Liquidity in Forex refers to the ability of a currency pair to be bought or sold without causing significant price fluctuations. It represents how easily a trader can enter or exit a position in a particular currency pair. In simpler terms, liquidity measures the degree to which a currency pair can be traded in large quantities at stable prices. What is liquidity in Forex? This concept is crucial because it directly affects the speed and ease of trading.

A liquid market is one where there are plenty of buyers and sellers, ensuring minimal price disruption when trades occur. The Forex market, being the largest and most liquid financial market globally, often provides high liquidity, especially in major currency pairs like EUR/USD or USD/JPY. However, liquidity can vary depending on factors such as market conditions, economic events, and trading sessions.

Table of Contents

Why is Liquidity Important in Forex Markets?

Liquidity in the Forex market is vital because it ensures smoother and faster trade executions, which is essential for both retail and institutional traders. In a liquid market, the presence of a large number of participants reduces slippage—the difference between the expected price of a trade and the actual price. This enables traders to execute large orders with minimal impact on price movements.

High liquidity leads to:

- Tighter spreads: The difference between the bid and ask prices is lower, making trading more cost-effective.

- Price stability: A highly liquid market can absorb larger trades without creating extreme volatility.

- Efficient execution: Traders can enter and exit the market at desired prices without significant delays.

In contrast, low liquidity can result in wider spreads and higher volatility, making trading riskier. This is particularly true during off-hours or in less traded currency pairs, where a lack of participants can lead to price swings.

Key Benefits of High Liquidity in Forex:

- Lower transaction costs due to narrower spreads.

- Quicker trade executions.

- More accurate price predictions due to stable market conditions.

How Does Liquidity Affect Currency Pairs?

Liquidity varies significantly between different currency pairs, affecting both the volatility and trading conditions. Major currency pairs like EUR/USD, GBP/USD, and USD/JPY tend to have higher liquidity because they involve economies with large trading volumes. These pairs experience less volatility and tighter spreads, making them more attractive for both beginners and professionals.

Conversely, exotic currency pairs like USD/TRY or EUR/ZAR have lower liquidity. This leads to:

- Wider spreads: Trading costs increase due to less market activity.

- Higher volatility: Price movements become more erratic, increasing risk.

- Potential slippage: Orders may not execute at expected prices, particularly during times of low market participation.

Liquidity can also fluctuate during the day depending on the trading session. For example, liquidity is typically highest during the London and New York sessions when both markets overlap.

Factors Influencing Liquidity in Currency Pairs:

- Trading volume: Pairs with higher daily volume, like EUR/USD, exhibit higher liquidity.

- Market hours: Liquidity peaks during major market session overlaps.

- Economic stability: Pairs from more stable economies tend to have higher liquidity.

What Are the Key Indicators of Liquidity in Forex Trading?

Traders use several indicators to assess liquidity levels in the Forex market. These indicators help to evaluate the market’s ability to absorb trades without causing significant price movements. The most common liquidity indicators include:

- Volume: While Forex is decentralized and does not have a central volume measure, indicators like tick volume (number of price changes in a specific period) are often used to estimate liquidity. High tick volume usually signals greater liquidity.

- Bid-Ask Spread: The difference between the bid and ask prices is a straightforward indicator of liquidity. A narrow spread indicates a liquid market, while a wide spread signals low liquidity.

- Market Depth: This indicator shows the number of buy and sell orders waiting at various price levels. A market with deep order books reflects higher liquidity because there are more participants willing to trade at different prices.

Common Tools to Measure Forex Liquidity

- Tick Volume Indicators: These give an approximation of liquidity based on the number of price changes within a certain period.

- Order Book Depth: Often provided by brokers, this shows the volume of pending buy and sell orders.

- Bid-Ask Spread Monitoring: Used to assess how tight or wide spreads are, offering insights into liquidity.

What Are the Most Liquid Currency Pairs in Forex?

In the Forex market, the most liquid currency pairs are often referred to as “major pairs.” These involve the U.S. dollar and the currencies of some of the world’s largest economies, ensuring high liquidity due to the sheer volume of trades conducted daily. The U.S. dollar is central to global trade, making any currency pair involving it highly liquid.

The most liquid pairs include:

- EUR/USD (Euro/US Dollar)

- USD/JPY (US Dollar/Japanese Yen)

- GBP/USD (British Pound/US Dollar)

- USD/CHF (US Dollar/Swiss Franc)

These currency pairs offer the tightest spreads and the lowest trading costs due to their immense liquidity. Additionally, these pairs are most active during the London and New York sessions, providing ample opportunities for traders to enter and exit trades quickly. Their liquidity ensures that large trades do not cause significant price changes, which reduces risk.

Characteristics of Liquid Currency Pairs

- High trading volume: These pairs have the highest daily turnover, making them attractive for day traders and scalpers.

- Narrow spreads: The bid-ask spread is tight, leading to lower transaction costs.

- Lower volatility: While still volatile, these pairs are more stable compared to exotic or minor pairs, making them predictable.

How Do Liquidity Providers Impact Forex Trading?

Liquidity providers play a crucial role in the Forex market, as they act as intermediaries, offering buy and sell quotes to ensure market fluidity. These are usually large financial institutions, hedge funds, or market makers that have the ability to handle significant trade volumes. They ensure that orders are executed without delay, and their presence minimizes the gap between the bid and ask prices.

The two types of liquidity providers include:

- Tier 1 liquidity providers: Large financial institutions, such as banks and central banks, which control the bulk of Forex liquidity. They provide liquidity to brokers, enabling them to execute trades swiftly.

- Market makers: These firms take the opposite position in a trade, offering liquidity by standing ready to buy when traders want to sell and vice versa. They profit from the bid-ask spread and play a vital role in preventing market gaps.

Benefits of Liquidity Providers:

- Faster trade execution: By having liquidity readily available, trades can be executed instantly without delay.

- Lower slippage: Since orders are filled more efficiently, the risk of slippage is minimized, allowing traders to lock in their desired prices.

- Market stability: Liquidity providers reduce price volatility by absorbing large orders and ensuring they do not disproportionately affect the market.

How Does Market Volatility Affect Liquidity in Forex?

Volatility and liquidity are two closely related concepts in Forex. While liquidity refers to the ease of entering and exiting trades, volatility measures the price fluctuations in the market. During periods of high volatility, such as economic news releases or geopolitical events, liquidity can sometimes dry up as traders hesitate to enter the market, leading to larger spreads and greater price swings.

In times of high volatility:

- Spreads widen: Liquidity providers adjust their pricing to account for increased risk, resulting in wider bid-ask spreads. This can increase the cost of trading during volatile periods.

- Execution delays: Liquidity can become thin, meaning fewer market participants are willing to take the opposite side of a trade. This results in slippage and delays in order execution.

- Opportunities for profit: Despite the risks, high volatility can present opportunities for experienced traders who are able to manage the reduced liquidity and capitalize on significant price movements.

Conversely, during periods of low volatility, liquidity is usually higher, as price movements are more predictable, and the market can easily absorb large trades without causing substantial price changes. This creates ideal conditions for traders who rely on tight spreads and stable pricing.

How to Trade During High Volatility

- Use limit orders: To avoid slippage, limit orders allow you to set a specific price at which your trade will be executed.

- Monitor economic calendars: Staying informed about upcoming news events can help you anticipate periods of high volatility.

- Trade major pairs: Major currency pairs generally retain liquidity even in volatile conditions, making them safer to trade during unpredictable times.

What Are the Risks of Low Liquidity in Forex?

Low liquidity in Forex markets can pose significant risks to traders, particularly during off-peak trading hours or when trading exotic currency pairs. Low liquidity means fewer market participants, leading to wider spreads, increased volatility, and a higher chance of slippage.

Key risks associated with low liquidity:

- Wider spreads: When liquidity is low, the difference between the bid and ask price widens, increasing trading costs. This makes it more expensive for traders to enter or exit positions.

- Increased slippage: In a low liquidity environment, trades may not execute at the expected price, resulting in slippage. This occurs because there aren’t enough buyers or sellers to fulfill the order at the desired price.

- Higher volatility: Low liquidity markets are more susceptible to sudden price movements. With fewer participants, large trades can cause significant price swings, making it harder for traders to predict market direction.

Common Scenarios Leading to Low Liquidity

- Off-market hours: Liquidity tends to be lower during the Asian session or when major markets are closed.

- Holiday periods: During public holidays, market participation decreases, leading to lower liquidity.

- News events: Just before significant news announcements, liquidity providers may pull back, widening spreads in anticipation of volatility.

How Does Liquidity Vary Between Different Forex Sessions?

Liquidity in the Forex market fluctuates significantly depending on the trading session. The Forex market is open 24 hours a day, but liquidity levels vary based on the region and time of day. The three main sessions are the Asian, London, and New York sessions, each offering different levels of liquidity.

- Asian Session: This session covers major markets like Tokyo, Hong Kong, and Sydney. Liquidity is generally lower during this period, and price movements are more subdued, making it ideal for range-bound strategies.

- London Session: As Europe opens, liquidity increases significantly. The London session overlaps with both the Asian and New York sessions, making it one of the busiest times to trade. Major currency pairs like EUR/USD see the most action during this time.

- New York Session: As the U.S. markets open, liquidity remains high, particularly in pairs involving the USD. The overlap between London and New York sessions is particularly liquid and is considered the most active period for Forex trading.

Best Times to Trade for High Liquidity

- London-New York Overlap: This is the most liquid period, as two of the largest financial markets are active simultaneously.

- London Session: If you’re trading pairs like EUR/USD or GBP/USD, the London session offers significant liquidity.

What Are the Tools to Measure Forex Liquidity?

Measuring liquidity in Forex can be challenging since the market is decentralized. However, several tools and indicators are commonly used by traders to estimate liquidity levels and make informed decisions.

- Bid-Ask Spread: The bid-ask spread is a straightforward indicator of liquidity. A narrow spread means high liquidity, while a wider spread suggests low liquidity. Many trading platforms display real-time spreads for currency pairs, making it easy to gauge liquidity.

- Market Depth: Some advanced trading platforms offer market depth tools, showing the number of buy and sell orders at various price levels. A deep market indicates high liquidity, as it reflects a large number of participants willing to trade.

- Volume Indicators: While there is no centralized volume data for Forex, some platforms use tick volume to measure liquidity. Tick volume counts the number of price changes in a specific period, with higher tick volume indicating higher liquidity.

Key Liquidity Measurement Tools

- Bid-Ask Spread Monitoring: Helps identify whether liquidity is high or low.

- Market Depth Indicators: Shows order flow and pending orders at different price levels.

- Tick Volume: Provides a rough estimate of liquidity by counting price movements.

These tools allow traders to assess market conditions, optimize trade entry points, and manage risk more effectively.

What Are Liquidity Traps in Forex, and How Can They Be Avoided?

A liquidity trap in Forex occurs when liquidity dries up in the market, typically during times of extreme volatility or economic uncertainty. In a liquidity trap, traders may struggle to enter or exit positions at favorable prices because the market lacks sufficient participants, leading to wider spreads and price slippage. These conditions are risky for traders, particularly those using high leverage.

Key Risks of Liquidity Traps:

- Increased volatility: With fewer buyers and sellers, prices can swing wildly, creating unpredictable market conditions.

- Wider spreads: As liquidity evaporates, the gap between bid and ask prices widens, increasing trading costs.

- Slippage: Traders may find that their trades are executed at a much worse price than expected, especially during news releases or unexpected market events.

How to Avoid Liquidity Traps:

- Trade during high liquidity periods: Stick to trading during the overlap of major sessions, like the London and New York overlap, when liquidity is highest.

- Monitor news events: Economic data releases or geopolitical events can create liquidity traps. Always keep an eye on the economic calendar to avoid trading during these volatile periods.

- Use limit orders: Limit orders can help control the price at which your trades are executed, reducing the risk of slippage in low-liquidity environments.

How Does Liquidity Affect Forex Trading Strategies?

Liquidity has a profound impact on the effectiveness of different Forex trading strategies. In highly liquid markets, strategies that rely on quick execution and narrow spreads, such as scalping or day trading, tend to perform better. Conversely, in low liquidity environments, strategies focused on longer-term positions, such as swing trading, might be more effective due to increased volatility and larger price movements.

Strategies Best Suited for High Liquidity:

- Scalping: This strategy involves making small profits on frequent trades within short time frames. Scalpers rely on tight spreads and quick executions, which are easier to achieve in a liquid market.

- Day Trading: Similar to scalping but with slightly longer trade durations, day traders also benefit from high liquidity. The ability to enter and exit trades rapidly allows them to capitalize on intraday price movements without facing significant slippage.

Strategies for Low Liquidity Markets:

- Swing Trading: Swing traders hold positions for several days or weeks, allowing them to ride out short-term volatility. Low liquidity can lead to larger price swings, which swing traders can exploit for bigger gains.

- Position Trading: This long-term strategy works well in low liquidity environments where large price movements over extended periods are more likely.

Adapting to Liquidity Changes in Trading Strategies

- Adjust position sizing: In low liquidity markets, reduce trade sizes to minimize exposure to volatility and slippage.

- Use stop-loss orders: Protect your positions by using stop-loss orders to limit potential losses in unpredictable markets.

What Role Do Central Banks Play in Influencing Forex Liquidity?

Central banks play a crucial role in influencing liquidity in the Forex market by controlling the money supply and interest rates. Their policies have a direct impact on the amount of liquidity in the market, affecting currency value, market volatility, and liquidity levels. Central banks like the Federal Reserve (Fed), European Central Bank (ECB), and Bank of Japan (BoJ) frequently intervene to stabilize their currencies and maintain economic balance.

How Central Banks Influence Liquidity:

- Monetary policy: By adjusting interest rates and conducting open market operations, central banks increase or decrease the supply of money in the economy. Higher interest rates generally lead to lower liquidity, as borrowing becomes more expensive and fewer funds are available for speculative purposes.

- Forex interventions: Central banks may directly intervene in the Forex market by buying or selling their own currency. Such interventions are often aimed at stabilizing exchange rates and can drastically affect market liquidity, especially during periods of economic uncertainty.

- Quantitative easing (QE): During times of economic recession, central banks may implement QE programs, injecting liquidity into the financial system by purchasing government bonds and other assets. This boosts liquidity in the Forex market and can lead to significant currency depreciation.

Key Central Bank Actions That Affect Forex Liquidity

- Interest rate changes: A hike in interest rates generally reduces market liquidity, while cuts increase liquidity by making borrowing cheaper.

- Direct market interventions: Central banks may buy or sell large amounts of currency to stabilize or influence their exchange rates, affecting overall liquidity.

How Can Traders Identify Periods of High and Low Liquidity in Forex?

Identifying periods of high and low liquidity in the Forex market is crucial for traders to optimize their strategies and minimize risks. Liquidity fluctuates throughout the day depending on the Forex trading session, economic events, and geopolitical factors. Understanding these patterns helps traders enter the market when conditions are favorable and avoid less liquid periods that can lead to wider spreads and slippage.

Identifying High Liquidity Periods:

- Overlap between major sessions: The overlap between the London and New York sessions is when the market experiences the highest liquidity. This is because both the European and North American markets are open, leading to more market participants and tighter spreads.

- Economic data releases: When key economic data (e.g., non-farm payrolls, GDP reports) is released, liquidity tends to spike as traders react to the news. However, while liquidity increases, so does volatility, so traders must be cautious.

Recognizing Low Liquidity Periods:

- Off-market hours: During the Asian session, particularly after the Tokyo market closes and before the European market opens, liquidity tends to be lower. This period can see wider spreads and more unpredictable price movements.

- Holiday periods: Liquidity drops during public holidays like Christmas or New Year, as major financial centers are closed.

Tips for Identifying Liquidity Fluctuations

- Monitor your broker’s spread: A wider spread usually indicates lower liquidity.

- Use economic calendars: Anticipate liquidity changes by staying informed about key news events.

- Trade during session overlaps: Focus on trading when Liquidity in Forex is highest, especially during the London-New York overlap.

What is the Relationship Between Liquidity and Forex Spread?

Liquidity and spreads in the Forex market are directly related. Spread refers to the difference between the bid price (the price at which a currency can be sold) and the ask price (the price at which a currency can be bought). When liquidity is high, spreads are typically narrow, meaning traders face lower transaction costs. Conversely, when Liquidity in Forex is low, spreads widen, increasing the cost of trading.

How Liquidity Affects Spread:

- High liquidity: When a market is liquid, there are more buyers and sellers available. This competition drives the spread down, making it more affordable for traders to execute trades. Major currency pairs like EUR/USD or USD/JPY typically have tight spreads due to their high Liquidity in Forex.

- Low liquidity: In periods of low liquidity, such as during the Asian session or in exotic currency pairs (e.g., USD/TRY), there are fewer participants in the market. This leads to wider spreads, which can increase trading costs and reduce profitability.

Key Factors Influencing Spread in Forex

- Market hours: Spreads narrow during peak trading hours when liquidity is at its highest.

- Currency pairs: Major currency pairs have narrower spreads due to higher Liquidity in Forex, while exotic pairs experience wider spreads.

- Economic events: During significant news releases, spreads may widen temporarily due to increased volatility and uncertain market conditions.

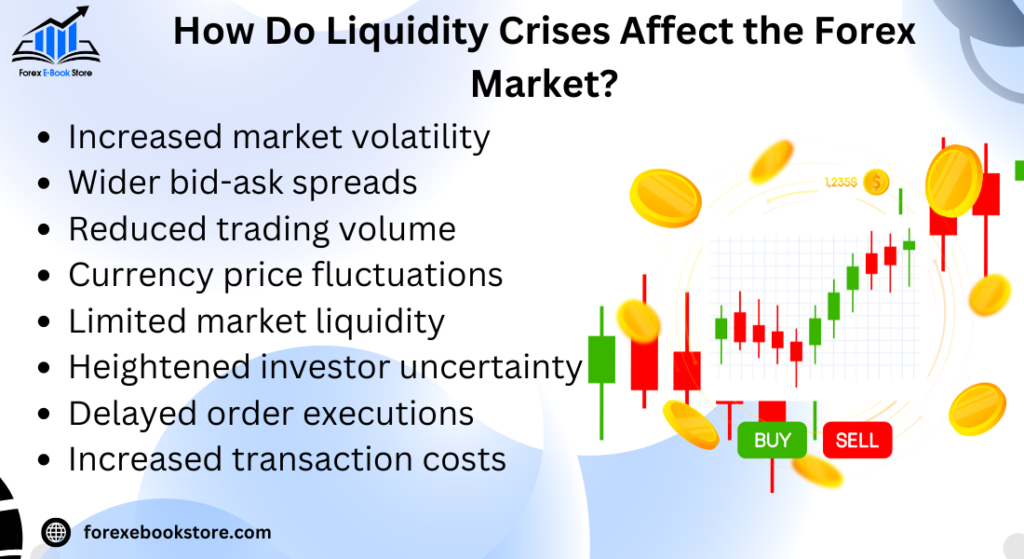

How Do Liquidity Crises Affect the Forex Market?

A liquidity crisis in Forex occurs when there is a sudden and severe shortage of liquidity in the market. This can happen due to unexpected economic events, geopolitical tensions, or disruptions in the financial system. During a Liquidity in Forex crisis, the normal flow of buy and sell orders is disrupted, leading to dramatic price fluctuations, wider spreads, and significant slippage.

Impact of a Liquidity Crisis on Forex:

- Increased volatility: With fewer market participants, even small trades can cause significant price swings, making the market highly unpredictable.

- Wider spreads: Liquidity in Forex providers increase the spread between the bid and ask prices to manage the risk of trading in such uncertain conditions.

- Execution delays: During a crisis, trades may not be executed at the expected price due to the scarcity of counterparties willing to take the opposite side of the trade.

Examples of Liquidity Crises in Forex:

- Global Financial Crisis (2008): The collapse of Lehman Brothers led to a significant liquidity crisis, causing massive currency fluctuations and increased spreads.

- Swiss Franc Unpegging (2015): When the Swiss National Bank unexpectedly removed the peg of the Swiss Franc to the Euro, Liquidity in Forex dried up, and the CHF experienced wild price swings, leading to large losses for traders.

How to Manage Forex Trading During a Liquidity Crisis

- Avoid trading during extreme events: Stay out of the market when signs of a Liquidity in Forex crisis emerge to avoid unexpected losses.

- Use limit orders: Limit orders help ensure that trades are executed at specific prices, reducing the risk of slippage during crises.

What Are the Key Differences Between Liquidity in Forex vs. Other Financial Markets?

Liquidity in the Forex market differs from liquidity in other financial markets like stocks, commodities, and bonds due to its decentralized nature and sheer size. The Forex market operates 24 hours a day across multiple time zones, ensuring that Liquidity in Forex is generally high, especially in major currency pairs.

Key Differences in Liquidity:

- Market structure: Forex is a decentralized, over-the-counter (OTC) market, which means trading is conducted directly between participants without a centralized exchange. This contributes to high Liquidity in Forex in Forex, particularly for major currency pairs, as compared to other markets like stocks, which are centralized on exchanges such as the New York Stock Exchange (NYSE).

- Trading hours: Unlike the stock market, which has specific trading hours, the Forex market operates around the clock. This continuous trading structure ensures that liquidity is available at almost all times, with the exception of low-activity periods, such as holidays and the Asian session.

- Market depth: In Forex, particularly with major currency pairs like EUR/USD, the depth of the market is substantial, meaning there are many buy and sell orders at various price levels. In contrast, smaller stocks or commodities may have less market depth, leading to lower Liquidity in Forex.

Forex Liquidity Compared to Stock and Commodity Markets

- Forex vs. Stocks: Stock markets have liquidity concentrated during the open hours of specific exchanges, while Forex Liquidity in Forex is more evenly distributed throughout the day.

- Forex vs. Commodities: Commodity markets can experience lower Liquidity in Forex due to less frequent trading, particularly in niche commodities like palladium or platinum, compared to major currency pairs in Forex.

What Are the Best Practices for Trading in Low Liquidity Conditions in Forex?

Trading in low liquidity conditions can be challenging but manageable with the right strategies. Low Liquidity in Forex environments typically lead to wider spreads, higher volatility, and slippage, but experienced traders can adjust their methods to mitigate these risks.

Best Practices for Low Liquidity Trading:

- Use limit orders: One of the most effective ways to protect against slippage in low liquidity conditions is by using limit orders instead of market orders. A limit order ensures that your trade will only be executed at your specified price or better.

- Avoid trading exotic currency pairs: Exotic currency pairs tend to have less Liquidity in Forex than major pairs, particularly during off-peak hours. Stick to major currency pairs like EUR/USD or USD/JPY for more stable liquidity.

- Monitor economic news: Major news events can significantly impact Liquidity in Forex. During such events, it’s best to avoid entering new trades, as spreads may widen, and volatility could increase unpredictably.

Adjusting Your Strategy for Low Liquidity

- Reduce trade sizes: In low liquidity environments, large trades can cause significant price movements. Reducing trade sizes can help manage this risk.

- Wider stop-loss levels: Adjust stop-loss levels to account for potential price swings, ensuring that normal market fluctuations don’t trigger premature exits.

How Does Technological Advancement Impact Liquidity in Forex Markets?

Technological advancements have revolutionized the Forex market, improving Liquidity in Forex by making it easier for participants to access and execute trades. Platforms, algorithms, and high-frequency trading systems have significantly enhanced market depth, execution speed, and accessibility.

Impact of Technology on Forex Liquidity:

- Algorithmic trading: One of the key advancements in the Forex market is the rise of algorithmic trading, where automated systems execute trades at high speeds. These systems contribute to Liquidity in Forex by consistently placing large volumes of buy and sell orders, narrowing spreads and making the market more efficient.

- Electronic communication networks (ECNs): ECNs provide direct access to the interbank market, allowing retail traders to trade with Liquidity in Forex providers directly. This increases transparency and liquidity, especially for major currency pairs.

- Mobile trading: The development of mobile trading apps has allowed a larger number of retail traders to participate in the Forex market, enhancing liquidity by increasing the number of active participants across different time zones.

Technological Tools Enhancing Liquidity

- High-frequency trading (HFT): HFT firms provide significant Liquidity in Forex by executing large numbers of trades in microseconds, reducing the bid-ask spread.

- Trading platforms: Platforms like MetaTrader 4 and MetaTrader 5 offer advanced features such as one-click trading, enabling faster trade execution and contributing to market Liquidity in Forex.

What Are the Top Liquidity Risk Management Strategies in Forex?

Managing liquidity risk is essential for Forex traders, as unforeseen Liquidity in Forex issues can lead to unfavorable trade executions, slippage, and even large losses. Liquidity risk management strategies focus on minimizing exposure to low Liquidity in Forex environments while ensuring trades are executed efficiently.

Key Liquidity Risk Management Strategies:

- Trade during high liquidity periods: The most effective way to manage liquidity risk is by trading during peak Liquidity in Forex hours, such as the overlap between the London and New York sessions. This ensures tighter spreads and better execution prices.

- Use limit orders: Limit orders allow traders to specify the price at which they want to enter or exit a trade, reducing the risk of slippage in low Liquidity in Forex conditions. This strategy ensures that you don’t get executed at a worse price than expected.

- Diversify your trading instruments: Sticking to highly liquid major currency pairs such as EUR/USD, GBP/USD, and USD/JPY can minimize liquidity risk. Avoiding exotic pairs with low Liquidity in Forex reduces the chances of experiencing extreme price fluctuations.

Additional Tips for Managing Liquidity Risk

- Avoid trading around major news events: Liquidity in Forex often decreases significantly during major economic releases, leading to higher spreads and volatility.

- Monitor market depth: By using market depth tools, traders can assess how much Liquidity in Forex is available at different price levels and adjust their strategies accordingly.

Conclusion

In conclusion, Understanding Forex Volatility is crucial for traders aiming to navigate the ever-changing landscape of the Forex market. Volatility directly impacts trading strategies, liquidity, and the risks associated with different currency pairs. By monitoring market conditions, using proper tools, and adjusting strategies based on periods of high and low volatility, traders can make more informed decisions and minimize potential losses. Staying aware of external factors such as economic events and geopolitical developments can also help manage the impact of volatility on trading outcomes.

Moreover, while Understanding Forex Volatility provides insights into the fluctuations and risks of the market, it is equally important to grasp how this volatility interplays with liquidity, as both concepts are interconnected. Low Liquidity in Forex can exacerbate volatility, while high Liquidity in Forex in Forex can help stabilize price movements. For a more comprehensive trading approach, traders should also focus on Understanding Liquidity in Forex, as it complements the strategies used to manage volatility and creates a more balanced trading environment. Interlinking both concepts ensures a holistic understanding of the Forex market dynamics.