Account balance is a fundamental concept in personal finance, reflecting the total amount of money available in a specific account at any given time. Whether you’re managing a checking account, savings account, or credit card, understanding your balance account is crucial for keeping track of your financial health and making informed decisions.

In its simplest form, the account balance represents the difference between the total credits (deposits) and debits (withdrawals) in your account. This figure can fluctuate daily based on your transactions and is a key indicator of your financial status. Knowing your balance helps you avoid overdrafts, plan your spending, and manage your budget effectively.

Account balance is sometimes referred to as the current balance, which might differ from the available balance depending on pending transactions. Regularly checking your balance is essential to ensure accuracy and to prevent any unexpected financial surprises.

Table of Contents

How is Account Balance Calculated?

The account balance is calculated by summing all deposits made into the account and subtracting all withdrawals or payments. This basic calculation applies to most types of accounts, whether it’s a checking account, savings account, or credit card. The resulting figure gives you the current state of your account and reflects the actual funds available for use.

For example, in a checking account, if you’ve deposited $1,000 and spent $200 on various transactions, your account balance would be $800. It’s important to note that pending transactions, such as checks that haven’t cleared or pending debit card charges, can affect this balance once they are processed. This is why the available balance might differ from the current balance, as the former accounts for any transactions that are yet to be finalized.

Understanding how your balance is calculated helps in managing your finances more effectively. By regularly checking your balance, you can avoid overdrafts and ensure that you have sufficient funds to cover your expenses. It’s a fundamental aspect of maintaining financial health and avoiding unnecessary fees.

What Factors Influence Your Account Balance?

Several factors can influence your account balance, making it fluctuate over time. The most obvious factors are deposits and withdrawals. Every time you deposit money into your account, your balance increases. Conversely, when you make a payment or withdraw funds, the balance decreases. Regular monitoring of these transactions is key to understanding the changes in your balance account.

In addition to transactions, interest earned on a savings account or charges like monthly maintenance fees on a checking account can also impact your balance. Interest is typically added to your balance periodically, depending on the terms of your account, providing a small but steady increase to your savings. On the other hand, fees for services such as overdraft protection or ATM usage might reduce your balance unexpectedly if you’re not keeping track.

Another significant factor is pending transactions. These are payments or deposits that have been initiated but not yet cleared by your bank. They temporarily hold a portion of your funds, which affects your available balance but not necessarily your current balance until the transaction is fully processed. Understanding these factors and how they interact can help you better manage your finances and avoid the pitfalls of unexpected changes in your account balance.

Why is Your Account Balance Important?

Your account balance is more than just a number; it’s a crucial indicator of your financial health. By regularly checking your balance, you can ensure that you have enough funds to cover upcoming expenses, avoid overdraft fees, and keep your finances on track. A healthy balance gives you the confidence to manage your daily expenses and plan for the future.

An accurate account balance also helps in maintaining a budget. Knowing exactly how much money is available allows you to make informed spending decisions, ensuring that you don’t spend beyond your means. This awareness is essential for financial planning, whether you’re saving for a major purchase, preparing for unexpected expenses, or simply managing your day-to-day finances.

Moreover, a positive account balance is vital for avoiding penalties and fees. For example, if your balance falls below a certain threshold, your bank might charge a low balance fee, or if you overdraw your account, you could incur significant overdraft fees. By keeping a close eye on your balance, you can avoid these unnecessary costs and maintain control over your financial situation.

What is the Difference Between Available Balance and Current Balance?

The terms available balance and current balance might seem interchangeable, but they represent different aspects of your account’s financial status. The current balance is the total amount of money in your account at a specific point in time, reflecting all completed transactions, including deposits, withdrawals, and transfers. It provides a snapshot of your finances, showing the exact funds you have in your account without considering any pending transactions.

On the other hand, the available balance is the amount of money that you can actually use or withdraw from your account. This figure takes into account any pending transactions, such as recent deposits that haven’t yet cleared or upcoming payments that haven’t been fully processed. The available balance is often lower than the current balance because it reflects these ongoing transactions, ensuring that you don’t accidentally overdraw your account by spending money that isn’t truly available.

Understanding the difference between these two balances is crucial for effective financial management. For instance, if you rely solely on your current balance to make spending decisions, you might overlook pending transactions that could lead to overdrafts or insufficient funds. By regularly checking your available balance, you ensure that you’re aware of your actual spending power, helping you avoid unnecessary fees and maintain better control over your finances.

How Often is the Account Balance Updated?

The frequency with which your account balance is updated depends on the type of transactions and the policies of your financial institution. Most banks update your balance in real-time for electronic transactions, such as debit card purchases, ATM withdrawals, and online transfers. As soon as these transactions are processed, your available balance reflects the changes immediately, providing you with an up-to-date view of your finances.

However, some transactions, such as check deposits or payments, may take longer to process. For example, when you deposit a check, the bank might hold the funds for a day or more to ensure that the check clears. During this period, your available balance might not immediately reflect the deposited amount, although your current balance may include it. Additionally, transactions made after business hours or on weekends and holidays may not be processed until the next business day, delaying the update to your balance.

To stay on top of your finances, it’s a good idea to monitor your balance regularly, especially if you’ve made several transactions in a short period. Many banks offer mobile apps or online banking services that allow you to check your balance at any time, giving you instant access to the most recent information and helping you manage your money more effectively.

What Are the Different Types of Account Balances?

There are several types of account balances that you might encounter, each serving a specific purpose in your financial management. The most common type is the current balance, which shows the total amount of money in your account after all completed transactions. This balance includes all deposits, withdrawals, and transfers that have been fully processed, offering a clear picture of your financial standing at a given moment.

The available balance is another critical type, reflecting the amount of money you can actually spend or withdraw. This balance takes into account pending transactions, such as checks that haven’t cleared or debit card purchases that haven’t been fully processed. The available balance is often lower than the current balance, particularly if you’ve made recent transactions that are still in the process of being finalized.

Additionally, some accounts might display an overdraft balance, which indicates the amount of money available if you have an overdraft protection service. This balance can be useful in emergencies, allowing you to make purchases or withdrawals even if your balance is insufficient. Understanding these different types of account balances is essential for making informed financial decisions, as each provides a different view of your account’s status and your actual spending power.

How Can You Check Your Account Balance?

Checking your account balance is a straightforward process that can be done in several ways, depending on your preferences and the tools provided by your financial institution. The most common method is through online banking, where you can log in to your account via the bank’s website or mobile app. This option offers real-time updates, allowing you to view your available balance, current balance, and any recent transactions at any time, making it highly convenient for managing your finances.

Another popular way to check your balance is by visiting an ATM. By inserting your debit or ATM card and entering your PIN, you can quickly see your account balance on the screen. Some ATMs also provide a printed receipt with your balance information. This method is useful if you’re on the go and need a quick update on your finances without accessing a computer or smartphone.

For those who prefer more traditional methods, you can also check your balance by contacting your bank’s customer service line or by visiting a branch in person. Bank tellers can provide you with your current balance and assist with any questions you might have about recent transactions. Regularly checking your account balance through these various methods helps you stay informed about your financial status and avoid any surprises.

What Does a Negative Account Balance Mean?

A negative account balance indicates that you have overdrawn your account, meaning you have spent more money than you actually have available. This situation often occurs when you make a payment or withdrawal that exceeds your available balance, leading to an overdraft. When your balance goes negative, it’s essential to act quickly to avoid further fees and complications.

Many banks offer overdraft protection services that cover transactions when your account balance is insufficient, but this service usually comes with fees. For example, each time you overdraft, your bank may charge an overdraft fee, which can add up quickly if you’re not careful. In addition, having a negative balance for an extended period can result in additional charges, such as extended overdraft fees or interest on the overdrawn amount.

To resolve a negative account balance, you should deposit sufficient funds into your account as soon as possible. This will bring your balance back to positive and help you avoid further fees. It’s also a good practice to monitor your balance regularly and set up alerts that notify you when your balance is low, helping you prevent future overdrafts and maintain a healthy financial standing.

How Does Account Balance Affect Financial Decisions?

Your account balance plays a pivotal role in shaping your financial decisions. Whether you’re planning a large purchase, paying bills, or considering an investment, knowing your current balance helps you determine what you can afford without jeopardizing your financial stability. A clear understanding of your balance ensures that you’re making informed decisions based on the funds you have available.

For instance, when planning to pay monthly bills, your account balance tells you if you have enough funds to cover them. If your balance is low, you might need to adjust your spending or prioritize which bills to pay first to avoid overdraft fees or late payment penalties. Similarly, when considering a large purchase, such as a new appliance or a vacation, your balance can help you decide whether to proceed with the purchase or wait until you have saved more money.

Moreover, your account balance is crucial for budgeting and saving. By regularly monitoring your balance, you can track your spending habits and make adjustments to stay within your budget. It also allows you to set aside funds for future goals, such as building an emergency fund or saving for retirement. In essence, your balance provides the foundation for sound financial management, guiding you toward responsible spending and saving practices.

What Happens if Your Account Balance is Low?

When your account balance is low, it can significantly impact your financial flexibility and increase the risk of incurring fees. A low balance means you have limited funds available for spending, which can make it challenging to cover essential expenses such as bills, groceries, or emergency costs. If you attempt to make a payment that exceeds your available funds, you could trigger an overdraft, resulting in additional fees and a negative balance.

Many banks impose low balance fees when your account balance drops below a certain threshold. These fees can vary depending on your account type and the bank’s policies but can add up quickly if not addressed. Additionally, a low balance may limit your ability to make necessary purchases or access cash, potentially leaving you in a difficult financial situation.

To avoid the complications of a low account balance, it’s important to regularly monitor your finances and maintain a buffer of funds in your account. Setting up alerts through your bank’s mobile app can notify you when your balance falls below a specified amount, allowing you to take action before overdrafts occur. By keeping an eye on your account balance and planning your expenses accordingly, you can avoid the stress and financial strain that comes with a low balance.

How Can You Maintain a Healthy Account Balance?

Maintaining a healthy account balance is essential for financial stability and avoiding unnecessary fees. One of the most effective ways to do this is through consistent budgeting. By tracking your income and expenses, you can ensure that you’re not spending more than you earn, which helps keep your balance in positive territory. Regularly reviewing your budget allows you to adjust your spending habits as needed, ensuring that you have enough funds to cover both routine expenses and unexpected costs.

Another key strategy for maintaining a healthy account balance is to automate your savings. By setting up automatic transfers from your checking account to a savings account, you can build a financial cushion over time without having to think about it. This not only helps you save for future goals but also ensures that you always have a reserve of funds available in case your balance dips unexpectedly.

Monitoring your account balance regularly is also crucial. Use online banking tools and mobile apps to check your balance frequently, especially after making large purchases or paying bills. This practice helps you stay aware of your financial status and avoid spending beyond your means. Additionally, setting up balance alerts can provide real-time updates on your balance, helping you to make informed financial decisions and maintain a healthy balance.

What Should You Do if You Notice an Incorrect Account Balance?

If you notice an incorrect account balance, it’s important to address the issue promptly to avoid potential financial complications. An incorrect balance could result from a bank error, unauthorized transaction, or even a technical glitch. The first step is to review your recent transactions carefully, checking for any discrepancies that might explain the error. Look for transactions that you don’t recognize or amounts that don’t match your records.

If the discrepancy persists, contact your bank’s customer service immediately. Most banks have procedures in place for handling disputes and correcting errors in your account balance. Be prepared to provide details of the issue, such as the transaction date, amount, and any relevant documentation. Your bank will investigate the matter, and if the error is confirmed, they will adjust your balance accordingly.

To prevent future issues, it’s a good idea to regularly monitor your account balance and review your statements carefully each month. Setting up alerts for large transactions or unusual activity can also help you catch errors or unauthorized transactions early. By staying vigilant and addressing any discrepancies quickly, you can protect your finances and ensure the accuracy of your balance.

Can You Spend More Than Your Account Balance?

Spending more than your account balance typically results in an overdraft, which occurs when your account lacks sufficient funds to cover a transaction. When this happens, your bank may allow the transaction to go through, but it will likely charge you an overdraft fee, and your balance will turn negative. Overdraft protection services can cover the shortfall, but these services often come with additional fees, making it costly to spend beyond your means.

Overdrafts are commonly linked to debit card transactions, checks, and automatic bill payments. If you regularly spend more than your available balance, these fees can quickly add up, leading to significant financial strain. Some banks offer an overdraft line of credit, which can act as a short-term loan to cover the difference, but this also involves interest charges that can compound over time.

To avoid spending more than your account balance, it’s crucial to monitor your finances closely. Setting up low balance alerts through your bank’s mobile app can help you stay informed about your financial status, allowing you to adjust your spending before triggering an overdraft. By managing your balance carefully and staying within your budget, you can avoid the costs and complications associated with overdrawing your account.

How Does Your Account Balance Impact Your Credit Score?

Your account balance can indirectly influence your credit score, particularly if it leads to overdrafts or missed payments. While your account balance itself isn’t reported to credit bureaus, the financial behaviors it reflects—such as responsible spending and timely payments—can affect your creditworthiness. For instance, if you frequently overdraw your account and fail to repay the overdraft promptly, it could result in late fees or even debt collections, which can negatively impact your credit score.

Credit scores are primarily determined by factors like payment history, credit utilization, and the length of credit history. While your account balance doesn’t directly factor into these components, maintaining a healthy balance can help you manage your finances more effectively, ensuring that you pay bills on time and avoid accumulating debt. For example, consistently low or negative balances might make it difficult to pay credit card bills or loan installments on time, which can lead to missed payments and damage your credit score.

To protect your credit score, it’s essential to maintain a healthy account balance that allows you to meet your financial obligations without difficulty. Regularly monitoring your balance, budgeting effectively, and using credit responsibly can all contribute to a strong credit score, which in turn can improve your financial opportunities in the future.

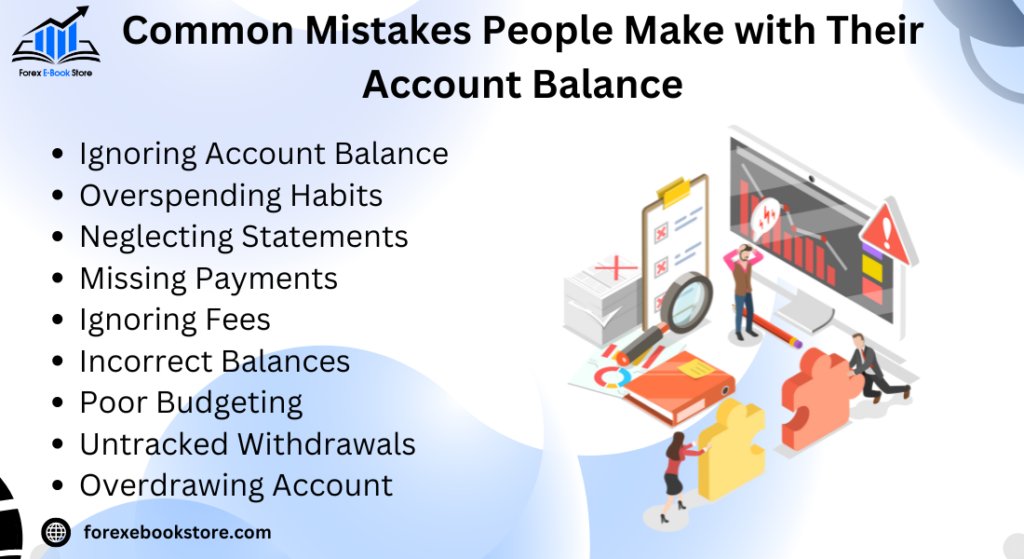

What Are the Common Mistakes People Make with Their Account Balance?

One of the most common mistakes people make with their account balance is not checking it regularly. Failing to monitor your balance can lead to unintentional overspending, overdrafts, and even missed payments. This oversight often results in unnecessary fees, such as overdraft charges or low balance fees, which could have been avoided with regular account monitoring. Regularly checking your balance through online banking or mobile apps ensures that you’re always aware of your financial status and can make informed spending decisions.

Another frequent mistake is misunderstanding the difference between available balance and current balance. Many people assume that their current balance reflects the amount they can spend, but this figure doesn’t account for pending transactions. Relying solely on the current balance can lead to overspending, as it doesn’t consider checks that haven’t cleared or pending debit card charges. Understanding the difference between these balances and using the available balance for spending decisions can help you avoid these pitfalls.

Lastly, not budgeting effectively can cause issues with managing your balance. Without a clear budget, it’s easy to lose track of your expenses, leading to overspending and a depleted balance. Creating a budget that tracks income and expenses helps you maintain control over your finances and ensures that your account balance remains positive. By avoiding these common mistakes, you can manage your balance more effectively and avoid financial difficulties.

What is the Relationship Between Account Balance and Budgeting?

Your account balance and budgeting are closely linked, with each influencing the other in significant ways. A well-maintained budget helps you track your income and expenses, ensuring that your balance remains positive and sufficient to cover your financial obligations. By setting a budget, you can allocate funds to different categories such as bills, groceries, savings, and discretionary spending, helping you avoid overspending and depleting your balance.

Regularly monitoring your account balance within the context of your budget allows you to adjust your spending as needed. For example, if you notice that your balance is lower than expected halfway through the month, you might need to cut back on non-essential expenses to avoid dipping into overdraft territory. Budgeting not only helps maintain a healthy balance but also provides a clear picture of your financial health, enabling better financial planning and decision-making.

Moreover, a positive account balance acts as a buffer against unexpected expenses, ensuring that your budget can accommodate unforeseen costs without derailing your financial goals. By integrating regular balance checks into your budgeting process, you can stay on top of your finances, avoid financial stress, and work towards long-term financial stability.

How Do Bank Fees Affect Your Account Balance?

Bank fees can significantly impact your account balance, often in ways that might not be immediately obvious. Common fees include monthly maintenance charges, overdraft fees, ATM fees, and low balance fees. Each of these can chip away at your balance, especially if you’re not actively monitoring your account or aware of the fees your bank charges.

For instance, if your account balance falls below a certain threshold, you might be charged a low balance fee, which can quickly turn into an overdraft situation if not addressed. Overdraft fees themselves can be particularly costly, as they’re often charged each time a transaction exceeds your available balance. Additionally, some banks charge for using out-of-network ATMs, further reducing your balance each time you withdraw cash.

To minimize the impact of bank fees on your account balance, it’s important to understand your bank’s fee structure and take steps to avoid unnecessary charges. This might include maintaining a minimum balance to avoid fees, opting out of overdraft protection to prevent overdraft charges, and using in-network ATMs to save on withdrawal fees. By being proactive about managing bank fees, you can protect your balance and avoid unexpected reductions in your available funds.

What Tools Can Help You Track Your Account Balance?

There are several tools available to help you effectively track your account balance, ensuring that you stay informed about your financial status and avoid overspending. One of the most widely used tools is your bank’s mobile app, which typically offers real-time updates on your balance, transaction history, and pending transactions. These apps often include features like low balance alerts and budgeting tools, making it easier to manage your finances on the go.

In addition to mobile apps, personal finance software like Mint, YNAB (You Need A Budget), or Quicken can provide a more comprehensive view of your financial situation. These tools allow you to link multiple accounts, track your account balance across different banks, and categorize your spending to identify areas where you might be able to cut back. They also offer advanced features like budget creation, goal tracking, and detailed financial reports, which can help you maintain a healthy balance over time.

For those who prefer a more hands-on approach, maintaining a simple spreadsheet can be an effective way to track your account balance and budget. By manually entering your income and expenses, you can create a clear record of your financial activity and monitor your balance closely. This method allows for full customization and can be tailored to fit your specific financial goals and tracking preferences.

How Does Online Banking Affect Your Account Balance Management?

Online banking has revolutionized the way individuals manage their account balances, offering unparalleled convenience and control. With online banking, you can check your balance in real-time, view transaction histories, and transfer funds between accounts with just a few clicks. This level of accessibility allows you to stay on top of your finances, ensuring that you’re always aware of your available balance and can make informed financial decisions.

One of the major benefits of online banking is the ability to set up alerts and notifications. These alerts can notify you when your account balance falls below a certain threshold, when a large transaction is made, or when a payment is due. By receiving these alerts in real-time, you can take immediate action to avoid overdrafts, missed payments, or unauthorized transactions, all of which can negatively impact your balance.

Furthermore, online banking platforms often integrate budgeting tools and spending trackers that help you monitor your expenses and keep your account balance healthy. By categorizing your spending and setting budget limits within your online banking app, you can see how each transaction affects your balance and adjust your financial habits accordingly. This integration of technology into banking has made it easier than ever to maintain a positive balance and achieve your financial goals.

Conclusion

In conclusion, understanding What is Account Balance? is fundamental to managing your personal finances effectively. Your account balance provides a clear snapshot of your financial status, helping you make informed decisions about spending, saving, and budgeting. By regularly monitoring your balance and utilizing tools like online banking and budgeting apps, you can ensure that your finances are in good shape and avoid the pitfalls of overspending or incurring unnecessary fees.

Similarly, if you’re involved in trading, particularly in the Forex market, it’s important to understand What is Equity in Forex?. Equity in Forex refers to the total amount of funds in your trading account, including both your initial deposit and any unrealized profits or losses from open positions. Just as managing your account balance is crucial for personal financial stability, understanding and managing your equity is key to successful trading. By linking these concepts, you can draw parallels between maintaining a healthy balance in your daily life and effectively managing your equity in Forex trading, ensuring a strong financial foundation across all aspects of your financial endeavors.