Understanding RSI Indicator is crucial for anyone looking to improve their technical analysis skills in the world of trading. The RSI (Relative Strength Index) is a popular momentum oscillator that helps traders identify overbought or oversold conditions in a market. By understanding how to properly use and interpret the RSI indicator, traders can make more informed decisions and spot potential trends before they fully develop.

The RSI indicator is especially useful in determining whether a stock or asset is being overbought, which might signal a possible reversal, or oversold, suggesting a potential upward correction. With its straightforward calculation and easily understandable format, the RSI is favored by both novice and experienced traders alike. Learning how to effectively integrate this tool into your trading strategy can lead to better market timing and more profitable trades.

Table of Contents

How does the RSI Indicator work in trading?

The RSI Indicator works by measuring the speed and change of price movements, oscillating between 0 and 100. When the RSI is above 70, it generally indicates that an asset is overbought, signaling a potential market correction or downward trend. Conversely, when the RSI is below 30, it suggests that the asset is oversold, which could mean that a price rebound is imminent.

The formula behind the RSI compares the magnitude of recent gains to recent losses. This results in a value that helps traders understand the current momentum in a market. Many traders look for RSI divergence, where the price is moving in the opposite direction of the RSI. This divergence can be a strong indication that a market reversal may be on the horizon.

Key Points on How RSI Works:

- RSI measures price momentum over a specified period.

- RSI readings above 70 signal overbought conditions; readings below 30 signal oversold conditions.

- RSI divergence can act as a predictive signal for potential market reversals.

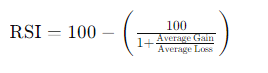

What is the formula for calculating RSI?

The RSI formula is straightforward but incredibly insightful. It is calculated using the following formula:

To calculate RSI, you take the average of the positive price changes over a specific period and divide it by the average of the negative price changes. This ratio is then plugged into the formula to arrive at the RSI value. Most traders use a 14-day period as the default setting for RSI calculation, but this can be adjusted based on the asset or market being analyzed.

Key Steps in RSI Calculation:

- Calculate average gains and losses over the chosen period (typically 14 days).

- Plug the values into the RSI formula.

- Adjust the period for more sensitive or smoother RSI readings depending on trading strategies.

How do you interpret RSI values?

Interpreting RSI values is a key skill for traders using this indicator. The RSI provides a score between 0 and 100, offering insights into market momentum:

- RSI > 70: The asset is considered overbought, and a price correction could be expected soon.

- RSI < 30: The asset is seen as oversold, indicating that a rebound in price may occur.

- RSI 50: A neutral zone that indicates no strong trend in either direction, often used as a confirmation or continuation signal for trends already in place.

It’s important to remember that the RSI shouldn’t be used in isolation. Many traders combine RSI with other indicators like moving averages or Bollinger Bands to confirm signals and strengthen their trading decisions. Additionally, different assets or markets might respond differently to the RSI. Therefore, it’s essential to adjust your strategies based on the historical performance of the indicator for that specific asset.

RSI Interpretation Overview:

- RSI above 70 = overbought, potential reversal downward.

- RSI below 30 = oversold, potential rebound upward.

- Combine RSI with other indicators for stronger trading signals.

What are the common RSI levels and thresholds?

The RSI indicator operates within a range of 0 to 100, with common thresholds set at 30, 50, and 70. These levels help traders quickly gauge the momentum and identify potential overbought or oversold conditions in the market. The 70 level is typically viewed as a threshold where an asset becomes overbought, suggesting a potential reversal. On the other hand, the 30 level indicates that the asset is oversold, signaling a possible bounce back.

Some traders use more customized thresholds, such as 80 and 20, to avoid false signals in particularly volatile markets. By shifting these thresholds, traders can fine-tune their strategy to align with the specific asset’s behavior. This adjustment is especially useful when trading assets like cryptocurrencies or tech stocks, where momentum can swing dramatically.

Common RSI Levels:

- 70-100: Overbought, signals a potential price correction or reversal.

- 0-30: Oversold, indicating a possible upward trend.

- 50: Neutral level, used to confirm existing trends or signal continuation.

What are the best practices for using RSI in different markets?

The application of the RSI Indicator can vary greatly depending on the market. In trending markets, where prices are steadily moving in one direction, RSI is often used to confirm the strength of the trend. For example, in a strong bull market, RSI may remain above 50 and approach overbought levels without necessarily signaling an immediate reversal. This is because momentum is inherently high during an upward trend, and slight overbought readings could be misleading if viewed in isolation.

In volatile or range-bound markets, traders may find that RSI behaves differently. Here, the RSI indicator helps traders pinpoint shorter-term overbought or oversold conditions, providing opportunities to capitalize on frequent price swings. It’s crucial to adjust RSI settings based on the asset’s volatility—reducing the default 14-day period to a shorter timeframe can produce more sensitive signals for faster-moving markets.

Best Practices:

- In trending markets, use RSI to confirm the trend and avoid false signals.

- In volatile markets, shorten the RSI period to catch rapid price movements.

- Combine RSI with moving averages or volume indicators for a more holistic view.

How does RSI compare to other momentum indicators?

While the RSI Indicator is one of the most commonly used momentum indicators, it is often compared to others, such as the Stochastic Oscillator and the MACD (Moving Average Convergence Divergence). Each of these indicators helps traders assess market momentum, but they differ in how they calculate and present that information.

- The Stochastic Oscillator compares a security’s closing price to its price range over a given period, making it particularly useful in identifying overbought or oversold conditions similar to RSI. However, some traders prefer RSI due to its relative simplicity and broader applicability across different market types.

- The MACD, on the other hand, focuses on the relationship between two moving averages. While RSI looks at price momentum, MACD tracks the difference between fast and slow moving averages, offering a different perspective on potential reversals or trend shifts.

Each indicator has its strengths, and traders often combine them to confirm signals. For instance, an RSI signal indicating an overbought condition might be validated if the MACD also shows a bearish crossover.

Comparison with Other Indicators:

- RSI vs. Stochastic: RSI is simpler and more adaptable to different markets, while Stochastic excels in range-bound markets.

- RSI vs. MACD: RSI focuses on price momentum, while MACD emphasizes the relationship between moving averages to detect trend shifts.

What are the limitations and drawbacks of the RSI Indicator?

Despite its popularity, the RSI Indicator is not without limitations. One of the primary drawbacks is its tendency to produce false signals in highly volatile markets. For instance, in a strong bullish trend, the RSI might remain over 70 for extended periods without leading to a reversal, misleading traders who rely solely on the RSI. This issue arises because the RSI does not account for external factors like market sentiment or broader economic conditions, which may drive momentum higher than the indicator suggests.

Another limitation is the lag effect. Like most technical indicators, RSI is based on historical data, meaning that by the time it signals an overbought or oversold condition, the price might already be reversing. As a result, relying solely on RSI without additional tools or market context can lead to missed opportunities or premature entries and exits.

Key Limitations:

- False signals in volatile markets, especially during strong trends.

- Lagging nature due to reliance on historical data.

- May need to be combined with other indicators for more accurate analysis.

How can RSI be used in combination with other technical indicators?

To mitigate the drawbacks of the RSI Indicator, traders often combine it with other technical indicators for a more comprehensive analysis. One of the most common combinations is pairing RSI with moving averages. Moving averages can help confirm the strength of a trend, while RSI provides insights into potential reversals. For instance, if the RSI shows an overbought condition but the price remains above a key moving average, this could signal that the upward trend is still strong and a reversal may not occur immediately.

Another useful combination is with Bollinger Bands, which measure volatility. When the RSI reaches overbought levels while the price touches the upper Bollinger Band, it can be a stronger signal of a potential reversal than relying on either indicator alone. Conversely, combining RSI with the MACD helps traders spot divergence in momentum, which strengthens their decision-making process by providing multiple layers of confirmation.

Common RSI Combinations:

- RSI + Moving Averages: Helps confirm trend strength and continuation.

- RSI + Bollinger Bands: Confirms overbought or oversold conditions with volatility analysis.

- RSI + MACD: Identifies divergence and strengthens signals for potential reversals.

What are the advanced RSI strategies for experienced traders?

Experienced traders often employ advanced strategies to maximize the effectiveness of the RSI Indicator. One such strategy is the use of RSI divergence. Bullish divergence occurs when the price makes a new low, but the RSI forms a higher low, suggesting weakening selling momentum and a potential reversal. Bearish divergence, on the other hand, happens when the price makes a new high, but the RSI creates a lower high, indicating slowing buying momentum and a potential downward reversal.

Another advanced tactic is to adjust the RSI period based on the asset or market conditions. While the default 14-period RSI works well for most markets, some traders prefer shorter periods (like 7) for more sensitive signals or longer periods (like 21) for a smoother, less volatile reading. Additionally, seasoned traders sometimes use RSI breakouts by drawing trendlines on the RSI itself. When the RSI breaks through these trendlines, it can act as an early warning of a potential price breakout.

Advanced RSI Strategies:

- RSI Divergence: Detects weakening momentum for potential reversals.

- Adjusting RSI Period: Tailor the sensitivity of RSI for different assets or market conditions.

- RSI Breakouts: Use trendlines on RSI to predict potential price breakouts.

What are the common mistakes to avoid when using RSI?

While the RSI Indicator is a powerful tool, many traders make common mistakes that reduce its effectiveness. One of the most frequent errors is relying solely on RSI without considering other factors. Traders who base decisions purely on RSI readings, particularly in volatile or trending markets, often fall victim to false signals. In strong bull or bear markets, RSI can stay overbought or oversold for extended periods without leading to a reversal, making it essential to use RSI in combination with other indicators.

Another mistake is over-trading based on RSI signals. Some traders act on every overbought or oversold signal, resulting in unnecessary trades and losses. It’s important to remember that RSI is a momentum indicator, and not all overbought or oversold conditions will lead to immediate reversals. Instead, traders should wait for confirmations from price action or other technical tools before making decisions.

Mistakes to Avoid:

- Using RSI in isolation: Combine with other indicators for stronger signals.

- Over-trading: Don’t act on every signal without confirmation.

- Ignoring market conditions: Adjust RSI interpretation in trending markets.

How does RSI perform during different market conditions?

The performance of the RSI Indicator varies significantly depending on market conditions. In trending markets, RSI tends to stay near the overbought or oversold levels for extended periods. For instance, in a strong uptrend, the RSI may hover above 70 for a long time, without signaling an immediate reversal. This is why using RSI in conjunction with trend indicators like moving averages is essential to avoid premature exits.

In range-bound markets, RSI performs exceptionally well as prices oscillate between support and resistance levels. During these periods, traders can confidently use RSI to spot overbought and oversold conditions and enter trades near these extremes. However, during volatile markets, RSI might generate more false signals due to sudden price swings. In these cases, it’s advisable to reduce the RSI period to capture shorter-term movements or combine RSI with volatility-based indicators like Bollinger Bands.

RSI in Different Markets:

- Trending Markets: RSI may remain overbought/oversold for long periods.

- Range-bound Markets: Ideal for identifying overbought and oversold conditions.

- Volatile Markets: Be cautious of false signals; adjust RSI period or combine with volatility indicators.

What are the historical origins and development of the RSI Indicator?

The Relative Strength Index (RSI) was developed by J. Welles Wilder in 1978 and was first introduced in his book, “New Concepts in Technical Trading Systems.” Wilder designed RSI as a momentum oscillator that could identify overbought and oversold conditions in a security’s price. His aim was to create a versatile tool that traders could use across various asset classes, from stocks to commodities.

Since its inception, RSI has undergone minor modifications and adaptations but remains one of the most widely used technical indicators in modern trading. The core calculation formula has not changed, but traders now have more flexibility in adjusting the RSI period to suit different markets and time frames. Additionally, new strategies have evolved around RSI, such as the use of divergences and combining RSI with other indicators to enhance its accuracy and usefulness.

Key Milestones in RSI Development:

- 1978: Developed by J. Welles Wilder, introduced in his book on technical trading systems.

- Evolution of strategies: Introduction of RSI divergence and its combination with other tools.

- Widespread adoption: Used across multiple asset classes and markets.

How can RSI be customized for different trading styles?

One of the strengths of the RSI Indicator is its flexibility, allowing traders to customize its settings according to their specific trading style. For day traders or those focused on short-term trades, reducing the default RSI period from 14 to something shorter, like 7 or 9 periods, can help capture faster market movements. This sensitivity allows traders to spot rapid shifts in momentum and react accordingly. However, the downside of shorter periods is the increased risk of false signals, so it’s important to use other indicators like moving averages to confirm the RSI readings.

For long-term traders or investors, increasing the RSI period to 21 or 30 can provide a smoother, less volatile view of the market. A longer period reduces the number of signals but increases their reliability, making it ideal for those looking to make fewer trades based on stronger trends. Additionally, long-term traders often combine RSI with trend-following indicators like the MACD to strengthen their decision-making process.

RSI Customization Based on Trading Style:

- Day Traders: Use shorter RSI periods (7 or 9) for more responsive signals.

- Long-term Traders: Opt for longer RSI periods (21 or 30) for smoother trends.

- Confirm Signals: Combine RSI with other indicators like moving averages or MACD.

What tools and platforms offer the best RSI analysis features?

There are several popular trading platforms that offer robust RSI analysis tools, allowing traders to fully leverage the power of the RSI indicator. TradingView is one of the most popular platforms due to its extensive library of indicators, including customizable RSI settings. Traders can not only adjust the period length but also overlay RSI with other indicators, such as Bollinger Bands or MACD, to create a comprehensive technical analysis framework.

MetaTrader 4 and 5 (MT4/MT5) are also widely used platforms for RSI analysis, particularly for forex and commodities trading. These platforms offer built-in RSI tools, which can be customized to match different trading styles. Additionally, they support the use of Expert Advisors (EAs) for automated RSI trading, making them ideal for traders who wish to automate their strategies.

For traders looking for more advanced analysis, Thinkorswim by TD Ameritrade offers sophisticated RSI settings and the ability to backtest strategies based on RSI signals. This is particularly useful for experienced traders who want to refine their RSI Indicator strategies before applying them in live markets.

Top RSI Analysis Tools:

- TradingView: Extensive customization and overlay options with other indicators.

- MetaTrader 4/5: Ideal for forex trading with customizable RSI tools and automation.

- Thinkorswim: Advanced backtesting capabilities and sophisticated RSI features.

How does RSI interact with other factors like volume and volatility?

While the RSI Indicator is an excellent tool for analyzing price momentum, it becomes even more powerful when combined with other market factors like volume and volatility. Volume is crucial in confirming RSI signals. For example, an overbought RSI reading followed by a spike in volume can indicate that the market is about to reverse, as high volume often signals a strong conviction behind the price movement.

Volatility is another key factor that interacts with RSI. In highly volatile markets, RSI may generate more frequent signals, and traders must adjust their strategy accordingly. For instance, combining RSI Indicator with Bollinger Bands, which measure volatility, can provide a more nuanced view of the market. When RSI hits overbought levels while the price also touches the upper Bollinger Band, it suggests a higher probability of a reversal than relying on RSI alone.

By incorporating volume and volatility into their analysis, traders can avoid false signals and make more informed trading decisions, particularly in fast-moving markets.

RSI Interaction with Volume and Volatility:

- Volume: High volume with overbought/oversold RSI strengthens reversal signals.

- Volatility: RSI in combination with Bollinger Bands provides more reliable signals in volatile markets.

- Avoid False Signals: Use these factors to validate or disregard RSI signals.

What is the role of RSI in algorithmic and automated trading?

The RSI Indicator plays a crucial role in algorithmic and automated trading strategies. Since RSI is a momentum oscillator, it can be integrated into algorithms that execute trades based on predefined thresholds, such as overbought and oversold conditions. This approach allows traders to remove emotional bias and ensure consistency in their trading decisions. Automated systems can trigger buy signals when RSI Indicator falls below 30 and sell signals when it exceeds 70, making RSI an ideal tool for rule-based trading strategies.

In automated trading platforms, such as MetaTrader and NinjaTrader, Expert Advisors (EAs) or scripts can be programmed to incorporate RSI into their algorithms. These tools allow for backtesting strategies based on RSI Indicator, optimizing them for different timeframes or asset classes. Traders can also combine RSI with other technical indicators like the Moving Average or MACD to create more complex and precise trading rules.

RSI in Algorithmic Trading:

- Automation: RSI is commonly used to trigger automated buy and sell signals.

- Backtesting: Allows for testing and optimizing RSI-based strategies before deploying in live markets.

- Combining with Other Indicators: Enhances algorithmic precision and reduces risk of false signals.

How do professional traders utilize RSI in their trading strategies?

Professional traders leverage the RSI Indicator by combining it with other technical indicators and market analysis techniques to refine their strategies. One key approach is using RSI divergence to identify potential reversals. For example, when the price is making new highs, but the RSI Indicator is making lower highs, this bearish divergence can signal that the upward trend is weakening, prompting traders to prepare for a sell-off. Conversely, a bullish divergence occurs when the price makes lower lows but the RSI Indicator is rising, suggesting an impending upward reversal.

In addition to divergence, professional traders often apply RSI with trend-following strategies. In this context, they don’t necessarily use RSI to predict reversals but instead to confirm the strength of a trend. For instance, if the RSI Indicator remains above 50 during a strong uptrend, it signals continued momentum, and traders may use this information to hold their positions longer.

Professional RSI Strategies:

- RSI Divergence: Professionals use divergence to spot early trend reversals.

- Trend Confirmation: RSI above 50 in uptrends or below 50 in downtrends confirms momentum.

- Combining with Fundamentals: Professional traders also incorporate fundamental analysis to refine RSI signals.

How can RSI signals be optimized for better trading decisions?

To optimize RSI signals, traders often tweak the default settings to better fit their trading style and market conditions. One common approach is adjusting the RSI period. While the standard RSI Indicator is calculated over a 14-period timeframe, reducing this to a 7-period RSI can make it more responsive in fast-moving markets, generating quicker signals. However, traders should be cautious, as shorter periods can increase the chance of false signals. Conversely, increasing the period to 21 or 30 provides smoother signals and is better suited for long-term investors.

Another way to optimize RSI is by using it in combination with other indicators, such as moving averages or Bollinger Bands. By confirming RSI Indicator signals with a moving average crossover or price touching the Bollinger Bands, traders can reduce the likelihood of false signals and make more informed trading decisions. Additionally, applying RSI divergence strategies can help traders avoid acting on every RSI Indicator signal and instead focus on stronger setups.

Optimizing RSI Signals:

- Adjust RSI Period: Shorter periods for faster signals, longer periods for smoother trends.

- Combine with Other Indicators: Use moving averages, MACD, or Bollinger Bands to confirm RSI signals.

- Focus on Divergence: Avoid relying on every signal and prioritize divergence for stronger setups.

What are the future trends in RSI and momentum indicator research?

The RSI Indicator and other momentum indicators continue to evolve as traders and researchers look for more refined and reliable ways to predict market movements. One emerging trend is the application of machine learning and artificial intelligence to optimize and customize RSI Indicator signals. AI-driven trading systems can adjust the RSI period and thresholds dynamically, learning from historical data to improve prediction accuracy. This allows traders to receive more personalized signals based on the specific behavior of the assets they are trading.

Another trend is the integration of alternative data sources into RSI models. Traditional RSI Indicator relies on price data, but by incorporating sentiment analysis from social media, news headlines, or even blockchain data in the case of cryptocurrencies, traders can gain a more comprehensive view of market conditions. This leads to a more nuanced interpretation of overbought or oversold signals, particularly in volatile markets like cryptocurrency or emerging sectors like renewable energy.

Future Trends in RSI:

- AI and Machine Learning: Dynamic adjustment of RSI based on historical data and real-time analysis.

- Alternative Data Sources: Integration of sentiment analysis and external data for more accurate signals.

- Cryptocurrency and New Markets: RSI’s role in adapting to emerging asset classes and volatile sectors.

How does RSI help in risk management and position sizing?

The RSI Indicator is not only used to identify overbought or oversold conditions but also plays a crucial role in risk management and position sizing. By helping traders identify potential market reversals, RSI can assist in adjusting the size of their positions based on the risk-reward ratio. For instance, if the RSI Indicator indicates that a market is oversold, traders may choose to enter a larger position, expecting an upward reversal. Conversely, in overbought conditions, traders might reduce their position size or set tighter stop-loss levels to manage downside risk.

Moreover, when combined with other risk management tools such as stop-loss orders or trailing stops, RSI can improve decision-making by offering clearer entry and exit points. Using RSI Indicator to inform position sizing can help traders allocate capital more effectively, ensuring they take on less risk when the market is overbought and more risk when the market is oversold.

RSI and Risk Management:

- Position Sizing: Adjust position size based on RSI signals and market conditions.

- Stop-Loss Placement: Combine RSI with stop-loss orders for more effective risk control.

- Risk-Reward Ratio: Use RSI to identify optimal risk-reward scenarios for entering and exiting trades.

What are the common RSI myths and misconceptions?

Despite its widespread use, there are several myths and misconceptions surrounding the RSI Indicator that can lead to poor trading decisions. One of the most common misconceptions is that RSI alone can predict market reversals. In reality, while RSI Indicator is a valuable tool for identifying overbought and oversold conditions, it should always be used in combination with other indicators, such as moving averages, to avoid false signals. Traders who rely solely on RSI Indicator without considering the broader market context may enter or exit trades prematurely.

Another myth is that RSI is not useful in trending markets. While it is true that RSI can stay in overbought or oversold conditions during strong trends, many traders mistakenly believe that RSI loses its value in these scenarios. In fact, RSI Indicator can still provide important insights in trending markets, particularly when used to spot divergence, which can signal weakening momentum even when a trend is still intact.

Common RSI Misconceptions:

- RSI Predicts Reversals: RSI should be used alongside other indicators for confirmation.

- RSI in Trending Markets: RSI is still valuable in trends, especially for spotting divergence.

- Over-reliance on RSI: It’s a helpful tool, but it doesn’t guarantee accurate predictions on its own.

Conclusion

In conclusion, understanding the RSI indicator is essential for traders looking to enhance their technical analysis and improve their decision-making process. The RSI helps identify overbought and oversold conditions, spot potential reversals, and confirm the strength of ongoing trends. However, it’s crucial to combine RSI with other indicators and tools, such as volume or moving averages, to avoid false signals and optimize trading strategies across different market conditions.

For a more comprehensive approach to trading, using Fibonacci retracement alongside RSI can further refine your entries and exits. While RSI Indicator focuses on momentum and price strength, Fibonacci retracement provides key support and resistance levels based on historical price movements. By integrating these two powerful tools, traders can develop a more robust strategy that considers both momentum and price correction levels, offering better insight into potential market turning points.