In financial markets, the ask price represents the lowest price a seller is willing to accept for a security. It is a crucial component of the bid-ask spread, which is the difference between the ask price and the bid price, the latter being the highest price a buyer is willing to pay. Understanding the asking price is essential for traders and investors as it influences trading decisions, impacts costs, and helps determine market liquidity. A narrow bid-ask spread usually indicates a liquid market with active trading, while a wider spread may suggest lower liquidity and higher trading costs.

The ask price is determined by several factors, including market liquidity, volatility, and supply-demand dynamics. In highly liquid markets, where there are many buyers and sellers, the ask price tends to be lower, reflecting the competitive nature of trading. Conversely, in less liquid markets, the ask price may be higher due to fewer participants. Additionally, market sentiment and volatility can cause the asking price to fluctuate, as sellers adjust their expectations based on perceived risk and market trends.

Table of Contents

How Does the Ask Price Differ from the Bid Price?

The ask price and the bid price are fundamental concepts in financial trading, representing the two sides of a transaction. The ask price is the minimum amount a seller is willing to accept for a security, while the bid price is the maximum amount a buyer is willing to pay. The difference between these two prices is known as the bid-ask spread. This spread is a key indicator of market liquidity: a narrow spread often signifies a liquid market, where there is high demand and supply, whereas a wider spread might indicate a less liquid market with fewer participants.

The relationship between the ask and bid prices also highlights the dynamics of supply and demand in financial markets. When demand for a security increases, buyers may be willing to pay more, thus pushing up the bid price. Conversely, if sellers are eager to sell, the asking price may decrease. Market makers, who facilitate trading by providing liquidity, often profit from the spread, buying securities at the bid price and selling at the ask price.

Why is the Ask Price Important for Investors and Traders?

For investors and traders, understanding the ask price is crucial because it directly affects the cost of purchasing securities. When buying a stock or any other financial instrument, the asking price determines the immediate cost. Therefore, it plays a significant role in formulating trading strategies and timing decisions. A higher ask price might suggest that sellers anticipate a future rise in the security’s value, which could influence an investor’s decision to buy now or wait for a more favorable price.

In addition, the asking price is a component of the bid-ask spread, which traders closely monitor to assess market conditions. A narrow spread suggests a more efficient market with lower transaction costs, which is favorable for both day traders and long-term investors. Conversely, a wide spread could indicate higher costs and potential price volatility, impacting short-term trading strategies. By analyzing asking prices, traders can make informed decisions about when to enter or exit the market.

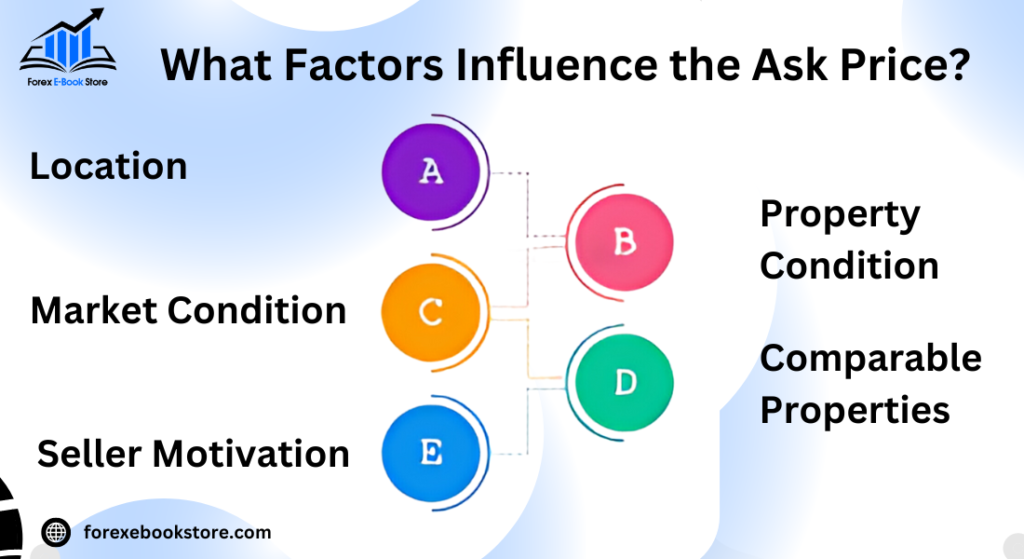

What Factors Influence the Ask Price?

The ask price is influenced by a variety of factors, including market liquidity, volatility, and supply-demand dynamics. In markets with high liquidity, where there are numerous buyers and sellers, the ask price is typically lower due to increased competition among sellers. This environment encourages tight bid-ask spreads and promotes active trading. On the other hand, in less liquid markets, the asking price may be higher as sellers seek compensation for the risk of holding less liquid assets.

Volatility is another crucial factor affecting the asking price. In volatile markets, prices can fluctuate rapidly, leading sellers to adjust their asking prices to reflect the perceived risk. This adjustment can result in wider bid-ask spreads as traders seek to mitigate the potential for sudden price changes. Furthermore, broader economic factors, such as interest rates, geopolitical events, and macroeconomic trends, can also impact the ask price by influencing market sentiment and expectations.

Lastly, the specific characteristics of the asset in question, such as its historical performance, investor sentiment, and industry trends, play a role in determining the ask price. For instance, in sectors where innovation is rapid, such as technology, asking prices may be more volatile as investors and sellers adjust their expectations based on the latest developments

How Does Market Liquidity Affect the Ask Price?

Market liquidity plays a crucial role in determining the asking price of a security. Liquidity refers to the ease with which an asset can be bought or sold in the market without affecting its price. In highly liquid markets, there are many buyers and sellers, which leads to narrower bid-ask spreads. This means that the ask price is closer to the bid price, making it easier and cheaper for investors to buy securities.

When liquidity is high, market participants can quickly execute trades at prices close to the current market value, which stabilizes the asking price. Conversely, in less liquid markets, the bid-ask spread widens, meaning the askjng price is higher relative to the bid price. This results from fewer market participants and a lower volume of trades, which can make buying securities more expensive due to increased transaction costs.

What Role Does Market Volatility Play in Determining the Ask Price?

Market volatility significantly influences the ask price by affecting the perceived risk associated with trading a security. Volatility refers to the degree of variation in a trading price series over time, indicating how much the price of an asset fluctuates. In volatile markets, prices can change rapidly within a short period, leading sellers to increase their ask prices to compensate for the higher risk of holding or selling the asset.

During periods of high volatility, the ask price may rise as sellers seek to protect themselves against potential losses due to rapid market shifts. This behavior can lead to wider bid-ask spreads as buyers become more cautious, unwilling to match the higher asking prices without assurances of stability. Conversely, when markets are stable with low volatility, ask prices tend to be lower, reflecting a more predictable trading environment where sellers are less concerned about sudden price changes

How is the Ask Price Quoted on Major Exchanges?

The ask price is a crucial part of financial market transactions and is prominently quoted on major stock exchanges. It represents the minimum price at which a seller is willing to sell a particular security. On exchanges like the New York Stock Exchange (NYSE) and NASDAQ, asking prices are continually updated to reflect the current supply and demand dynamics. These prices are part of the electronic order book, where they are paired with bid prices—the highest prices buyers are willing to pay—to facilitate trades.

The asking price displayed on trading platforms and market feeds is often the best available offer, reflecting the lowest price at which shares or securities can be bought at that moment. This dynamic is crucial for traders and investors who need real-time data to make informed decisions about buying or selling. The continuous updating of asking prices ensures that they accurately represent the market’s current state.

What is the Impact of the Ask Price on Trading Strategies?

For traders and investors, the ask price plays a significant role in shaping trading strategies. The asking price, along with the bid price, forms the bid-ask spread, which is a key indicator of market liquidity and transaction costs. A narrow bid-ask spread indicates a highly liquid market, which is favorable for executing trades at lower costs. In contrast, a wide spread suggests lower liquidity, potentially leading to higher transaction costs.

Traders often use the ask price to gauge market sentiment and potential price movements. A rising asking price can indicate increased demand or bullish sentiment, suggesting that investors are willing to pay more for a security. This information can help traders decide whether to enter or exit positions. Moreover, understanding the ask price is essential for executing different types of orders, such as limit orders, which specify the maximum price a trader is willing to pay for a security.

How Does the Ask Price Contribute to the Bid-Ask Spread?

The bid-ask spread is the difference between the bid price and the ask price of a security. This spread is a fundamental aspect of trading, reflecting the cost of executing a trade and the liquidity of the market. The asking price is a critical component of this spread, as it sets the floor for what buyers must pay to acquire a security.

A narrow bid-ask spread indicates that buyers and sellers are in close agreement on the security’s price, which typically occurs in liquid markets with high trading volumes. This environment is ideal for traders, as it reduces transaction costs and allows for more efficient trade execution. Conversely, a wide spread can signal a less liquid market, where buyers and sellers are farther apart in their price expectations, potentially increasing trading costs.

Understanding the ask price and its role in the bid-ask spread is essential for evaluating market conditions and making informed trading decisions. By analyzing these elements, traders can better anticipate price movements and optimize their entry and exit points in the market.

How Can Investors Use the Ask Price in Decision-Making?

The ask price plays a vital role in the decision-making process for investors by determining the cost at which they can purchase security. Investors analyze ask prices to assess the market sentiment and make informed decisions. For instance, a high ask price might suggest that sellers anticipate a rise in the security’s value, reflecting bullish market sentiment. Conversely, a lower ask price may indicate bearish sentiment, where sellers expect a decline in value.

Investors often consider the asking price in conjunction with other factors such as the bid-ask spread, market conditions, and the security’s intrinsic value. A narrow bid-ask spread usually indicates a liquid market, allowing investors to execute trades at minimal cost. By comparing the asking price with historical data and financial analysis, investors can decide whether to enter the market immediately or wait for more favorable conditions.

What are the Common Misconceptions About the Ask Price?

One common misconception about the ask price is that it represents the fair value of a security. In reality, the ask price is simply the lowest price a seller is willing to accept at a given moment, which may not necessarily reflect the security’s true market value. This misunderstanding can lead to overpayment if investors assume the asking price is a fair indicator of value without conducting further analysis.

Another misconception is that the ask price is static. In truth, asking prices fluctuate constantly due to changes in supply and demand dynamics, market news, and investor sentiment. This volatility means that the asking price can vary significantly over short periods, and investors need to be aware of these changes when making trading decisions.

How Does the Ask Price Vary Across Different Asset Classes?

The ask price can vary widely across different asset classes due to differences in liquidity, volatility, and market structure. In highly liquid markets such as large-cap stocks, the ask price is typically close to the bid price, resulting in a narrow bid-ask spread. This reflects the ease with which these assets can be bought and sold without significantly affecting their price.

In contrast, less liquid markets, such as small-cap stocks or certain commodities, may exhibit wider bid-ask spreads due to fewer participants and less trading activity. These wider spreads reflect the higher transaction costs and potential price impact of trades in these markets. Additionally, asset classes like bonds and options may have different asking price dynamics based on their specific market conditions and the role of market makers in providing liquidity

How Can Technology Influence the Ask Price in Modern Trading?

Technology has profoundly impacted trading, particularly in how ask prices are determined and accessed. Algorithmic trading, which uses complex algorithms to execute trades based on pre-set conditions, has become a cornerstone of modern trading practices. These algorithms analyze vast amounts of market data in real-time to make split-second decisions about buying and selling, often leading to tighter bid-ask spreads and increased market liquidity. By automating these processes, technology has made markets more efficient, allowing trades to occur at the best possible prices with minimal human intervention.

High-frequency trading (HFT), a subset of algorithmic trading, further illustrates technology’s role in shaping asking prices. HFT systems can execute thousands of trades in seconds, taking advantage of minute price differences. This speed and efficiency help narrow the bid-ask spread by increasing the volume of trades, thereby reducing the cost for traders. However, the reliance on speed and automation also means that asking prices can fluctuate rapidly in response to market signals, requiring sophisticated technology to track and respond to these changes.

What Tools are Available to Track and Analyze Ask Prices?

A variety of tools are now available to traders and investors to track and analyze asking prices, thanks to technological advancements. Trading platforms like MetaTrader and Thinkorswim offer real-time data analysis, charting tools, and the ability to execute trades directly from the platform. These tools provide insights into asking prices and allow traders to visualize price movements over time, making it easier to identify trends and make informed trading decisions.

In addition, artificial intelligence (AI) and machine learning (ML) have become integral to analyzing financial markets. These technologies can process large datasets to identify patterns that might not be visible to the human eye, offering predictive analytics that can suggest optimal times to buy or sell based on asking price trends. For individual investors, AI-driven platforms like Robo-advisors offer personalized investment strategies that consider market conditions and asking prices to optimize portfolio performance.

What are Real-World Examples of Ask Price Scenarios?

Understanding real-world scenarios can provide valuable insights into how asking prices function in practice. For instance, during times of high market volatility, such as during economic announcements or geopolitical events, asking prices can fluctuate significantly. Traders must be agile in responding to these changes, as rapidly shifting asking prices can create opportunities for profit or risk.

In another scenario, consider the initial public offering (IPO) of a popular tech company. During the IPO, demand might outstrip supply, causing the asking price to rise as sellers capitalize on the heightened interest. Conversely, in a bearish market, sellers might lower asking prices to attract buyers, illustrating how external market conditions directly influence asking price dynamics.

These scenarios highlight the critical nature of understanding asking prices and the broader market context, as they can significantly impact trading strategies and investment outcomes. By leveraging technology and staying informed about market conditions, traders and investors can better navigate the complexities of modern financial markets.

Conclusion

In conclusion, understanding the ask price is essential for forex traders as it represents the lowest price a seller is willing to accept for a currency. This price is crucial for buying decisions and impacts the overall cost of a trade. Additionally, it is important to recognize the interplay between the ask price and the bid price—the highest price a buyer is willing to pay. The difference between these two prices, known as the spread, can significantly influence trading strategies and profitability. To gain a comprehensive view of forex trading dynamics, it’s beneficial to also explore our article on “What is the Bid Price?” which delves into the other side of the transaction and its implications on market activities. Understanding both ask and bid prices equips traders with the knowledge needed to navigate the forex market effectively.