

- Example: MT4 allows traders to create and run their own algorithms using MQL4 programming, while MT5 supports more advanced features and additional order types.

- VPS Hosting: For reliable and continuous trading, many brokers offer Virtual Private Server (VPS) services. VPS allows traders to run their algorithms 24/7 without downtime, ensuring their trades are executed even if their personal computer is off.

- Benefit: Reduces latency and increases reliability, especially important for high-frequency or scalping strategies.

Broker Considerations for Algorithmic Traders:

- Low Latency: Choose a broker with fast execution speeds and low latency, as this can significantly impact the performance of your trading algorithms.

- Leverage and Margin Requirements: Algorithmic traders need to consider the leverage options and margin requirements offered by their broker, as these affect the capital needed for opening and maintaining positions.

By choosing a broker that offers the right tools and support, traders can maximize the effectiveness of their algorithmic trading strategies.

What are the legal considerations for algorithmic Forex trading?

Algorithmic trading in Forex, while highly effective, is subject to various legal and regulatory considerations. Traders need to ensure they comply with local and international regulations to avoid potential legal issues.

Key Legal Considerations:

- Regulatory Compliance: Many countries regulate Forex trading, and this extends to algorithmic trading. Traders must ensure that their algorithms comply with the rules set by regulatory bodies such as the Commodity Futures Trading Commission (CFTC) in the US or the Financial Conduct Authority (FCA) in the UK.

- Example: In the US, algorithmic traders must ensure that their systems follow the rules on fair market practices and do not engage in price manipulation or spoofing (placing orders with the intent to cancel them).

- Market Manipulation: Algorithms must not engage in practices that could be viewed as manipulative, such as wash trading or artificially inflating trading volumes to deceive other market participants.

- Important Note: Regulators actively monitor for unusual patterns that suggest market manipulation, and violations can result in heavy fines or trading bans.

Risk of Flash Crashes:

- Flash Crashes: Algorithmic trading, especially high-frequency trading, has been linked to flash crashes, where market prices drop suddenly due to rapid-fire automated trades. Regulators may impose additional scrutiny or limitations on algorithms to prevent such events.

- Example: The 2010 Flash Crash in US markets, where rapid algorithmic trading contributed to a dramatic, temporary plunge in stock prices.

Legal Best Practices:

- Maintain Transparency: Ensure that trading activities are transparent and comply with reporting requirements.

- Keep Accurate Logs: Maintain records of your algorithmic trading activities, including backtesting and real-time performance logs, to provide evidence of compliance if needed.

How does machine learning enhance algorithmic Forex trading?

Machine learning has significantly enhanced algorithmic trading in Forex by allowing algorithms to learn from historical data and improve their decision-making over time. Unlike traditional rule-based algorithms, machine learning models can adapt to changing market conditions, making them more dynamic and responsive.

Machine Learning in Forex Trading:

- Predictive Analysis: Machine learning algorithms can analyze vast amounts of historical data and identify patterns that may not be visible through conventional technical analysis. By using these patterns, machine learning models can predict future price movements with greater accuracy.

- Example: A machine learning algorithm might recognize subtle changes in market conditions that precede price breakouts or reversals, enabling more informed trading decisions.

- Adaptive Strategies: One of the key advantages of machine learning is its ability to adapt. As market conditions evolve, machine learning models can adjust their strategies based on new data, allowing for real-time optimization.

- Benefit: Unlike static algorithms, machine learning systems continuously refine their strategies to maximize profitability, especially in volatile markets.

Machine Learning Techniques Used:

- Supervised Learning: In supervised learning, algorithms are trained on labeled historical data (e.g., identifying when prices rise or fall after specific conditions). This helps the model make predictions in similar situations.

- Reinforcement Learning: Algorithms learn through trial and error by making decisions in a simulated trading environment, optimizing for rewards over time.

With machine learning, algorithmic trading becomes more flexible and capable of handling the complexities of the ever-changing Forex market.

How to optimize an algorithmic trading system in Forex?

Optimization is a critical step in ensuring the effectiveness of an algorithmic trading system. It involves refining the algorithm’s parameters and strategies to improve performance and minimize risk in live market conditions.

Steps to Optimize an Algorithmic Trading System:

- Parameter Tuning: One of the most important optimization tasks is adjusting the algorithm’s parameters (e.g., moving average periods, risk thresholds). By testing different values, traders can find the optimal combination that maximizes returns while minimizing drawdowns.

- Example: For a trend-following algorithm, adjusting the length of the moving average (e.g., 50-day vs. 200-day) can significantly affect performance.

- Walk-Forward Testing: This is an advanced backtesting technique where traders divide historical data into multiple segments. The algorithm is optimized on one segment and tested on the next to avoid curve fitting and ensure robustness in different market conditions.

- Benefit: Walk-forward testing prevents over-optimization on past data, making the algorithm more reliable in live markets.

Additional Optimization Techniques:

- Risk Management Adjustments: Fine-tune risk management parameters, such as stop-loss and take-profit levels, to ensure that the algorithm can protect against large losses while capturing profits.

- Market Condition Adaptation: Optimize the algorithm for different market conditions, such as volatile or trending markets, ensuring that it performs well under various scenarios.

By regularly optimizing their algorithmic trading system, traders can ensure consistent performance and adapt to the evolving dynamics of the Forex market.

What are future trends in algorithmic trading for Forex?

The future of algorithmic trading in Forex is driven by rapid advancements in technology and data science. Traders and institutions alike are adopting new tools and methods to stay competitive in the market.

Key Trends Shaping the Future of Algorithmic Trading:

- Artificial Intelligence and Machine Learning: AI and machine learning continue to evolve, enabling algorithms to make smarter, faster decisions. As more data becomes available and computing power increases, algorithms will become even more adept at identifying complex market patterns and adjusting strategies in real-time.

- Example: AI-driven algorithms might detect subtle changes in market sentiment using social media data or news analytics, allowing for more accurate predictions of price movements.

- Quantum Computing: Though still in its early stages, quantum computing holds the potential to revolutionize algorithmic trading by solving problems far faster than classical computers. This technology could enable traders to process vast datasets in real-time, leading to better decision-making and more sophisticated strategies.

- Potential Impact: Quantum algorithms could optimize trading strategies in ways that are currently impossible, giving traders a significant edge in speed and efficiency.

Other Emerging Trends:

- Increased Regulation: As algorithmic trading becomes more prevalent, regulators may impose stricter rules to prevent market manipulation and ensure transparency. Traders will need to stay informed of regulatory changes to remain compliant.

- Data-Driven Strategies: As access to alternative data sources (e.g., satellite data, news sentiment) becomes more widespread, algorithms will incorporate these datasets to make more informed decisions, creating opportunities for innovation in algorithmic trading.

Conclusion

Algorithmic trading in Forex has transformed the way traders approach the market, offering faster execution, reduced human error, and the ability to process vast amounts of data in real time. With the integration of machine learning and artificial intelligence, traders can build adaptive strategies that evolve with the market. However, it’s important to optimize these systems regularly and manage risks effectively to maximize profitability.

In relation to margin trading in Forex, both techniques can be combined for greater leverage and automation. While algorithmic trading enhances decision-making through automation, margin trading allows traders to amplify their positions using leverage. Together, these methods provide opportunities for more efficient and potentially profitable trading, but they also require a solid understanding of risk management to avoid significant losses.