In Forex trading, leverage is a powerful tool that allows traders to control large positions with a relatively small amount of capital. Essentially, leverage involves borrowing capital from a broker to increase the potential return on investment. This means that with a small initial investment, traders can enter trades that are much larger than their actual account balance, amplifying both potential profits and potential losses.

Leverage is typically expressed as a ratio, such as 1:50 or 1:100. For example, a leverage ratio of 1:100 means that for every $1 in your trading account, you can trade $100 in the Forex market. Understanding how leverage works is crucial for Forex traders because it significantly affects trading strategies, risk management, and overall profitability.

Table of Contents

How Leverage Works in Forex Trading?

Leverage in Forex trading is a financial tool that allows traders to control larger positions in the market with a smaller amount of capital. Essentially, leverage involves borrowing funds from a broker to increase one’s trading position beyond what would be possible with the trader’s capital alone. This concept is fundamental to Forex trading and significantly amplifies both potential profits and losses.

For example, with a leverage ratio of 100:1, a trader can control $100,000 worth of currency with just $1,000 of their funds. This magnification of the trading position means that even small market movements can result in substantial profits. Conversely, the same leverage can lead to significant losses if the market moves against the trader’s position. Therefore, understanding and managing leverage is crucial for effective risk management in Forex trading.

Leverage is typically expressed as a ratio, such as 50:1 or 100:1. Higher leverage ratios mean greater potential for both profits and losses. For instance, a leverage ratio of 50:1 means that for every $1 in the trader’s account, they can control $50 in the market. This ability to trade larger positions than what one’s capital would normally allow is what makes leverage an attractive but risky feature in Forex trading.

What Are the Benefits of Using Leverage in Forex?

Leverage in Forex trading provides several notable benefits that can enhance a trader’s potential for profit:

Increased Profit Potential: One of the primary advantages of leverage is the ability to amplify gains from trades. With leverage, traders can control larger positions with a smaller amount of capital. For instance, with a leverage ratio of 100:1, a trader can control a $100,000 position with just $1,000. This magnification means that even small price movements can result in significant profits, making leverage particularly appealing for those looking to maximize returns from short-term market opportunities.

Access to Larger Markets: Leverage enables traders to participate in the Forex market, the world’s largest and most liquid financial market, with relatively small amounts of capital. This access allows traders to take advantage of numerous trading opportunities that would otherwise be out of reach without significant capital investment. By using leverage, traders can engage in the market’s vast liquidity and volatility, which can lead to more trading opportunities.

Diversification: Leverage allows traders to diversify their portfolios by spreading their capital across multiple positions and currency pairs. This diversification helps mitigate risk by not putting all capital into a single trade. It allows traders to balance their portfolios and increase their chances of making profitable trades across different market conditions.

What Are the Risks of Forex Leverage?

While leverage offers substantial benefits, it also introduces significant risks that traders must manage carefully:

Amplified Losses: Just as leverage can amplify profits, it can also magnify losses. If the market moves against a trader’s position, the losses incurred can exceed the initial investment, potentially leading to a margin call. This scenario can result in the trader losing their entire trading capital if not managed properly.

Margin Calls: Trading with leverage requires maintaining a minimum margin level in the trading account. If the account balance falls below this level due to adverse market movements, the broker may issue a margin call, demanding additional funds to maintain the position. Failure to meet a margin call can result in the broker closing the trader’s positions at a loss..

Emotional Stress: High leverage can lead to significant emotional stress, causing traders to make impulsive decisions driven by fear or greed. The potential for large gains can lead to overtrading, while substantial losses can trigger panic, leading to poor decision-making and increased risk.

How to Calculate Leverage in Forex?

Calculating leverage in Forex is straightforward and involves understanding the relationship between the amount of margin used and the total value of the position controlled. Leverage is typically expressed as a ratio, such as 50:1 or 100:1. The formula to calculate leverage is:

Leverage=Total Value of PositionMargin Required\text{Leverage}

= \frac{\text{Total Value of Position}}{\text{Margin Required}}Leverage

=Margin RequiredTotal Value of Position

For example, if a trader wishes to control a $100,000 position in the EUR/USD pair and the broker requires a $1,000 margin, the leverage ratio is 100:1 ($100,000 / $1,000). This means the trader can control $100,000 worth of currency with just $1,000 in their trading account..

Understanding How Leverage Works and how to calculate leverage helps traders manage their risk and make informed decisions about the appropriate level of leverage to use based on their risk tolerance and trading strategy.

What is the Margin in Forex Trading?

Margin in Forex trading refers to the collateral that traders must deposit with their brokers to open and maintain leveraged positions. It acts as a good faith deposit that ensures the trader can cover potential losses. Margin is not a cost or a fee; rather, it’s a portion of the trader’s account balance set aside to support the leveraged positions.

For example, if a broker requires a 2% margin to open a trade, a trader needs to deposit $2,000 to control a $100,000 position. The remaining $98,000 is effectively borrowed from the broker, allowing the trader to leverage their capital significantly. This leverage amplifies both potential gains and potential losses, making it a powerful but risky tool.

There are several types of margins that traders should be aware of:

- Initial Margin: This is the minimum amount required to open a new position. It ensures that traders have sufficient funds to cover potential losses from the outset.

- Maintenance Margin: This is the minimum balance that must be maintained in the trading account to keep a position open. If the account balance falls below this level, the broker may issue a margin call, requiring the trader to deposit more funds or close positions to meet the requirement.

- Free Margin: This refers to the funds available in the account to open new positions or withstand adverse market movements. It is calculated by subtracting the used margin from the total equity in the account

How to Manage Risk When Using Leverage in Forex

Managing risk is crucial when using leverage then must have knowledge about How Leverage Works in Forex trading, as it can amplify both profits and losses. Here are some effective strategies for managing risk:

1. Use Proper Position Sizing: Determine the appropriate position size for each trade based on your risk tolerance and account balance. Avoid overleveraging, which can lead to substantial losses if the market moves against you. A general rule is to risk only a small percentage of your account on any single trade, often suggested to be around 1-2%.

2. Set Stop-Loss Orders: Always use stop-loss orders to limit potential losses. A stop-loss order automatically closes a trade at a predetermined price, helping to prevent significant losses. This risk management tool is essential for protecting your capital, especially when trading with high leverage.

3. Diversify Your Portfolio: Avoid concentrating your trades on a single currency pair or market. Diversifying your portfolio by trading different currency pairs can help spread the risk and reduce the impact of any single trade on your overall account balance. This approach helps manage risk by not putting all your capital at risk in one position.

What Are the Different Leverage Ratios in Forex?

How Leverage Works ratios in Forex trading vary widely and can significantly affect your trading strategy:

1. Common Leverage Ratios: Leverage ratios typically range from 1:10 to 1:500, depending on the broker and the regulatory environment. For example, a 1:100 leverage ratio means you can control $100,000 in the market with just $1,000 of your own capital.

2. Regulatory Limits: Different regions have specific regulations on maximum leverage ratios to protect traders. For instance, the European Securities and Markets Authority (ESMA) limits leverage to 30:1 for major currency pairs and 20:1 for non-major pairs for retail traders. These limits are designed to prevent excessive risk-taking and potential losses among retail investors.

3. Broker-Specific Ratios: Some brokers offer higher leverage ratios, especially for experienced traders or those trading with larger accounts. However, higher leverage also means higher risk, and it is crucial to understand the implications before opting for maximum leverage.

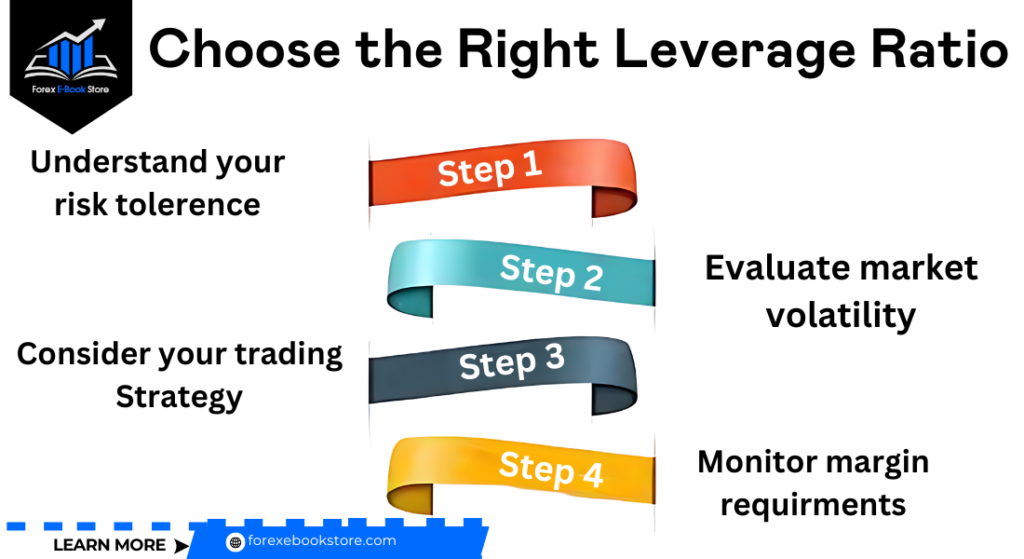

How to Choose the Right Leverage Ratio?

Choosing the right leverage ratio depends on several factors, including your trading experience, risk tolerance, and trading strategy:

1. Assess Your Risk Tolerance: Determine how much risk you are willing to take on each trade. If you are a conservative trader, you might opt for lower leverage ratios to minimize potential losses. Conversely, more aggressive traders might choose higher leverage ratios to maximize potential gains, understanding the associated risks.

2. Start Small: Especially for beginners, it’s wise to start with lower leverage ratios and gradually increase as you gain experience and confidence. Using a demo account to practice with different leverage levels can help you understand How Leverage Works impacts your trades without risking real money.

3. Align with Your Trading Strategy: Your trading strategy should dictate your leverage usage. For example, if you are a day trader making multiple trades per day, you might use higher leverage to capitalize on small price movements. Long-term traders, on the other hand, might prefer lower anfd know about How Leverage Works to avoid significant risks over extended periods

What Role Do Brokers Play in Providing Leverage?

Brokers play a crucial role in providing leverage in Forex trading. Here’s how they influence leverage and its implications for traders:

- Facilitating Access to Leverage: Forex brokers enable traders to use and guide How Leverage Works by offering various leverage ratios, such as 1:50, 1:100, or even higher. These ratios allow traders to control larger positions with a smaller amount of capital. For example, a 1:100 leverage ratio means that a trader can control $100,000 with just $1,000 in their account. This access to leverage makes Forex trading more accessible, especially for those with limited initial capital.

- Risk Management and Margin Requirements: Brokers set margin requirements to manage the risks associated with leveraged trading. Margin is the collateral required to open and maintain a leveraged position. Brokers require traders to maintain a minimum margin level in their accounts to cover potential losses. If the account balance falls below this level, a margin call is issued, requiring additional funds to avoid liquidation of positions. This mechanism helps brokers mitigate the risk of significant losses.

- Enhancing Market Liquidity and Competitiveness: How Leverage Works, brokers enhance market liquidity and attract a broader range of traders, including small investors. This increased participation boosts trading volumes, contributing to market liquidity and stability. Additionally, competitive leverage offerings help brokers attract and retain clients, making them more competitive in the industry.

Conclusion

Understanding how leverage works in Forex is essential for maximizing your trading potential while managing risks effectively. Leverage can significantly amplify both gains and losses, making it crucial to use it wisely. To further refine your trading strategy, don’t overlook the importance of understanding What is a Spread in Forex?—as both leverage and spread are key factors that influence your overall profitability in the Forex market.